3 Ways Biden’s Supreme Court Term Limits Could Help Your Wallet

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

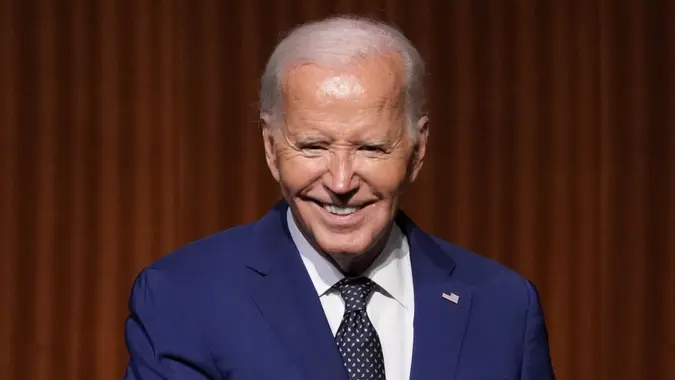

President Joe Biden’s plan to reform the U.S. Supreme Court by setting term limits and implementing an ethics code has mainly been analyzed for its potential impact on the legal and political worlds. But it could have a financial impact as well — at least indirectly.

The White House announced the plan in a July 29 press release. Among other things, the press release said the current Supreme Court majority has “overturned long-established legal precedents protecting fundamental rights, gutted civil rights protections, taken away a woman’s right to choose (and) granted presidents broad immunity from prosecution for crimes they commit in office.”

Three main pillars of the plan were announced: term limits for SCOTUS justices, an ethics code for the court, and no immunity for crimes former presidents committed in office.

“The United States is the only major constitutional democracy that gives lifetime seats to its high court Justices,” the press release said. “Term limits would help ensure that the Court’s membership changes with some regularity; make timing for Court nominations more predictable and less arbitrary; and reduce the chance that any single Presidency imposes undue influence for generations to come.”

Biden called on Congress to “quickly establish term limits,” the AP reported, but that’s a long shot. It almost certainly won’t happen with Biden in office because Republicans control the U.S. House. And even if 2024 Democratic presidential candidate Kamala Harris wins the November election, she’ll likely face a tough slog getting SCOTUS term limits approved.

If lawmakers ever do approve term limits for Supreme Court justices, here are three ways it could help your wallet.

Student Loan Forgiveness

Last year the Supreme Court famously shot down Biden’s federal student loan forgiveness plan, which would have forgiven up to $20,000 in debt per borrower. The ruling, handed down on June 30, 2023, impacted more than 45 million borrowers who at the time owed $1.6 trillion in federal college loans. Had the SCOTUS not killed it, those borrowers would be a lot better off financially right now.

Chief Justice John Roberts, who joined the court under a Republican president, wrote the opinion for the majority, the AP reported. He was joined by fellow GOP appointees Neil Gorsuch, Clarence Thomas, Samuel Alito, Amy Coney Barrett and Brett Kavanaugh. If term limits had been in effect, Thomas (who joined the SCOTUS in 1991) might not have been on the court. Depending on the length of the limit, Roberts and Alito — who joined in 2005 and 2006, respectively — might not have been on the court, either.

Government Regulation

In another 6-3 decision that went along ideological lines, the Supreme Court recently overturned a “decades-long precedent” that required federal courts to defer to expert opinions of federal agencies, according to the National Association of Student Financial Aid Administrators (NASFAA). The ruling involved Chevron U.S.A., Inc. v. Natural Resources Defense Council, known as the “Chevron deference.”

The NASFAA cited commentary from Forbes legal analyst Adam Minsky, who wrote that the decision could jeopardize the Biden administration’s Saving on a Value Education (SAVE) plan, which is an income-driven repayment plan designed to save student loan borrowers money.

Although the NASFAA focused on student debt, broader SCOTUS decisions having to do with regulations could help or hurt your wallet. For example, regulations that might lead to higher consumer prices could conceivably be struck down by the Supreme Court, which would help your wallet. Setting term limits means that justices with a long history of ruling against consumer interests will have to leave the court much sooner than they do now.

Taxes

In a 7-2 ruling this past June, the SCOTUS upheld the constitutionality of income taxes on foreign earnings in certain cases. According to the Tax Foundation, the ruling “favored” favored the government’s ability to impose taxes “under the narrow, particular circumstances of the case.” However, the Foundation added, the opinions “strongly suggest” that the court could rule in favor of taxpayers under other circumstances.

Setting term limits could rid the court of justices with a long history of supporting increased taxation, which would also benefit your wallet.

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. For more coverage on this topic, please check out 4 Ways Biden’s Supreme Court Term Limits Could Hurt Your Wallet.

Written by

Written by  Edited by

Edited by