5 Ways the Lives of the Wealthy Could Change Under Trump

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

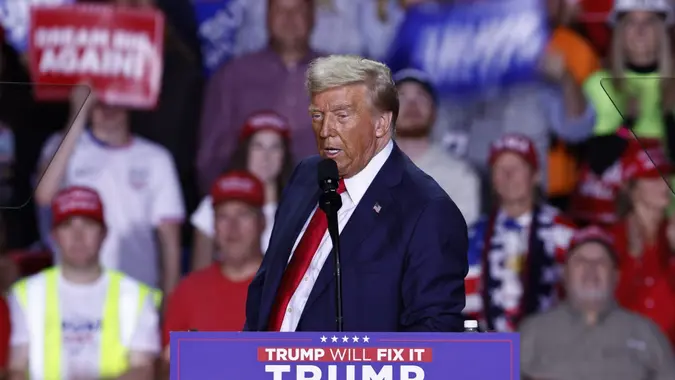

President-elect Donald Trump’s return to the White House has sparked a wave of anticipation and apprehension, particularly among those with the most to gain — or lose. With policies that promise sweeping tax cuts, aggressive tariffs and a crypto-friendly overhaul, his administration could reshape the financial landscape in ways that heavily favor the wealthy. But, as with any bold agenda, there are trade-offs that could ripple through every corner of the economy.

Here’s a closer look at what Trump’s plans might mean for the wealthy — and what costs could emerge along the way.

Tax Reforms

Trump’s commitment to extending the 2017 Tax Cuts and Jobs Act is music to the ears of the affluent. On top of that, he’s proposed eliminating taxes on tips, overtime pay and Social Security benefits, while offering exemptions for groups like military personnel and first responders.

Perhaps most striking is the suggestion to replace federal income taxes with a tariff-based funding system.

The Perks: Wealthy individuals stand to gain the most from these reforms, enjoying drastically lower tax liabilities and more disposable income to invest or save. Businesses and entrepreneurs may also benefit from fewer financial constraints, allowing for expanded growth opportunities.

The Costs: Critics warn that a tariff-based system could lead to underfunded public services, as tariffs are less reliable revenue sources than income taxes. Additionally, this approach may deepen income inequality, disproportionately benefiting high earners while leaving middle- and lower-income households with fewer resources.

Tariffs: A Hidden Tax for Consumers

Tariffs have long been a centerpiece of Trump’s economic vision. His plan includes imposing tariffs of 10% to 100% on imports from countries like China and Mexico, with the goal of encouraging domestic production and making foreign competitors “pay their dues.”

The Perks: Wealthy individuals with stakes in domestic industries may see significant gains as tariffs boost demand for American-made goods. Certain sectors, such as manufacturing, could experience renewed investment and growth.

The Costs: Tariffs often result in higher prices for imported goods, ranging from electronics to luxury items, which may strain household budgets — even for affluent consumers. Critics also note that such policies can exacerbate inflationary pressures, particularly for everyday essentials like groceries, impacting broader consumer spending habits.

Trade Policies

Trump’s trade policies, centered around imposing steep tariffs on Chinese imports, aim to revitalize domestic industries and reduce reliance on foreign manufacturing. While these measures appeal to proponents of economic nationalism, they come with a mixed bag of consequences.

The Perks: These policies could provide U.S. manufacturers with a competitive edge, creating new investment opportunities in domestic markets. For affluent investors, this opens avenues to capitalize on industrial growth.

The Costs: Tariffs drive up production costs and consumer prices, affecting everything from luxury goods to basic necessities. Even high-income households may feel the pinch, while industries dependent on exports could face retaliation from trade partners, dampening economic gains.

Real Estate Investment

Trump’s policies have historically benefited real estate developers through tax incentives, such as expanded bonus depreciation and like-kind exchanges. The introduction of Opportunity Zones has further incentivized investment in economically distressed areas, while deregulation has streamlined project approvals.

These policies created lucrative opportunities for developers and investors but also sparked concerns about wealth inequality and gentrification.

The Perks: Wealthy real estate investors may enjoy reduced taxes and increased investment opportunities, making it easier to build generational wealth. Deregulation could also lower costs, encouraging more expansive development projects.

The Costs: These benefits have sparked concerns about gentrification and wealth inequality. Critics argue that such policies primarily enrich developers while displacing vulnerable communities and widening economic disparities.

Healthcare and Social Safety Nets

Trump’s approach to healthcare and social programs focuses on cutting government spending and shifting more responsibility to individuals. Policies like reducing funding for Medicare aim to save public money but could weaken the support systems many people rely on.

The Perks: Cutting government spending on programs like Medicare could lower taxes for high earners, giving them more financial flexibility. It could also boost private healthcare options, offering tailored solutions for wealthy individuals.

The Costs: Weakening social safety nets might harm the workforce, reduce consumer spending and hurt businesses in the long run.

Editor’s note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

More From GOBankingRates

Written by

Written by  Edited by

Edited by