Can You Write a Check to Yourself?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Yes, you can write a check to yourself — and it’s quite common, especially if you’re in a hurry and need cash right away. It’s your money, and so you have control over how you use it.

Why would you need to write a check to yourself, though? You can do a quick bank-to-bank transfer, create a paper trail for a specific transaction or withdraw money from your own account when you need it. Here’s how to do it safely and quickly.

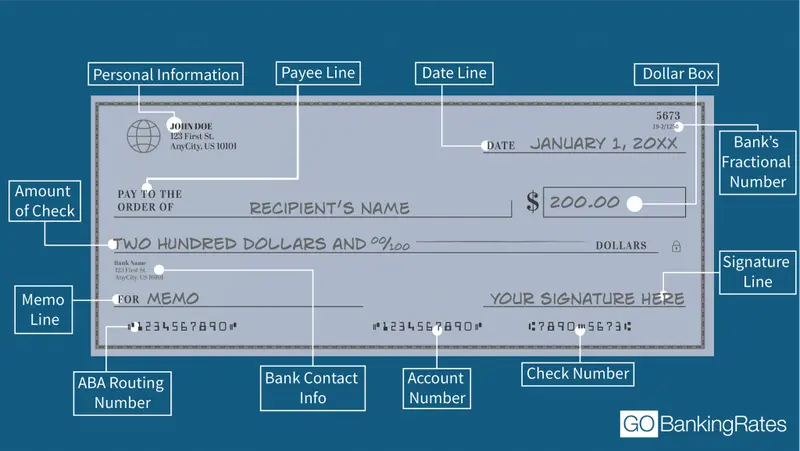

How To Write a Check to Yourself

The next time you want to write a check, follow this step-by-step guide. Keep in mind the process is the same as writing any other check.

- Date the check. In the right hand corner, write in the month, day and year.

- Pay to the order of. On the “Pay to the Order of” line, write the recipient’s name, which is the person or company you’re paying.

- Enter the numeric amount. Write the numerical amount in dollars and cents in the blank next to the $ sign.

- Write the amount in words. Under the “Pay to the Order Of” blank, write out the amount in words.

- Memo line. At the bottom left of the check you can write a brief memo on the check line. This isn’t required.

- Sign the check. Don’t forget to sign the check in the bottom right-hand corner.

Common Mistakes to Avoid

Try to avoid these mistakes when issuing a check:

- Forgetting to sign: If you don’t sign your check, the bank will likely decline your transaction.

- Mismatched or unclear amounts: Make sure the written and numeric amount match as it may cause delays, or the bank may decline the translation.

- Insufficient funds: Not having enough funds in your account can lead to the check bouncing, which will lead to fees and potential account closure. Repeated patterns of this behavior will be considered check kiting — which is intentionally floating funds between two accounts. This is illegal.

- Illegible writing: Poor handwriting can result in delays or processing errors.

Why Would You Write a Check to Yourself?

There are several reasons why you may want to write a check to yourself.

Moving Money Between Banks

Writing a check to yourself is convenient when electronic access isn’t available or ideal. To close an account, you may also need to write a check to yourself.

Withdrawing Cash

Sometimes you need cash and will need to write a check to yourself. This may occur when your debit card isn’t handy or you need to withdraw large amounts of cash that can’t be done at an ATM.

Creating a Paper Trail

If you need to create a paper trail for financial tracking, tax preparation or budgeting, writing a check to yourself automatically helps with documentation.

Avoiding Transfer Fees

Some banks may charge fees for wire transfers or same day ACH transfers. Writing a check to yourself can be a cost-saving measure so you don’t have to pay unnecessary fees.

ACH Transfer Limits/Delays

Many banks post ACH transfer limits, and standard ACH transfers can take one to three days. Writing a check to yourself is a simple workaround to move large amounts without delay.

What Happens if You Make a Check Out to ‘Cash?’

When you write a check out to “Cash,” be aware that anyone who holds the check can cash or deposit it. You don’t need to present an ID required to process the check. Losing a check made out to “cash” can be exceedingly risky.

Alternatives to Writing Yourself a Check

Electronic Transfers (ACH)

Electronic transfers are an easy — and paperless — way to quickly transfer money from one account to another. They’re extremely secure, and you usually won’t run into “holds” for high-dollar transactions.

You can have intra-bank transfer, which means you move your funds from one account to another at the same bank. The transfer occurs on the same day and is usually free.

Inter-bank transfers involve moving money between two different banks. It usually takes one to three days, and there may be some costs involved.

Bank Apps and Mobile Deposits

You can move money or make a deposit with your bank app. It’s convenient because you can conduct transactions from anywhere. The handy part of using an app is you can make direct transfers between accounts with the same bank.

Cash Withdrawals and In-Person Deposits

Sometimes you need a personal touch. When you go in person to a branch, you can talk to a personal banker or tellers about a specific bank transaction. Also, there’s immediate access if you want to withdraw cash or initiate same-bank transfers.

Wire Transfers

To move large amounts of money, you may want to do a wire transfer. This is a high-speed option to transfer large amounts of money. There’s a higher cost associated with a wire transfer, but you may be able to get that waived depending on your bank account.

Final Take

You can definitely write a check to yourself — make sure to fill in the right amount and sign the check. Writing a check to yourself comes in handy if you need cash, want to avoid transfer fees or need to create a paper trail.

Alternatives to writing a check to yourself include using your bank app, visiting a branch in person or doing an electronic transfer.

If you’re looking to start fresh with a new account, take a look at the GOBankingRates’ Best Checking Accounts for 2025.

FAQs on Writing a Check to Yourself

Here are the answers to some of the most frequently asked questions about writing yourself a check.- Can I write a check to myself and cash it the same day?

- You can write a check for yourself and cash it the same day. As long as you haven't post-dated the check, you can use it immediately. The bank may place a hold based on the amount, account history and availability of funds.

- Can I write a check to myself from a business account?

- An ATM fields your self-written check similarly to a bank teller or a mobile check deposit. The check may be subject to a temporary hold while the bank makes sure the check is kosher. This could last from a few hours to a few days.

- Can I write a check to myself from a business account?

- Yes, you can write a check to yourself from a business account, but it's treated as a business withdrawal. The process is as easy, though, as writing yourself a check from your personal account. Write your name as the payee, and you can quickly transfer money between business and personal bank accounts.

- What happens if the check bounces?

- If the check you write to yourself bounces, a few things can happen. You'll likely be charged fees for non-sufficient funds, overdraft, returned check, as examples. But the bank may take even stronger action -- including closing the account. If the bank suspects you're writing bad checks to temporarily gain access to more money than you have, you could find yourself in legal hot water.

Joseph Hostetler contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Consumer Financial Protection Bureau "Electronic Fund Transfers FAQ"

- Consumer Financial Protection Bureau "Money transfers"

- Office of the Comptroller of the Currency "Writing a Check: Understanding Your Rights"

Written by

Written by  Edited by

Edited by