SDCCU Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Find Your SDCCU Routing Number for Easy Transactions

Founded in 1938, San Diego County Credit Union is the largest locally owned financial institution in San Diego. SDCCU serves customers who live or work in counties throughout Southern California, including San Diego, Los Angeles, Orange, San Bernardino, Riverside, Santa Barbara and more.

Most members will likely need to know their SDCCU routing number when setting up fund transfers like direct deposits or bill payments. This guide will cover what you need to know about the SDCCU routing number and how to use it.

SDCCU Routing Number

San Diego County Credit Union has just one routing number:

| SDCCU Routing Number |

|---|

| 322281617 |

How To Find Your SDCCU Routing Number

If you need to find your routing number, you can check a few different places.

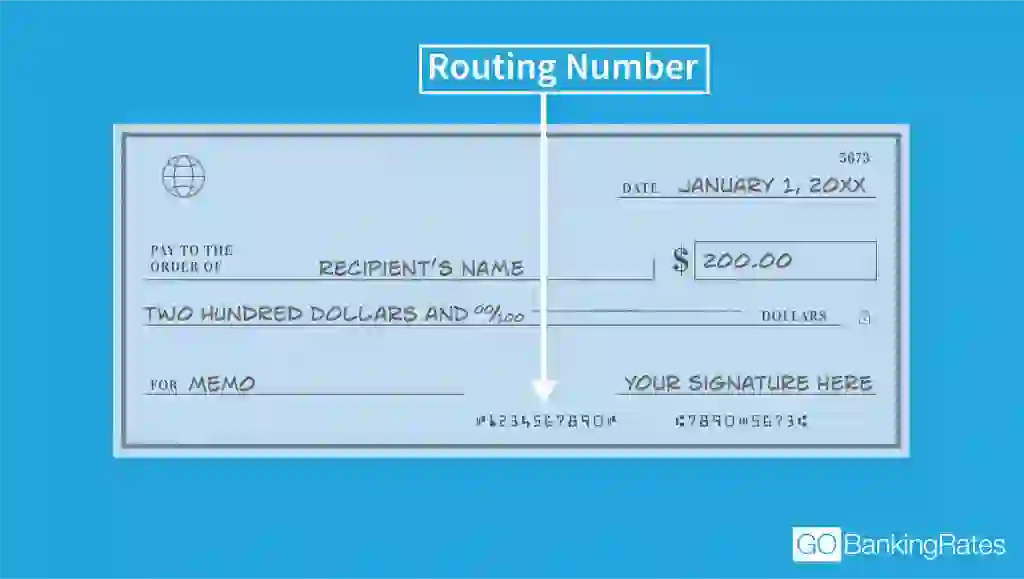

On a Check

One way for an SDCCU account holder to locate their routing number is to look at the lower left corner of a paper check. The routing number is the first nine digits listed along the bottom.

Through Online Banking

If you don’t have checks on hand, you can find your routing number online. Follow these steps:

- Visit SDCCU’s website and click “Log In.”

- Enter your username and password.

- Navigate to your account summary.

- Your routing number should be listed close to your account number.

By Contacting Customer Service

If you need your routing number, call SDCCU at 877-732-2848 to speak with a representative during the following hours:

- Monday to Thursday: 8 a.m. to 6 p.m.

- Friday: 8 a.m. to 6 p.m.

- Saturday: 9 a.m. to 4 p.m.

SDCCU Routing Numbers for Wire Transfers

Routing numbers can be used for domestic wire transfers. If you want to transfer funds internationally, you’ll also need a SWIFT code.

SDCCU does not have a SWIFT code for international wire transfers. To receive funds, you need to use a U.S.-based intermediary bank, which will process the transfer and send it to SDCCU through a domestic wire transfer.

You can use this information for wire transfers:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 322281617 | N/A |

| International Wire Transfer | 322281617 | N/A |

SDCCU Routing Number vs. Account Number: What’s the Difference?

SDCCU routing numbers identify the credit union for processing transactions, while account numbers specify the exact account where funds should be deposited. Both numbers play a role in ensuring transfers are accurate and secure.

How To Use Your SDCCU Routing Number

Routing numbers serve a variety of purposes for banks and other financial institutions. For example, they’re used as a form of identification and help direct money transfers to the correct account.

Banks and credit unions alike use routing numbers to perform various financial activities, including:

- Transferring money by check.

- Making a wire transfer or ACH payment.

- Depositing funds, such as paychecks or pension payments, into individual accounts.

- Setting up direct deposits or automatic bill payments from individual accounts.

FAQ

Here are the answers to some of the most frequently asked questions about SDCCU routing numbers.- Do all SDCCU accounts have the same routing number?

- Yes, SDCCU has just one routing number for all accounts -- 322281617.

- How do I find my SDCCU routing number without a check?

- You can find your routing number by calling 877-732-2848, checking on your paper bank statements or looking online at your account details.

- Can I use the same routing number for wire transfers?

- Yes, you can use the same routing number for domestic wire transfers. However, for international transfers, SDCCU requires a U.S.-based intermediary bank since it does not have a SWIFT code.

More About SDCCU

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by