Put Options Explained: A Beginner’s Guide to Profiting from Market Declines

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A put option, also known as a put, is a right given to a holder to sell an underlying stock at a decided price before a certain date.

To understand the definition completely, it is important to understand these terms:

- Strike price. The price you can sell the stock if you choose to do so.

- Expiration date. The last day you can use the option.

- Premium. The cost to buy the option.

What Is the Difference Between Put and Call Options?

There are two kinds of options, or contracts, you can buy on a stock or other type of equity. These options are as follows:

- Put options. These give you the opportunity to sell at an agreed-upon price in a set amount of time.

- Call options. These enable you to buy at a selected price, which is called the strike price, in a set amount of time, which is the expiration date.

| Feature | Pull Option | Call Option |

|---|---|---|

| Right to | Sell a stock | Buy a stock |

| When does profit occur? | When the price goes down | When the price goes up |

| Purpose | When stocks decline | Growth speculation |

| What does the buyer pay for? | Buyer pays a premium for the option | Buyer pays a premium for the option |

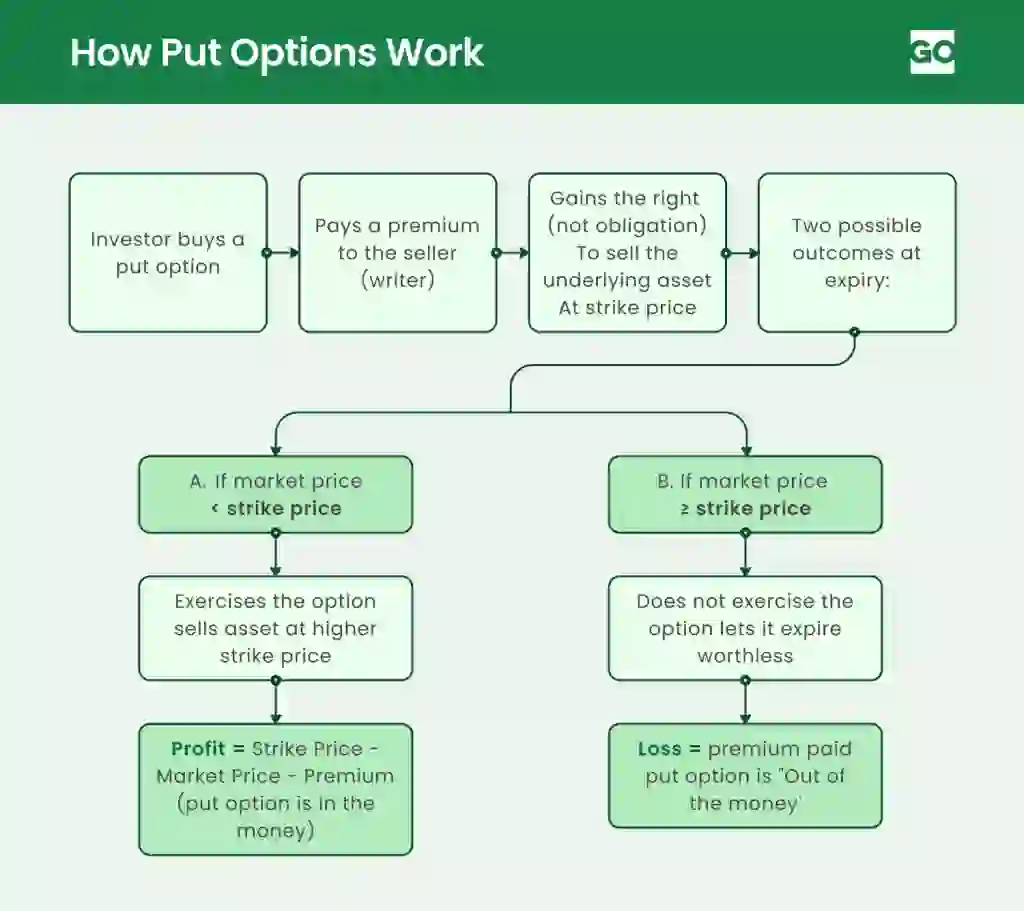

How Put Options Work

Put options aren’t easy to understand, but the following flow chart may offer some guidance:

The Mechanics of Put Options

A put option is essentially a contract between a buyer and a seller. And each party has rights and obligations. Let’s take a further look:

Rights of the Buyer

When the strike price hits, the buyer has the right to sell. However, the buyer isn’t obligated to exercise this option. The buyer has paid an upfront premium to buy the option.

Obligations of the Seller

If the buyer chooses to exercise the option at the strike price, the seller is obligated to sell. The seller takes on that risk in exchange for the upfront premium. The seller has no control if the buyer chooses to exercise the option.

Scenarios: In-the-Money, At-the-Money, Out-of-the-money

There is a special lingo used in the put option space. Some of the scenarios are called in-the-money, at-the-money, out-of-the-money.

| Option Status | Meaning |

|---|---|

| In-the-Money (ITM) | The stock price is below the strike price, so the option has value |

| At-the-Money (ATM) | The stock price is equal to the strike price, so there is no gain or loss yet |

| Out-of-the-Money (OTM) | The stock price is above the strike price, so the option is worthless |

Factors Influencing Put Option Prices

Put option prices are influenced by several factors. These factors include the following:

- Underlying asset price. You need to consider the price of the asset in determining whether you want to exercise your put option. As the stock price falls, the value of your put option rises.

- Time until expiration. The closer you move to the expiration date, the higher your premium becomes.

- Market volatility. When the market is volatile, it’s more likely the option prices will be higher. Market uncertainty creates a higher likelihood of profit.

Reasons to Buy Put Options

Here are some of the reasons it makes sense to buy a put option:

Hedging Against Potential Losses

- Protecting existing investments. Use a put as insurance especially if you fear a long-term stock may decline in value. A put essentially locks in a set selling price so you can protect your existing investment.

- Limiting downside risk. Even if the stock declines, you will lose only the amount of the premium paid. Buying a put sets a defined maximum loss.

Speculating on Price Declines

- Profiting from anticipated drops in asset prices. Buy puts when you expect a stock or asset to fall in value — you profit as the price drops below the strike price.

- Leveraging small investments for larger gains. Puts let you control 100 shares with a small premium, offering the potential for high returns if the trade goes your way — while capping your loss to that premium.

Step-by-Step Guide to Buying Put Options

Here are some steps to help you navigate buying a put option:

Step 1. Assess Market Conditions

- Analyze market trends. It is a good idea to identify stocks and sectors that appear to demonstrate signs of weakness.

- Identify overvalued assets. It isn’t necessarily easy to identify overvalued assets, but when you do, try to spot the downside potential.

Step 2. Select the Right Put Option

- Choose the appropriate strike price. What is the right strike price? You will have to gauge how far the stock will fall. That will require analyzing previous history and trends.

- Determine the optimal expiration date. Allow enough time for the move to happen, but not too much to avoid time decay.

Step 3. Place the Trade

- Use a brokerage account. You can use your existing brokerage account or open a brokerage account at places like Robinhood or Ameritrade that support the buying of put options.

- Understand order types. The order types are a market order, which is an instant execution or limit order which allows you to set the price.

Step 4. Risks and Considerations

- Potential loss of the premium paid. Consider that if the stock stays above the strike price, you will likely lose the amount of the premium you paid. Make sure your overall economic portfolio can withstand this hit.

- Time decay and its impact on option value. Be aware that every day that passes, your put option becomes less profitable. It means that there is less time for the stock to move in your favor.

- Market unpredictability. You cannot trust the market. The stock price may not drop as expected.

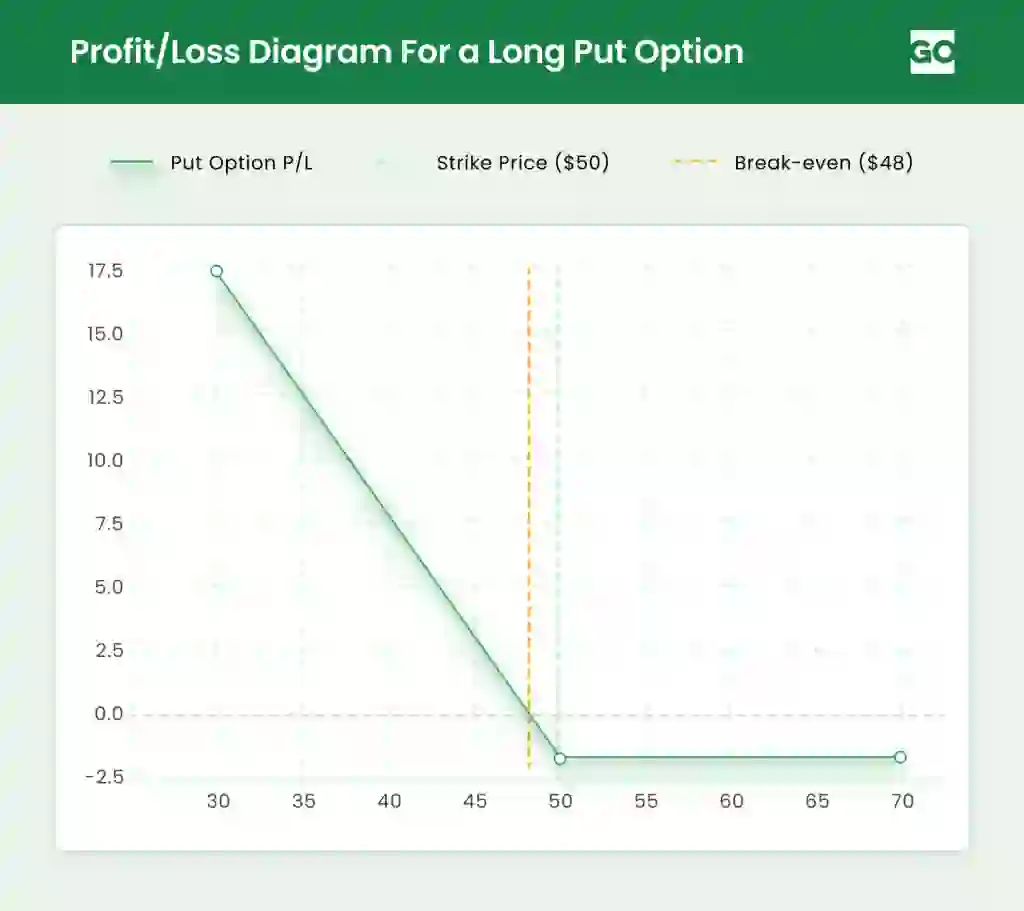

Real-World Example of Buying a Put Option

Let’s try to visualize how a put option operates in an example. You decide to buy a put option in company SAS. These are the specifics:

- Stock price is $60.

- Strike price is $55.

- Premium is $2 ($200 for every one contract).

You will break even if the stock price is $53. If the stock price is less than $53, you will generate a profit. If the stock exceeds $53 or more dollars, you will lose the premium amount that you paid. The total loss is $200. Here’s how that translates in a graph:

Alternatives to Buying Put Options

There are alternatives to buying put options. These options include short selling stocks, using stop-loss orders or exploring other derivative instruments. Here is how they work and what it could mean for your portfolio:

Short Selling Stocks

If you short sell stocks, you essentially sell your borrowed shares. The goal is to buy them back at a lower price. However, the cautionary tale is that if the stock rises, you won’t be able to capitalize on your short sell.

Use Stop-Loss Orders

You can set an automatic sell order when your stock reaches a certain price. This strategy limits your losses.

Explore Other Derivative Instruments

You can invest in inverse ETFs or bear spreads. Inverse ETFs are funds that move in the opposite direction of a specific index. It is a strategy that traders use to profit from market declines.

A bear spread is an options trading strategy when you expect a moderate decline in a stock’s price. It limits your risk and potential profit and is generally a safer way to bet against a stock.

FAQ

- What is a put option in stocks?

- A put option gives the holder the right, but not the obligation, to sell a stock at a specific price (strike price) before or on a certain date.

- How do put options work?

- Generally, if you think a stock price is trending down, you will buy a put. If the stock drops below the strike price, your put increases in value. You can either sell the put or exercise it to sell the stock at the higher strike price.

- When should I consider buying a put option?

- You should buy a put option when the market is uncertain or you think the stock price is going to drop.

- What are the risks of buying put options?

- If the stock doesn't drop below the strike price, the option may expire worthless. You will lose the cost you paid for the option. Since options have expiration dates, time may work against you.

- Can I sell a put option before its expiration date?

- Yes, you can sell your put option before the expiration date. It is a move to either cut loss or capitalize on profit.

Written by

Written by  Edited by

Edited by