How To Get Preapproval For A Car Loan and Secure the Best Rates

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

An auto loan preapproval can help you navigate the car-buying experience more efficiently. Since a lender evaluates your financial situation and initiates a hard credit pull, getting preapproved gives you a good idea of what a lender is willing to loan you for your car purchase.

This makes it easier to stay on budget and potentially negotiate a better deal when shopping for a car. Here’s how to get approved for a car loan and what to know about preapprovals.

What Does It Mean to Get Preapproved for a Car Loan?

When you get preapproved for a car loan, it means the lender has reviewed your financial situation and decided to offer you a loan preapproval.

Within the preapproval documents, you’ll find out how much the lender is willing to loan you and at what interest rate. Generally, a loan preapproval holds more weight than a loan prequalification. That’s because a preapproval acts as conditional approval from the lender to finance the vehicle purchase. In contrast, a prequalification indicates how much you might be able to borrow but it is far from a guarantee.

Benefits of Getting Preapproved

Getting preapproved for a car loan comes with several benefits, these include:

- Knowing your budget. When you know what a lender is willing to loan you, you can avoid shopping for cars outside of your price range.

- Better interest rates. If you get preapproved before heading to the car lot, you can shop around to compare lenders and find the best deal.

- Stronger negotiating power. If you know how much you can spend, this gives you a hard limit to improve your negotiations. Additionally, dealers might offer better financing if they know you already have a financing offer.

- Faster car buying process. Since you already have a preapproval, this typically speeds up the paperwork process at the dealership.

Steps to Get Preapproved for a Car Loan

If you want to get preapproved for a car loan, use the steps below as a guide.

- Check your credit score. Start by seeing where your credit score stands. Typically, borrowers with a higher credit score can tap into lower interest rates.

- Compare lenders. Don’t stick with one lender. Instead, compare rates across multiple lenders to find the best option for your situation. Consider banks, credit unions, and online lenders.

- Gather your financial documents. Be prepared to share information with the lender, including identification, employment, and proof of income.

- Apply for preapproval. You can submit your application to multiple lenders during the preapproval process. This gives you a chance to compare offers across lenders.

- Review your offers. Determine which lender gives you the best offer by comparing interest rates, loan terms, and fees.

- Get your preapproval letter. Before heading to the dealership, get a copy of your preapproval lender to use during your negotiations.

Where to Get Preapproved for a Car Loan

Many financial institutions offer car loan preapprovals. The table below highlights the pros and cons of working with different types of financial institutions.

| Financial Institution | Pros | Cons |

|---|---|---|

| Banks | Competitive rates for strong credit | Stricter approval requirements |

| Credit Unions | Lower rates, flexible terms | Membership required |

| Online Lenders | Quick application process | Rates vary widely |

| Dealerships | Convenient but often higher rates | May pressure you into dealer financing |

Common Mistakes to Avoid When Getting Preapproved

As you navigate the preapproval process, avoid the following mistakes:

- Not checking your credit score first. Since a low credit score can lead to higher rates, not checking where you stand can make financing more expensive. If you discover your credit score is low, consider working to improve it before applying. Some ways to build your score include making on-time payments and avoiding new debt.

- Applying with too few lenders. If you don’t compare your options across multiple lenders, you could miss out on the best deal.

- Ignoring loan terms. A lower monthly payment may mean a longer loan with more interest paid.

- Letting your preapproval expire. Typically, a preapproval lasts between 30 and 60 days. Make sure to apply when you are actually ready to make your car purchase.

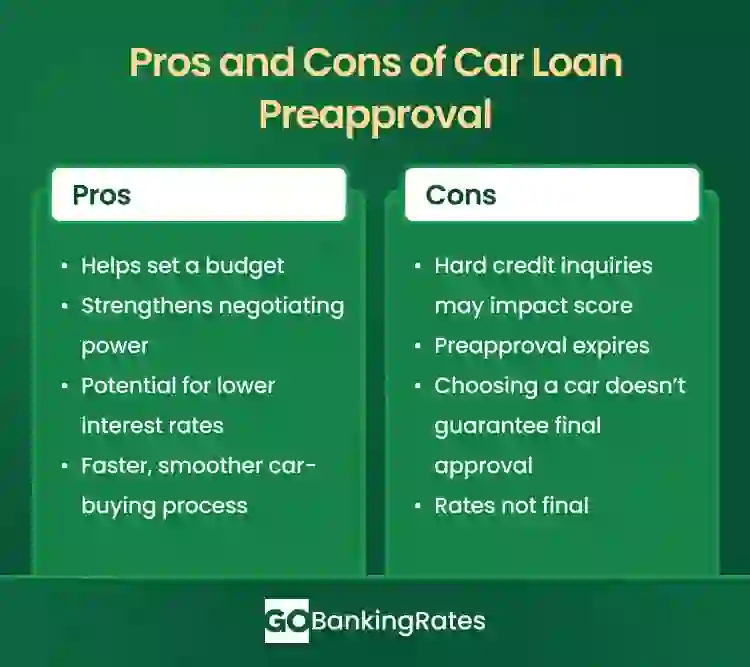

Pros and Cons of Car Loan Preapproval

Every financial decision comes with pros and cons. We explore both sides of the equation in the table below.

Is Car Loan Preapproval Worth It?

If you are shopping for a car, getting a loan preapproval is usually worth it. Preapprovals typically set the stage for better rates, a smoother buying process and more negotiation power. As you consider your preapproval options, compare multiple lenders to find the best offer across loan terms, interest rates, and fees.

When you are ready to buy a car, getting your preapproval before heading to the dealership can make your life easier.

- Does preapproval guarantee a car loan?

- A preapproval doesn't guarantee financing. But, typically, a preapproval means more than a prequalification.

- How long does car loan preapproval last?

- The length of a car loan preapproval varies depending on the lender. Typically, a car loan preapproval lasts between 30 and 60 days.

- Will getting preapproved hurt my credit score?

- When you apply for a car loan preapproval, your score might dip due to the new credit inquiry. Typically, your score will recover quickly if you stick with other responsible credit management habits, like making on-time payments.

- Can I get preapproved with bad credit?

- Some lenders allow drivers with bad credit to get preapproved for a car loan. But whether or not you are approved varies from lender to lender.

- What happens if I don't use my preapproved loan?

- If you don't use your preapproved loan, the offer will expire. If you don't accept the loan, you won't face any repayment obligations.

Written by

Written by  Edited by

Edited by