What Happens in a Recession: Key Indicators and What It Means for You

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Recession is a scary word, and for good reason. An economic recession impacts the overall economy and people’s lives in many ways. Knowing what happens in a recession — from job losses to reduced spending — can help you prepare. Read on to learn more.

What You Need To Know About Recessions

- Recessions signal an economic downturn marked by job losses, reduced spending and lower GDP.

- Common effects: Layoffs, higher prices and stock market volatility.

- How to prepare: Save more, reduce debt, adjust risky investments and stick to long-term financial plans.

What Is a Recession and How Is It Defined?

A recession is widely defined as two successive quarters of negative growth. In other words, two quarters in a row in which gross domestic product, or GDP, declines.

To identify a recession before it is officially called, watch for the following:

- Negative GDP in multiple quarters

- Increasing unemployment

- Declining consumer spending

- Declining real income

How Long Do Recessions Typically Last?

- The average length of a recession since 1857 is about 17 months.

- Overall, recessions have become less frequent and less severe since World War II. This is due to the safeguards that were put in place after the Great Depression that began in 1929.

- Since World War II, recessions have lasted an average of about 11 months.

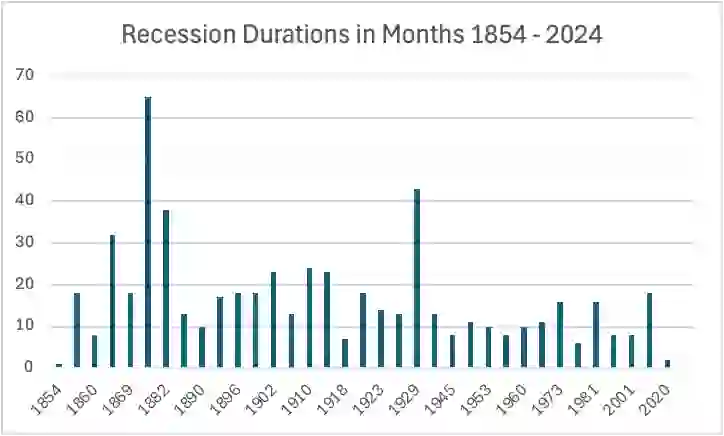

Recession Durations at a Glance

This chart shows the length in months of each U.S. recession beginning in 1854.

Early Warning Signs and Indicators

Although a recession isn’t officially called until several months into the contraction, there are some early signs that a recession is imminent. These are known as leading indicators, as they predict a downturn in advance.

- Inverted yield curve:

- The yield curve tracks the difference between long-term and short-term interest rates.

- When short-term interest rates are higher than long-term rates, the inversion signals that lenders expect future rate cuts and economic slowdown.

- The yield curve inverted in March 2025.

- Declining Leading Economic Index (LEI):

- The Conference Board’s LEI monitors business cycle turning points to forecast economic direction.

- A 0.7% decline in March and a 0.2% in February 2025 indicate slowing economic activity and heightened recession risk.

What Happens in a Recession?

There are several things that can happen during a recession. Sometimes they all occur; other times only some of them do.

- GDP contracts.

- GDP is the amount of goods and services produced in the country.

- When that number is smaller than it was the quarter before, for two quarters in a row, a recession is usually declared.

- Higher unemployment is common.

- Companies lay off workers because they are not doing as much business as they were in the recent past, or they don’t fill open positions for the same reason.

- The stock market is volatile.

- Investors don’t know what the immediate future holds, or they may fear losing money, so they sell.

- Other investors may “buy the dip” causing stock prices to rebound slightly before there’s another selloff.

- Consumers purchase fewer goods, especially non-essential goods.

- They fear their jobs will be cut or wages will be lowered, or that prices will go up.

- A decline in housing starts.

- Consumers put off large purchases until the economy becomes more stable.

How a Recession Can Affect You: 3 Ways To Know

Understanding what happens in a recession can help you anticipate its effects on your job, finances and investments. Here’s what a recession can mean for each of these areas.

Your Job

Unemployment may spike during a recession, as companies scale back in anticipation of slower sales. Employers may reduce the hours of part-time or hourly workers or may not hire for open positions.

Good To Know

The industries that are most susceptible to a recession are those that provide products or services that are not essential.

The travel and hospitality industry, manufacturers of new automobiles or boats, and retail stores will often feel the effects of a recession sharply.

Your Finances

Even if you retain your job, a recession can hit your finances hard.

Rising prices and higher interest rates can negatively impact your finances.

Your Investments

It can be tempting to ditch your investments for the safety of cash during a recession, but this can be counterproductive.

It’s usually best to stick to your long-term strategy and not sell in a panic during a recession.

How To Prepare for a Recession: 3-Step Guide

There are steps you can take to minimize the negative effects of a recession. Here are some things to do when a recession is imminent.

Step 1: Save More, Spend Less

Try to postpone any unnecessary purchases until the economy is on more solid footing.

Save the money you’re not spending on that vacation or new clothes to build up that emergency fund so you’ll be ready in case of a job loss or a prolonged downturn.

Step 2: Rebalance Risky Investments

Take a look at your portfolio to see where you can take some risk off the table. Here are some points to keep in mind:

- Don’t liquidate everything or move completely to cash. Staying invested is still important.

- Shift some money out of volatile positions into more defensive, recession-resistant stocks.

- Consider dividend-paying stocks — reinvesting dividends allows you to buy more shares at lower prices during a downturn.

Step 3: Consider Where You Put Your Money

While you probably don’t want to move everything into fixed investments, it makes sense to consider where your safe investments should be.

Some good options for low-risk investing are the following:

- High-yield savings accounts

- Certificates of deposit

- Bonds

The Bottom Line

Recession is part of the economic cycle, but knowing what happens in a recession — and how to respond — can make a big difference. The key is to be proactive, monitor your spending and saving and have a plan in case your job is in jeopardy. Being proactive will help get you through until the economy begins to expand again.

FAQ

Here are the answers to some of the most frequently asked questions about recessions.- What does a recession do to the average person?

- A recession often means increased unemployment, so people may lose their jobs or work fewer hours. The stock market often fluctuates and may drop moderately or even significantly.

- Do prices go down in a recession?

- They can. Fewer goods and services are sold during a recession, resulting in an economy that contracts. This can cause prices to decline as companies try to entice consumers to buy their goods.

- Where do you put your money during a recession?

- Recessions often see a so-called "flight to safety" or movement from stocks into bonds and fixed investments like CDs and savings accounts.

- Savvy investors will typically reduce their exposure to volatile investments without moving totally to cash.

- Is a recession coming in 2025?

- The common indicators for a recession are in place right now, so a downturn in 2025 is likely. Take steps now to prepare to get through a downturn that could last several months or more.

Erika Giovanetti, Andrew Lisa, John Csiszar and Gail Kellner contributed to the reporting for this article.

Information is accurate as of May 14, 2025.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- The Conference Board. 2025. "The Conference Board Leading Economic Index® (LEI) for the US Fell in March."

- Kiplinger. 2025. "What Is a Recession? 10 Facts You Need to Know."

- Federal Reserve Bank of New York. 2006. "The Yield Curve as a Leading Indicator: Some Practical Issues."

- National Bureau of Economic Research. "Business Cycle Dating."

- Statista. 2024. "Duration of economic recessions in the United States between 1854 and 2024."

Written by

Written by  Edited by

Edited by