SECU Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

SECU Routing Number: The Key To Smooth Transactions

The State Employees’ Credit Union routing number is required when setting up transfers such as direct deposits or organizing a recurring bill. These transactions can be completed online, through the mobile app or by contacting a customer service representative. Learn more with this full guide on how to find your SECU routing number quickly and when you might need to use it.

SECU Routing Number

The State Employees’ Credit Union has just one routing number for all accounts:

| SECU Routing Number |

|---|

| 253177049 |

How To Find Your SECU Routing Number

If customers ever have any difficulty locating SECU’s routing number, there are a few easy ways to find it.

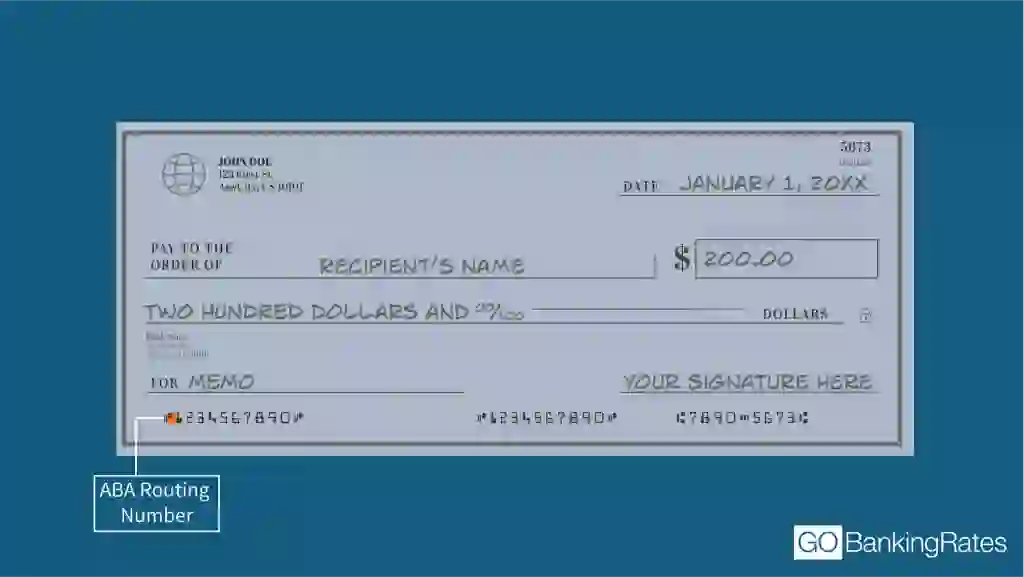

On a Check

The SECU routing number is the nine digits that can be found in the bottom-left corner of a check. The routing number comes just before the customer’s account number.

Through Online Banking

For customers who don’t have immediate access to a physical check, SECU’s routing number can also be found through online banking.

- Log in to SECU online banking using your username and password.

- Navigate to your account details or settings page.

- Locate the routing number under account information.

By Contacting Customer Service

You can also contact customer service for help with your routing number and accounts. Representatives can be reached at 888-732-8562. Support is available 24/7.

SECU Routing Numbers for Wire Transfers

SECU members can send, receive or schedule recurring wire transfers by visiting a SECU branch or calling customer service.

Sending an international wire transfer with SECU will cost $25, while sending a domestic transfer will cost $10.

To complete the transaction, you’ll typically need to provide the recipient’s name, address, account number, and either their routing number if you’re sending a domestic transfer or their bank’s SWIFT code if you’re sending an international one.

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 253177049 | N/A |

| International Wire Transfer | 253177049 | SMCUUS31 |

SECU Routing Number vs. Account Number: What’s the Difference?

Your routing number and account number work together to ensure your money reaches the correct destination. Your routing number identifies the bank or financial institution, while the account number specifies your individual account within that institution.

How To Use Your SECU Routing Number

You will need your SECU routing number for a few different financial transactions:

- Transferring funds electronically through automated clearing house payments.

- Making domestic or international wire transfers.

- Setting up automatic bill payments.

- Ordering new checks.

- Depositing tax refunds or government payments.

FAQ

Here are a couple of additional questions that people ask about SECU routing numbers.- Do all SECU accounts have the same routing number?

- Yes, the State Employees' Credit Union has just one routing number for all accounts: 253177049.

- How do I find my SECU routing number without a check?

- You can find the SECU routing number by calling 888-732-8562. It will also be on your paper bank statements and on the top right corner of the bank's website.

- Can I use the same routing number for wire transfers at SECU?

- To set up a wire transfer at SECU, you can provide the routing number 253177049.

More About SECU

Information is accurate as of Feb. 14, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by