Safe Harbor 401(k): Rules, Benefits and How It Works

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A safe harbor 401(k) is a special type of employer-sponsored retirement plan that helps businesses skip the hassle of annual IRS testing — while guaranteeing employer contributions to employees. In short, it’s a simpler, more predictable version of a traditional 401(k) that automatically meets government fairness rules.

If you’re a small business owner, high earner or HR manager, a safe harbor 401(k) can make it easier to stay compliant and maximize how much everyone saves for retirement. Here’s what you need to know.

Quick Facts: Safe Harbor 401(k) at a Glance

| Feature | Details |

|---|---|

| Purpose | Automatically satisfies IRS nondiscrimination tests |

| 2025 Employee Contribution Limit | $23,500, plus $7,500 catch-up for age 50+ |

| Employer Obligation | Must make matching or 3% nonelective contributions |

| Vesting | Contributions are immediately 100% vested |

| Setup Deadline (Calendar-Year Plan) | October 1, 2025 |

| Best For | Small to mid-sized businesses, highly compensated employees |

Why Choose a Safe Harbor 401(k)?

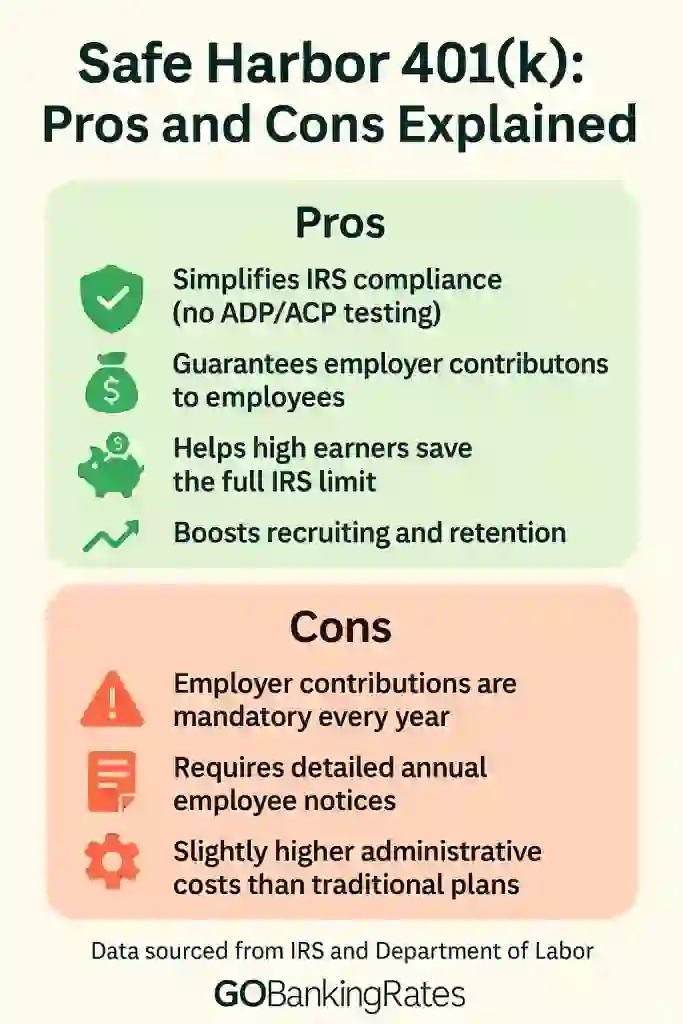

A safe harbor 401(k) offers one of the easiest ways for employers to simplify compliance while helping employees build long-term savings. It removes much of the red tape tied to traditional 401(k)s, allowing companies to focus on growth instead of annual IRS testing.

Here’s why many business owners and high earners choose this plan over a standard 401(k):

Avoid IRS Testing Headaches

Traditional 401(k)s must pass annual “nondiscrimination tests” to ensure the plan doesn’t unfairly favor higher earners. A safe harbor 401(k) skips these tests altogether — as long as employers make specific contributions. That means fewer administrative costs and no surprise compliance issues.

According to the IRS, safe harbor plans are automatically treated as passing both the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests, saving employers time and penalties.

Help High Earners Max Out Contributions

If your business has highly compensated employees (HCEs), a safe harbor plan lets them contribute the full IRS limit without restriction. For 2025, HCEs are defined as those earning $155,000 or more, according to the IRS.

With a safe harbor plan, those high earners can defer the full $23,500 — and up to $31,000 if they’re age 50 or older — without worrying about refunds or contribution limits.

Reduce the Risk of Being “Top-Heavy”

When more than 60% of total plan assets belong to key employees, a 401(k) becomes top-heavy, triggering extra employer contributions.

Safe harbor plans are automatically exempt from top-heavy rules, as long as the employer meets safe harbor contribution requirements.

Types of Safe Harbor 401(k) Contributions

Safe harbor plans come in three standard flavors. Each one requires employer contributions but offers different levels of flexibility and cost.

| Type | Employer Contribution | Employee Required to Contribute? | Vesting |

|---|---|---|---|

| Basic Match | 100% of the first 3% of pay + 50% of the next 2% | Yes | Immediate |

| Enhanced Match | 100% match on up to 4% (sometimes up to 6%) | Yes | Immediate |

| Nonelective | 3% of pay to all eligible employees, whether they contribute or not | No | Immediate |

Example: If you earn $100,000 and contribute 5% ($5,000), your employer’s basic match adds $4,000 — a 100% match on the first 3% and 50% on the next 2%.

Fast fact: According to the U.S. Bureau of Labor Statistics, roughly 70% of private-sector workers have access to a defined contribution plan like a 401(k), but fewer than half take full advantage of employer matches.

Safe Harbor 401(k) Contribution Limits for 2025

The contribution limits for a safe harbor 401(k) are the same as a traditional 401(k):

- $23,500 for employee elective deferrals

- $7,500 catch-up contribution for those age 50+

- $11,250 special catch-up for ages 60-63 (new in 2025 under SECURE 2.0)

That means some older workers could contribute up to $34,750 in 2025 — an all-time high, per IRS data.

Who Should Consider a Safe Harbor 401(k)?

While any company can adopt a safe harbor 401(k), it’s especially valuable for small businesses and highly compensated employees who want to save more without testing limits.

If your organization is looking to stay compliant, boost employee satisfaction or gain a recruiting edge, this plan might be the perfect fit.

Small Business Owners

For owners of small and mid-sized companies, safe harbor plans are a stress-free way to offer strong retirement benefits. There’s no need for complex annual testing, and contributions can be used as a tax-deductible business expense.

High-Earning Professionals

Safe harbor 401(k)s let high-income earners contribute the full IRS limit without being restricted by discrimination tests. It’s a great option for those trying to maximize pre-tax savings.

Businesses Competing for Talent

Offering a safe harbor match is a proven way to attract and retain top performers. A recent Guideline study found that 93% of employees say retirement benefits influence their decision to join a company, and a 2022 TIAA survey found 82% of employees say benefits, and specifically 77% for retirement benefits, are important when deciding whether to change jobs.

Safe Harbor 401(k) vs. Traditional 401(k)

| Feature | Safe Harbor 401(k) | Based on the employer’s schedule |

|---|---|---|

| IRS Testing | Not required | Required annually |

| Employer Contributions | Required (match or 3% nonelective) | Optional |

| Vesting | Immediate | Based on employer’s schedule |

| Complexity | Moderate | Higher |

| HCE Contribution Limits | No restriction | May be limited |

A traditional 401(k) may still make sense if your workforce primarily consists of lower earners or consistent savers. In those cases, you might pass IRS testing naturally without needing mandatory contributions.

How To Start a Safe Harbor 401(k)

- Choose a plan provider: Compare 401(k) administrators (Fidelity, Vanguard, Guideline) that offer safe harbor options and user-friendly dashboards.

- Select a contribution formula: Decide between basic match, enhanced match or nonelective contributions.

- Provide employee notices: Must be sent 30-90 days before the start of each plan year.

- Automate payroll and funding: Integrate your payroll system so contributions are deposited on time and accurately.

Did you know? According to the Department of Labor, missing or late 401(k) deposits are among the most common plan compliance errors, which can lead to costly penalties.

Final Take to GO: Is a Safe Harbor 401(k) Right for You?

A safe harbor 401(k) can be a win-win for employers and employees alike. Businesses enjoy fewer IRS headaches, while workers benefit from guaranteed, immediately vested contributions. If you’re looking for a plan that strikes a balance between compliance and generosity, this could be your best option.

Before you decide, compare contribution types and costs — and make sure you meet all IRS deadlines.

The right setup can help your business stay compliant while helping you and your team save more for the future.

Next Steps:

- Estimate your potential savings using our retirement calculator.

- Learn how different plans compare in our guide to safe harbor IRA fees.

FAQs About Safe Harbor 401(k)

Here are some common questions and concerns that might pop up around Safe Harbor 401(k) plans:- What is the safe harbor 401(k) match formula?

- The IRS allows a basic match (100% of the first 3% you defer + 50% of the next 2%) or an enhanced match (100% up to at least 4%). Employers can alternatively make a 3% non-elective contribution to all eligible employees.

- When does a safe harbor 401(k) need to be adopted?

- For calendar-year plans, by Oct. 1 to get safe harbor status for that year, plus time to meet the 30–90 day notice window.

- Can you change a safe harbor plan mid-year?

- Often yes -- for example, you can switch to a 3% non-elective safe harbor as late as 30 days before year-end under SECURE rules, with proper notices.

- Is a safe harbor 401(k) good for small businesses?

- Yes, if you want predictable compliance and HCEs who can contribute the max. The tradeoff is required employer contributions each year.

- What are the 2025 safe harbor 401(k) contribution limits?

- You can defer $23,500; age 50+ can add $7,500; ages 60–63 can add $11,250 instead of $7,500.

Melanie Grafil contributed to the reporting for this article.

Information is accurate as of Oct. 21, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- IRS "401(k) Plan fix-it guide - You haven't timely deposited employee elective deferrals"

- TIAA "2022 TIAA Employee Retention Survey"

- Guideline "Report: Are employers undervaluing 401(k) plans?"

- CNBC "There’s still time for ‘super catch-up’ 401(k) contributions for 2025 — here’s who benefits"

- U.S. Bureau of Labor Statistics "https://www.bls.gov/news.release/ebs2.nr0.htm"

- IRS "401(k) plan fix-it guide - 401(k) plan - overview"

- IRS "COLA increases for dollar limitations on benefits and contributions"

Written by

Written by  Edited by

Edited by