5 Things Barbara Corcoran Wants You To Stop Doing With Your Money

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

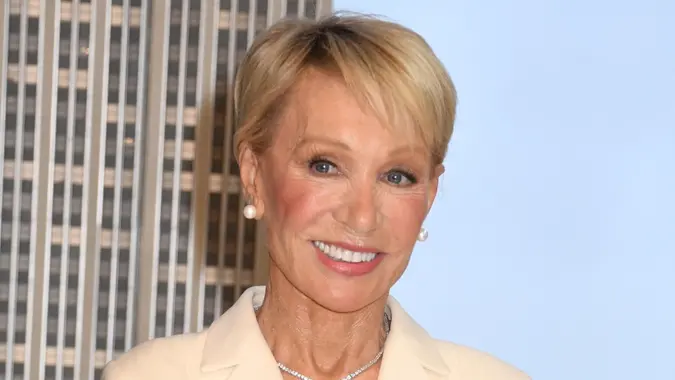

Barbara Corcoran is not only an investor on ABC’s “Shark Tank,” but also the founder of the Corcoran Group — one of the largest real estate brokerages in New York City. She launched the company with a $1,000 loan after leaving her job as a waitress, eventually selling it in 2001 for a deal that built her multi-million fortune.

Corcoran knows exactly how to grow her money and — just as important — how to protect it. If you want to achieve financial freedom just like she did, here are five things she suggests you stop doing with your money.

Paying for First-Class Flights

Corcoran is a multimillionaire, but she still flies coach. “I will not buy a business class ticket on a plane,” she told CNBC Make It. “Always in coach.” Instead, she finds ways to make her coach experience feel like first class, such as bringing her own fancy meals or a small bottle of wine.

Of course, if you can comfortably afford business class (or need a more comfortable seat for health reasons), go for it. But if you’re paying thousands just to impress other people, Corcoran would rather see that money invested or saved for something that actually moves you closer to your financial goals.

Paying for Bottled Water

Another thing Corcoran doesn’t believe in is paying for bottled water. She trusts New York’s tap water and sees no reason to spend a few dollars a day on something you can get almost for free.

That said, tap water isn’t safe to drink everywhere. If your local supply is questionable, invest in a water filter like Brita. They’ll cost you some money upfront, but could save you hundreds, or even thousands, of dollars over the course of a year.

Parking Your Money in a Checking Account

Even after she sold her company for millions, Corcoran admitted she made a mistake leaving too much money sitting in a checking account. Fear of losing her “golden goose” kept her from investing, but her cash was also slowly losing value to inflation by not being invested or parked in a high-yield savings account.

There’s nothing wrong with being cautious about your money, but being overly conservative could mean missing out on gains. A high-yield savings account is a low-risk way to earn more than a traditional checking account, and once you’ve built an emergency fund, you can look at other options to grow your wealth. For example, investing in the stock market, real estate or starting a small business are prime options. If you’re not sure what to do with your money, meet with a financial advisor to help map out a course of action.

Not Considering Closing Costs

Despite being someone who made her name in real estate, Corcoran once underestimated the closing costs on a home purchase and didn’t have enough to cover the bill. “When I bought my first home, I showed up at the table to close without the closing costs,” she told CNBC Make It. “Thank God I was able to borrow it from the very nice seller, or I couldn’t have closed on the place.”

So, before buying a house, make sure to factor in not only the down payment, but also the closing costs, which can range between 2% to 5% of the total cost of the home.

Believing Money Fixes Everything

Perhaps the most important lesson Corcoran shares is that money won’t solve all your problems. She’s met plenty of wealthy people who are still anxious or unhappy. Money gives you freedom, but it won’t solve deep insecurities or create a sense of purpose. “Money has nothing to do with being happier. It really doesn’t,” she said in an interview with CNBC Make It.

Don’t simply focus all your energy on making as much money as possible; take time to invest in relationships, health and personal goals.

Written by

Written by  Edited by

Edited by