What Is a Bad Credit Score and How Can You Fix It?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

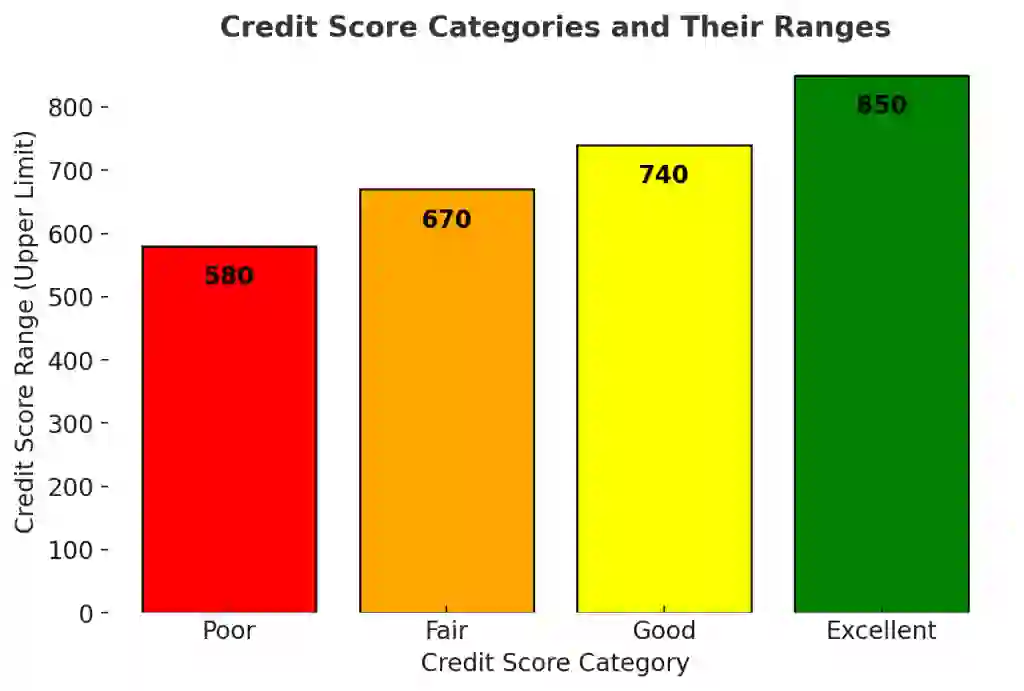

Worried about whether your credit score is good or bad? Under most scoring models, a bad credit score is between 300 and 579. Generally, if your credit score is lower than 580, lenders see you as a high-risk borrower.

Different scoring models have slight variations in ranges, but the fact is that bad credit makes borrowing harder. Ultimately bad credit will impact your pocketbook.

What Causes a Bad Credit Score?

If you become careless with your financial behavior, this will likely lead to a bad credit score. Even a few missed payments will likely send your credit score downward.

Here are reasons why a bad credit score could happen:

- Late or missed payments: How often are you paying your bills late or missing them completely? A prolonged history of late payments can impact your credit score negatively.

- High credit card balances: Are you maxing out your credit cards? If you’re using too much of your credit, it will hurt your credit score.

- Accounts sent to collections: If you fail to make payments, companies will send your accounts to a collection agency. Accounts sent to collections will be reflected in your credit history and as a result negatively impact your credit score.

- Lack of credit history: Having no credit can also lead to a bad score. Creditors and lenders have very little to rely on to determine your creditworthiness with no credit history.

- Bankruptcy or foreclosure: If you’ve filed for bankruptcy or foreclosed on your home, this will cause a bad credit score.

How Does a Bad Credit Score Affect Your Life?

Getting rejected for loans? Need a cosigner for your apartment? These are the financial consequences that can impact your life. A bad credit score could be the reason you aren’t receiving favorable decisions when getting a loan, securing a mortgage or renting an apartment.

With a bad credit score, it is harder to get a credit card, car loan or rental property. If you do secure loans or a mortgage with bad credit, you will likely have to pay higher interest rates.

Also, with day-to-day transactions like utilities, phone plans and rental properties, you will likely have to put down a larger security deposit.

Bad Credit Score vs. Fair Credit Score

If you have even a slight improvement in your credit score by moving the needle from bad credit to fair, you can lower your interest rate and receive more approvals for loans and credit cards. If your credit score improves, you will see the biggest difference in your pocketbook.

With a lower credit score, you can save money on day-to-day transactions, as well as your mortgage or car loan.

| Credit Score Range | What It Means | What You Get |

|---|---|---|

| 300-579 | Bad Credit | Hard to get approved, very high interest rates |

| 580-669 | Fair Credit | Some approvals, still higher rates |

| 670+ | Good Credit | Easier approvals, better interest rates |

Can You Fix a Bad Credit Score?

If you’re currently facing a bad credit score, it is not impossible to move it in the right direction. There are some easy ways to improve your credit score. Here are some potential ways:

- Make timely payments: You should attempt to pay your bills on time.

- Review your credit report regularly: It’s free to request your credit report every year from the three bureaus. Review your report to check for any inconsistencies.

- Pay down your credit card balances. Ideally, you want your credit card balances to be below 30% of your credit limit.

- Build credit history: A lack of credit history can impact your credit. Try to get a secured credit card or credit-builder loan to build your credit history.

- Be patient: Credit repair is a process. It takes time, but you can continue to build your credit with each positive action.

How Long Does It Take to Fix Bad Credit?

You can strategically work toward fixing your bad credit by understanding what caused your low score. Depending on the cause of your low credit score, it may take months or years to improve. The key is the faster you address these causes, the quicker your credit score will improve.

Let’s take a look at some causes of a low credit score and the timeline it may take to fix it:

- Are you carrying high balances? Once you start paying down debt, it could take a few months to see improvement in your credit score.

- Do you have late payments on your credit history? It could take six to 12 months to rebuild, sometimes longer.

- Do you have accounts in collections? It could take a few years for this history to drop off your credit history, but paying these accounts off could help.

- Are there bankruptcies on your credit history? Bankruptcies stay on your report for seven to 10 years, but that shouldn’t stop you from rebuilding your credit.

Final Take to GO

A bad credit score can make it harder to qualify for loans, credit cards, and even rental applications — but the good news is that it’s fixable with the right strategy. By making on-time payments, lowering credit utilization, disputing errors and building positive credit habits, you can start seeing improvements over time.

Next Steps:

- Check Your Credit Report: Get a free copy at AnnualCreditReport.com and review it for errors.

- Pay Bills on Time: Set up reminders or autopay to avoid late payments, which can significantly impact your score.

- Reduce Credit Utilization: Aim to keep your credit card balances below 30% of your total limit.

- Consider a Credit-Building Tool: Secured credit cards, credit builder loans, and authorized user status can help strengthen your credit profile.

Improving your credit score takes time, but small, consistent actions can lead to big changes. Want to learn more? Explore our expert credit repair guides here.

FAQs About Bad Credit Scores

A bad credit score can be an absolute financial disaster if you're not careful. Thankfully, we've got you back. Here are some common and frequently asked questions when it comes to bad credit and how to fix it:- What is considered a bad credit score?

- With FICO's credit scale model (the more commonly used scoring model that lenders use), a bad credit score is under 580. VantageScores that fall under 500 are considered poor credit scores.

- Can you get a loan if you have bad credit?

- Yes, you can receive a loan with bad credit, but your loan will likely have a higher interest rate with stricter terms, and you may need a cosigner.

- How fast can you fix a bad credit score?

- You can see small improvements within several months, but more severe issues may take several months to a few years.

- Do late payments automatically mean bad credit?

- No. However, late payments over 30 days may be reported to the credit bureaus. Several late payments will likely impact your credit.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- FTC "Credit Scores"

- FTC "Understanding Your Credit"

- CFPB "Credit reports and scores"

- USA.gov "Understand, get, and improve your credit score"

- AnnualCreditReport.com "website"

Written by

Written by  Edited by

Edited by