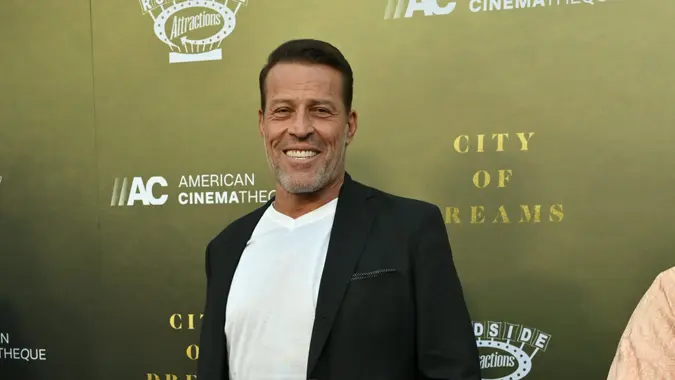

1 Thing You Need To Understand About Social Security, According to Tony Robbins

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Many retired Americans rely on their monthly Social Security check to get by. While the extra cash helps, it shouldn’t be a replacement for saving for retirement, according to personal finance author Tony Robbins.

Here’s what Robbins says you need to know about Social Security and saving for retirement.

Social Security and Retirement Savings

A 2024 Gallup survey found that 23% of retirees say their only major source of income in retirement is Social Security, and four in 10 claimed they are not financially comfortable. The average monthly Social Security benefit for retirees is only $1,976 as of January 2025, which is usually not enough to cover monthly expenses.

“Social Security was never intended to become a replacement for retirement savings,” Robbins wrote in a blog post on his website.

And this is true. Social Security only replaces about 40% of an average wage earner’s income in retirement, according to the U.S. Department of Labor. Most financial advisors say retirees will need about 70% to 80% of their work income to live comfortably in retirement.

Citing data from the Center for Retirement Research, Robbins added that nearly 50% of “American households are ‘at risk’ for not having enough money in retirement to maintain their living standards.”

How Much You Need for Retirement

Robbins suggested one reliable formula to figure out how much you need to save for retirement. Here are the steps:

- Calculate your current spending. This is the amount you spend on a normal basis. If you don’t know how much you spend, Robbins recommended tracking your budget.

- Multiply your current spending by 20. This gives you an estimate of your financial needs through retirement.

- Be conservative. While financial planners will generally tell you to multiply your annual income by 10 or 15, Robbins claimed it’s smarter to use 5%. This means that twenty times your income assumes a 5% return.

- Start planning. Robbins recommended asset allocation and dedicated retirement accounts for the best returns.

If you want to travel the world and live in luxury, Robbins wrote that you need to figure out what this type of lifestyle would cost on a yearly basis and use the same process above to calculate your savings.

Written by

Written by  Edited by

Edited by