How To Lower Your Car Payment: Before and After Buying a Car

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Car payments can eat up a huge chunk of your monthly budget. According to Experian’s State of the Automotive Market report in late 2024, the average new car payment has ballooned to $737.

There are ways to keep your car payment low, however, and if you already have a high car payment and are struggling to keep up, you can still lower your monthly payment. Here are 10 ways to reduce your car payment, both before and after you’ve purchased a vehicle.

Should You Refinance Your Car Loan?

It can be worth it to refinance your car loan. If you have improved your credit score or if interest rates have dropped — you may be able to secure a lower rate and lower monthly payment. It may also be worth it if you can extend your loan term to lower your payments if your current car payment is too expensive.

How To Lower Your Car Payment Before Buying a Car

Before buying a car, there are a few strategic moves you can make to keep your payment as low as possible.

Choose a Less Expensive Car

Purchasing a less expensive vehicle than your first choice can help you save money and have a much lower monthly payment. Maybe you like the Toyota Camry, but don’t necessarily need all the bells and whistles to enjoy having the car. Choosing the basic model can save thousands, which equates to a lower payment.

Or maybe you can check out certified pre-owned vehicles instead of a new one. These cars can save you a ton of money and may still come with dealer warranties and similar perks of a new vehicle. This can give you the “new car feel” with a much lower payment.

Make a Bigger Down Payment

The more you put down on a car, the smaller your loan will be, resulting in a lower monthly payment. It’s a good idea to put at least 10% to 20% down on your vehicle purchase. This helps give you some equity in your car purchase, and the amount you need to borrow. If you can’t quite put down 10% — you may want to consider holding off on the car purchase until you can stack some additional cash.

Get the Lowest Interest Rate

The lower your car loan interest rate, the lower your monthly payment will be. The interest rate on your loan is determined by your credit score, down payment amount and loan terms. If you have good credit, you can usually secure the lowest rates with most lenders.

It’s also a good idea to shop around for car loans. Check with local banks, credit unions and online lenders to see what rate you qualify for. They may offer pre-qualification without hurting your credit score, so you can get several quotes before choosing.

Be Cautious When Choosing a Longer Loan Term

Your auto loan term is the length of your loan. While choosing a shorter loan term will lower the overall cost of your car loan, it may result in high car payments. If you want lower payments, you can choose a longer loan term to spread your payments over a longer period.

Most lenders now allow up to 72 to 84-month loan terms, which allows you up to seven years to repay your car loan. This can significantly reduce your car payment each month — but may end up costing you more in interest payments over the life of the loan.

Trade In Your Current Car for a Lower Payment

If you are driving a car that’s simply too expensive, you may be able to trade it in for a more modest car and lower your payment at the same time. For this to work, your vehicle should have some equity — otherwise, you’ll end up in a much worse position financially. Negative equity in your old car would result in higher debt with the new vehicle.

If you do have equity, you can trade in the vehicle and use that equity toward your next car purchase. Assuming you purchase a less expensive vehicle, you could end up with a lower car payment.

How To Lower Your Car Payment After Buying a Car

If you already have a car loan and it’s too big, here are a few things you can do to lower your monthly payment.

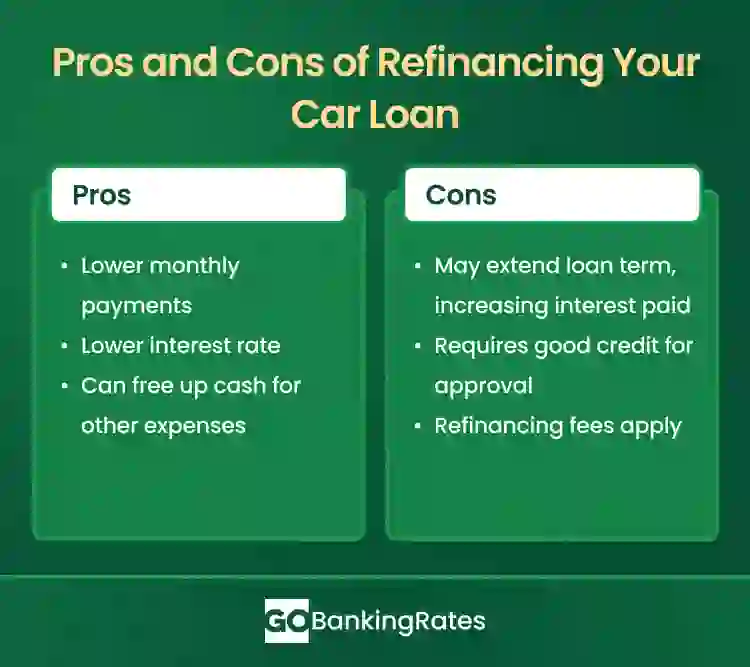

Refinance Your Car Loan

You may be able to refinance your car loan to one with a lower interest rate or longer loan term. This can reduce your monthly car payment and potentially help you save money in interest. Just make sure to understand the fees on a loan refinance, as it may not be worth it. And if you extend your car loan term, you may end up paying more in interest, depending on how much longer your loan ends up being.

Extend Your Loan Term

If you can’t keep up with your monthly car payments, your lender may be willing to extend your loan term to lower your monthly payment. While this can cost more in the long-run, it can provide immediate financial relief in the form of a lower monthly payment. Just make sure that you can continue making on-time payments, or you may end up further in debt.

Make a Large One-Time Payment

If you have extra cash available, you may be able to make a large one-time payment to lower the amount you owe. Some lenders will adjust your monthly payments after making a lump-sum payment on your loan. This can be a great way to lower your payment with extra cash from a tax return, bonus, or any other unexpected cash you come across.

Negotiate With Your Lender

If you’re struggling to keep up on your car payment, you may be able to negotiate with your lender and come up with a payment you can afford. While not all lenders offer payment relief, some will work with you to reduce your payment, at least temporarily. This can be a great option if you lose a job or just need temporary relief on your high car payment.

Trade In Your Car for a More Affordable One

Sometimes your car is just too expensive, and it may be worth considering a trade-in for a cheaper vehicle. If your car has some equity, you can trade it in for credit on the purchase of another vehicle. Look for a good used vehicle or certified pre-owned car that is cheap and reliable. This can help lower your payment and total cost of car ownership.

Pros and Cons of Extending Your Loan Term

Before you decide whether to extend your loan term, it helps to weigh the trade-offs.

Pros

- Helps lower your payments

- Helps avoid missed payments and credit damage

- Can make car ownership more affordable

Cons

- Increases total interest paid over time

- You may owe more than your car’s value (negative equity)

- Longer-term loans can result in higher costs overall.

FAQs About How to Lower Your Car Payment

Here are answers to some of the most frequently asked questions about lowering your car payment.- Can I lower my car payment without refinancing?

- Yes, you may be able to lower your car payment by depositing a lump-sum payment on your loan or negotiating with your lender on a lower monthly payment. You may also be able to trade in your car for a more affordable one, lowering your overall payment and cost of ownership.

- How much can I save by refinancing my car loan?

- You may be able to save up to $100 per month (or more) when refinancing your car loan. The amount you save depends on your current loan term, interest rates and loan balance.

- Will lowering my car payment hurt my credit score?

- Lowering your car payment might hurt your credit score if you negotiate a lower payment with your lender, or if you refinance your loan. The hard credit pull for a new loan could slightly drop your score.

- Can I skip a car payment if I'm struggling financially?

- If you can't afford your car payment, call your lender before missing any payments. Many lenders offer hardship plans and payment relief if you lose a job or have another life circumstance that makes it impossible to pay your full monthly loan payment. Missing a payment can severely damage your credit score.

- Is trading in my car a good idea if I can't afford the payments?

- If your car is too expensive, you may be able to trade it in for a lower-priced car. But you'll need to make sure you have equity in your car, which means you owe less than it's worth, and watch out for dealer fees when buying another vehicle.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Experian. 2024. "Average Car Payment in 2024."

Written by

Written by  Edited by

Edited by