Understanding SWIFT/BIC Codes and Their Role in International Transfers

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you have a bank account, you’ve probably heard of a routing number. But if you’re making international money transfers, you may have to use a SWIFT code.

Read on to learn about SWIFT codes and their importance in global money transfers.

What Is a SWIFT Code?

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. It’s a network that many banks use to facilitate the transfer of money to banks in different countries. The network itself doesn’t carry out transfers. It merely transmits transfer instructions between banks. It sometimes uses intermediary institutions to pass along these transfer instructions.

A SWIFT code is a standard format for a business identifier code. Every bank that belongs to the SWIFT network has one or more SWIFT codes. They will correlate to the bank’s business identifier code or codes.

The organization that issues SWIFT codes also issues BIC codes. The terms SWIFT and BIC are used interchangeably. They are sometimes mentioned together on banking sites since these codes are the same.

How SWIFT Codes Work

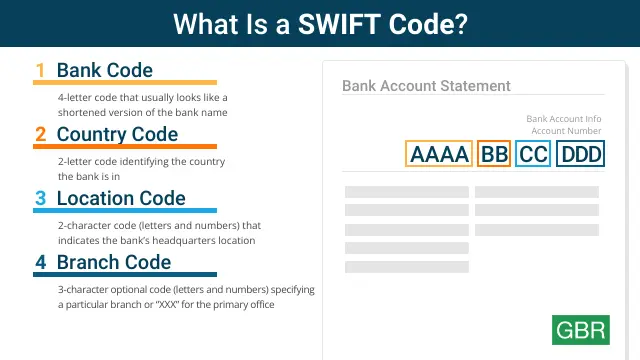

A bank’s SWIFT code is an eight- or 11-digit code with four components:

- Bank code: Four letters that represent an abbreviated version of the financial institution’s name

- Country code: Two letters that indicate the country in which the financial institution is located

- Location code: Two numbers or letters that identify the city of the financial institution’s headquarters

- Branch code (optional): Three characters that identify a financial institution’s branch, as opposed to its headquarters

BIC codes follow the same structure.

When Do You Need a SWIFT Code?

A SWIFT code is needed when someone wants to transfer money internationally. When you want to send money internationally, provide your bank with the SWIFT code for the receiver’s bank so your money goes to the right place. You’ll also usually have to provide the:

- Receiver’s name

- Address

- Bank account number

Your bank uses the code to identify the receiving bank. It then sends a SWIFT message to the receiving bank. Your bank will use its own SWIFT or BIC code to identify itself and request the receiving bank to accept the transfer. Once the receiving bank approves the request, the transfer will be completed.

How To Find a Bank’s SWIFT Code

Anyone needing to make an international money transfer via the SWIFT network will need to know the SWIFT code of the recipient’s bank. Those wanting to receive an international transfer need to supply the sender with the SWIFT code for their own bank. Most SWIFT codes can be found in one of the following ways:

- Searching the bank’s website

- Contacting the bank

- Checking a bank statement

- Logging in to the online banking platform or mobile banking app associated with the account

In the U.S., some banks have SWIFT codes for specific branches, while others have one SWIFT code for incoming transfers in U.S. dollars and another SWIFT code for incoming transfers in foreign currency. It is important to use the correct SWIFT code when transferring money.

Difference Between SWIFT Codes and IBANs

SWIFT or BIC codes are sometimes used with International Bank Account Numbers, or IBANs. An IBAN identifies a particular bank account. If a transfer uses IBANs, it’ll use both the sender’s and the receiver’s. This will ensure the funds come from the correct account and go into the correct account.

How to Use a SWIFT Code Accurately

The biggest issue with an international transfer is entering the SWIFT/BIC number or the recipient’s details incorrectly.

If this happens, the transaction will be rejected by the bank and you’ll have to submit it again.

Daria Uhlig contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by