What Is a Bump-Up CD? Features, Benefits and How It Works

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

With interest rates at their highest in decades, now may be a smart time to consider certificates of deposit (CDs). While many CDs lock in a fixed rate for the entire term, bump-up CDs offer a unique twist: the chance to increase your rate during the term if rates rise. Here’s how they work — and how to tell if they’re the right investment option for you.

Quick Take: What Is a Bump-Up CD?

A bump-up CD is a type of CD that lets you raise your interest rate during the term — usually once or twice — if rates go up.

They are ideal in rising interest rate environments, allowing you to lock in your CD at today’s rate and take advantage of increased rates in the future.

How Do Bump-Up CDs Work?

Bump-up CDs work much like traditional CDs: you deposit money for a set term and earn a fixed interest rate. The key difference? If your bank raises rates on a CD with the same term, you can request to “bump” up your rate once — or possibly more — during the term.

To qualify for a bump, these conditions must be met:

- The rate must have increased on a fixed-rate CD with the same term at your bank.

- You must request the bump, and the bank must approve it.

Because of this added flexibility, bump-up CDs often start with a slightly lower rate than traditional CDs. Early withdrawal penalties still apply.

Key Features of Bump-Up CDs

Bump-up CDs offer several built-in benefits:

- No cost for a rate increase: Bump-up CDs allow you to lock in a higher interest rate during your term at no additional cost.

- May allow more than one bump: Most bump-up CDs offer a single rate increase for the duration of your CD term, but longer-term CDs may allow more than one rate increase.

When a Bump-Up CD Makes Sense — and When It Doesn’t

Use this quick comparison to see if a bump-up CD fits your savings goals or if another option might be better

| When a Bump-Up CD Is Worth It | When a Bump-Up CD Isn’t Worth It |

|---|---|

| You expect interest rates to rise | You expect rates to stay flat or decline |

| You want flexibility without sacrificing a guaranteed return | The initial annual percentage yield (APY) is much lower than other CDs |

| You don’t plan to access the funds early — to avoid penalties | You need penalty-free access to your funds |

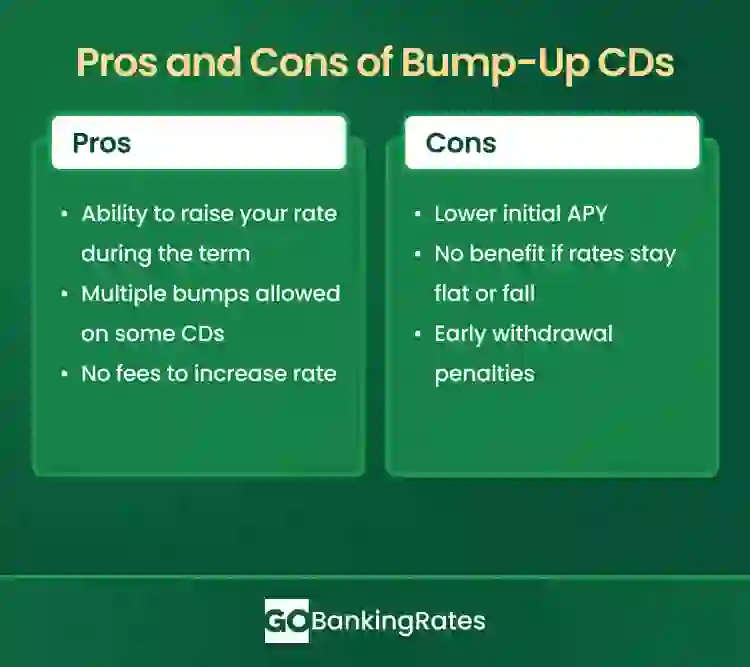

Pros and Cons of Bump-Up CDs

Here’s a quick look at the main advantages and disadvantages of choosing a bump-up CD.

Bump-Up CDs vs. Traditional CDs

Here’s how bump-up CDs compare to traditional CD accounts in key features.

| Feature | Traditional CD | Bump-Up CD |

|---|---|---|

| Interest rate | Fixed | Fixed but can increase |

| Rate flexibility | None | One or more bumps |

| Initial APY | Usually higher | Usually lower |

| Early withdrawal penalty | Yes | Yes |

Where To Find the Best Bump-Up CDs

To find the best bump-up CD, focus on reputable banks that offer competitive rates, flexible terms and fair bump and deposit requirements.

Below are some of the best bump-up CD options available now:

| Bank and Account | APY | Term | Bumps Allowed | Minimum Deposit |

|---|---|---|---|---|

| Ally Bank Raise Your Rate |

2 years, 4 years | Raise the rate once during the 2-year CD and twice during the 4-year CD term | $0 | |

| Marcus by Goldman Sachs Rate Bump CD |

20 months | Raise your rate if the bank increases APYs | $500 | |

| Synchrony Bank Bump-Up CD |

24 months | One bump | $0 |

Alternatives to Bump-Up CDs

Here are some other options to consider beyond bump-up CDs.

Savings Accounts

Bump-up CDs offer high interest rates with the ability to increase your rate during your CD term. Savings accounts offer a variable interest rate that can change at any time.

Savings accounts are more liquid, though, and you can access your money at any time without penalty. Bump-up CDs lock your funds in for a fixed length of time and charge penalties for withdrawing funds early.

Market-Linked CDs

Bump-up CDs offer a fixed interest rate and set term length, but you can increase your interest rate at least once during your term if rates increase. Market-linked CDs offer potentially higher returns linked to a market index or fund, but there are drawbacks.

While bump-up CDs give a guaranteed rate of return, market-linked CDs may have no return at all, and the upside is capped. Plus, market-linked CDs may come with high fees and stiff penalties.

How To Open a Bump-Up CD

You can follow these steps to open a bump-up CD:

- Research banks, CD rates and terms.

- After picking the right one for you, either visit the branch or go to the bank’s website.

- You must provide a form of identification, your Social Security number and your address.

- Wait for approval and fund your new CD account.

Should You Open a Bump-Up CD?

A bump-up CD offers a safe, fixed-rate investment with the flexibility to raise your rate if CD rates go up during your term. It’s ideal if you want to hedge against rising rates but are comfortable with a potentially lower starting APY.

Bump-Up CD FAQs

Before you lock in a bump-up CD, here are the most common questions — and the answers that can help you decide if it's right for you.- Can you bump up a CD more than once?

- Yes, some banks allow multiple bumps, usually on longer-term CDs. For example, Ally Bank's Raise Your Rate CD lets you increase your rate twice during the 4-year term.

- Are bump-up CDs FDIC-insured?

- Yes, your deposits will be insured as long as you open your bump-up CD at an FDIC-insured bank or an NCUA credit union.

- What is the difference between a bump-up CD and a step-up CD?

- A bump-up CD lets you request a rate increase if rates rise. A step-up CD automatically increases your rate on a set schedule, regardless of market changes.

- Are bump-up CDs worth it?

- They can be worth it in a rising-rate environment. Consider whether rates will go up during your term.

- What is the disadvantage of bump-up CD?

- The main drawbacks are the lower starting APYs compared to traditional CDs, limited opportunities to bump your rate and early withdrawal penalties if you need your funds before maturity.

Melanie Grafil contributed to the reporting for this article.

Rates are subject to change; unless otherwise noted, rates are updated periodically. All other information on accounts is accurate as of Aug. 12, 2025.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Consumer Financial Protection Bureau. 2023. "What is a certificate of deposit (CD)?"

- Office of the Comptroller of the Currency (OCC). "What is an index-linked certificate of deposit (CD)?"

- Office of the Comptroller of the Currency (OCC). "What are the penalties for withdrawing money early from a certificate of deposit (CD)?"

Written by

Written by  Edited by

Edited by