5 Tips for Retirees To Save on Holiday Shopping

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

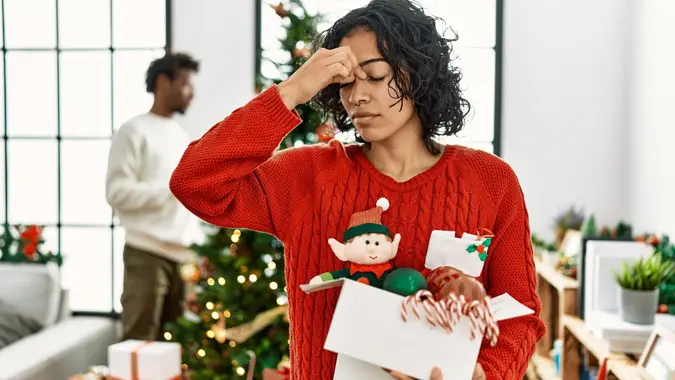

While Retirees often have more free time than those still working full-time, the holiday season can still get pretty hectic. Last-minute shopping, rising prices, tariffs and a fixed retirement income can make budgeting during the holidays all the more challenging.

The holidays are just around the corner, and with them comes the need for retirees to be especially mindful about their spending. These five tips can help retirees save money on everything from last-minute gifts to holiday meals.

1. Utilize Senior Discounts

You’ve reached the age where you can cash in on some deals and discounts, so why not use them to your advantage? Many retailers offer exclusive senior discounts, especially during holiday sales or on specific days of the week. These deals can range from 5% to 25% off and apply to retail stores, grocery chains and restaurants.

You should take advantage of these savings opportunities throughout your golden years by checking store policies, signing up for senior discount programs and planning holiday shopping trips around discount days.

2. Cash In Your Cash-Back Rewards

All year long, you’ve spent money using your credit card, debit card and money apps, many of which have accumulated rewards in the process. If you are in a bind for some extra dough to spend on gifts, now is the time to cash in those rewards.

Don’t forget that retail loyalty programs can offer store cash, coupons or exclusive discounts. Retirees should check their accounts and apps to see what rewards they have available before heading to the store this holiday shopping season.

3. Seek Out Price Matching

Retirees can also look for price-matching opportunities. While it may take a little extra time, price matching can lead to significant savings, especially on big-ticket items or bulk purchases. By comparing prices from a variety of stores, you can ensure you are getting the best cost per item, which adds up to big savings overall.

4. Shop at Big Retailers and in Person

While shopping online can be a fun experience, you have to wait for shipping and possibly pay overpriced delivery fees. Shopping locally in boutique stores can help support businesses in your area, though they tend to have more expensive price tags.

Instead, consider shopping in person at a warehouse club like Costco or Sam’s Club. These stores offer bulk discounts on gifts, wrapping supplies and holiday essentials, and going in person allows retirees to inspect items and avoid shipping costs.

5. Make Your Own Gifts

Retirees can use their time and creativity to create thoughtful presents that resonate with loved ones. Consider giving personalized, lower-cost gifts, like baked goods, homemade crafts or photo albums, which are often more meaningful and budget-friendly than store-bought items.

A little planning for your seasonal shopping goes a long way toward helping you avoid overspending and post-holiday debt.

J. Arky contributed to the reporting for this article.

More From GOBankingRates

Written by

Written by  Edited by

Edited by