Biden’s New Retirement Proposal: Could It Save You Thousands?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Roughly 35% of Americans consult with a financial advisor, according to data cited by Financial Strategists. However, some unscrupulous financial advisers are chipping away at people’s retirement savings.

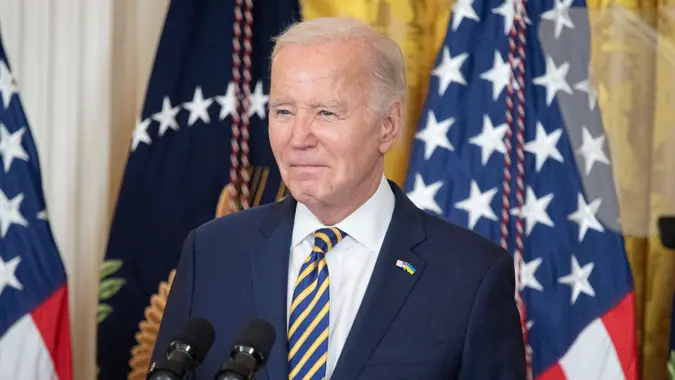

“Most financial advisers give their clients good advice at a fair price and are honest with them,” said President Joe Biden at a White House event. “But that’s not always the case. Some advisers and brokers steer their clients towards certain investments, not because of the best interests of the client, [but] because it means the best payoff for the broker,” reported CNN Business.

The Biden administration recently announced a new measure that targets financial advisers who are charging junk fees and purposely misleading clients to line their pockets.

Biden Cracks Down On Financial Adviser Junk Fees

As a part of the Bidenomics agenda, the Department of Labor has proposed a new rule to close loopholes and require that financial advisers provide retirement advice in the best interest of the saver rather than chasing the highest payday, according to the official White House press release.

The idea behind this rule is that it would promote competition among financial advisers, reduce junk fees in common retirement products, and most importantly, protect American’s hard-earned retirement savings.

Specifics Of The New Financial Advisor Rule

Here’s what the new rule intends to cover:

- Advice to plan sponsors about which investments to make available as options in 401(k)s and other employer-sponsored plans: Currently, there is no requirement that the investment products made available to employees through employer-sponsored 401(k) plans be the best investment products for the employee. This rule would change that. Since most Americans save for retirement through their employers, having access to the lowest-cost and highest-yielding investment products is crucial.

- Cover advice to roll assets out of an employer-sponsored plan like a 401(k): Currently, the advice provided to Americans in regards to how to roll out assets from an employer-sponsored 401(k) plan to a traditional individual retirement plan (IRA) is not required to be in the best interest of the saver. This rule would change that and ensure that Americans aren’t losing money or investment potential in the process.

- Close loopholes so that recommendations to purchase any investment product must be in the savers’ best interest: Under current law, advice provided to Americans regarding investment products like mutual funds is regulated by federal law. However, advice for products like fixed index annuities is governed by state laws with inadequate oversight. Financial advisors may push products like fixed index annuities for their personal gain, but this change will regulate advice for all retirement investment products.

The creation of this new rule is a part of the Biden administration’s broader effort to reduce or eliminate junk fees to put more money back in the pockets of Americans.

Written by

Written by  Edited by

Edited by