What Is Zero-Based Budgeting and How Does It Work?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you frequently end the month wondering where your money went, you probably aren’t using a budget. Alternatively, you could be using a budget that doesn’t work with your income schedule or financial goals.

Zero-based budgeting is a budgeting method that can help you gain better control over your spending, saving and debt repayment habits. Here’s a quick guide.

What Is a Zero-Based Budget?

Zero-based budgeting meansthat for any budget period, typically a month, your income minus your expenses should equal zero. A zero-based budget requires that every dollar be allocated to a budget category so that the ending balance of the budgeting period is zero. The goal is to make sure every dollar that comes in serves a purpose, whether it’s discretionary spending or paying bills, building savings or reducing debt.

It requires you to track both where your money is currently going and where you know it will go. Otherwise, it’s almost impossible to end the period with a zero balance. This can help you become more mindful of your spending and saving habits.

Advantages of Zero-Based Budgeting

When you’re mindful about where your money is going, you can better meet your short- and long-term financial goals, which should, in turn, improve your chances of financial success. The most significant advantage of using a zero-based budget is that it requires a decision about every dollar spent or saved to ensure a zero balance, reducing the likelihood of overspending. This makes zero-based budgeting especially advantageous if you have tight finances or liberal spending habits.

Disadvantages of Zero-Based Budgeting

Budgeting is time-consuming work. Zero-based budgeting requires you to track each dollar and make each expense a line item, which can be tedious and feel restrictive. A zero-based budget, in particular, doesn’t work if you don’t regularly enter expenditures into your budgeting app or spreadsheet.

Zero-based budgeting can be especially difficult for people with unpredictable or variable income. It works best if you can save up enough money to use last month’s income to cover this month’s budget. That way, you know exactly how much income you have to budget.

How To Create a Zero-Based Budget

The following steps aim to help you set up and track your zero-based budget. All you need to do is update it and refer to it regularly.

1. Choose a Budget Tracking Tool

First, choose a tool for tracking your budget. You can use an app, a spreadsheet or even just a pen and paper. The key is having a means of keeping track of all income and every expense.

Budgeting apps help automate much of the process, but they can also be particularly easy to ignore. Tracking spreadsheets can become tedious, even when they remain open where you can see them on your computer. The best way to track your budget is one that you know you’re most likely to use regularly.

2. List All Monthly Income and Expenses

Go back through your last few months of bank and credit card statements and list all expenditures. Some you will need to add up and categorize, such as groceries or entertainment. Also, list any once- or few-times-a-year expenses, such as gifts or taxes.

Make sure you list all money that goes to investments and savings. You need to account for savings with zero-based budgeting, just as you do with every expenditure.

3. Set Up a Preliminary Budget That Equals Zero

With your list of expenses and income, make a preliminary budget. If it doesn’t equal zero, adjust variable budget categories until it does. For instance, if you need an additional $40 for your grocery category, then lower your entertainment category by that amount.

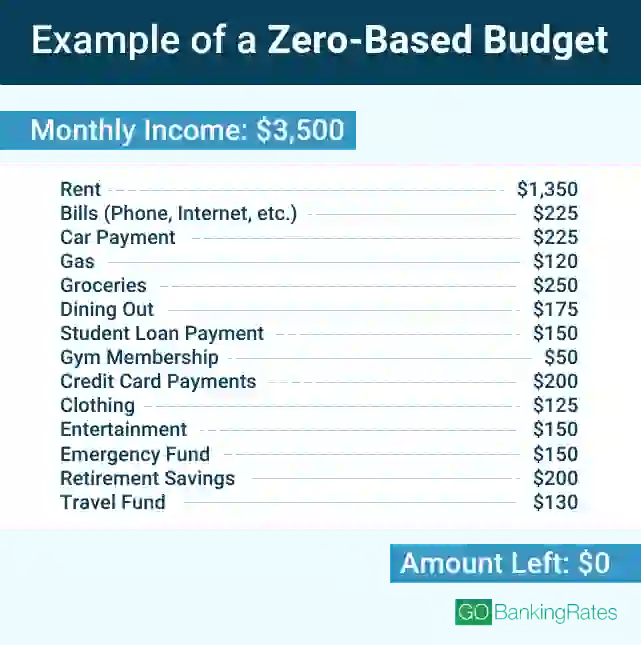

Once your budget equals zero, you’ll have your guide for how much you can spend the next month and on what. The following is an example of a zero-based budget.

4. Use the Budget To Make Spending Decisions

Refer to your budget before spending, at least on discretionary categories. Otherwise, a zero-based budget becomes pointless. Remember, zero-based budgeting requires thinking about your money ahead of time and in real time, and not just after the fact.

5. Diligently Track Income and Expenditures

Update your budget at least once per week. Waiting until the end of the month to record your spending defeats the purpose of zero-based budgeting. The data required to make spending decisions will not be up to date.

Zero-Based Budgeting vs. Other Budgeting Methods

Zero-based budgeting isn’t your only option. There are other types of budgets that you might find more useful, depending on your preferences.

50/30/20 Budgeting

The 50/30/20 budget recommends spending 50% of your income on necessities like housing, food and transportation, 30% on wants and 20% on savings and paying off debt.

Although this is a manageable budget to follow, it doesn’t allow for much flexibility or prioritizing debt repayment and savings, unlike the zero-based budgeting method. This method might not work as well as the zero-based budgeting method for those trying to gain greater control over their spending and saving.

Pay-Yourself-First Budgeting

With the pay-yourself-first budgeting method, money is first put into savings before paying any bills. Next, credit cards and other debts are paid. After that, necessities are paid. The remaining money can then be used for discretionary purchases.

This budgeting method can feel even more restrictive than the zero-based method and might be hard for some people to stick with if a little discretionary spending can’t be worked in before all other bills get paid. It can be the best budgeting method for building savings, though.

Cash Envelope Budgeting

Like zero-based budgeting, the cash envelope system accounts for every dollar. An envelope is created for each category, and each category is assigned a dollar amount. Monthly income is then distributed among the envelopes per the designated amounts. All spending comes from the envelope for that category. Once an envelope is empty, no more can be spent on that category until next month.

For those who feel that using cash is inconvenient, there are ways to use the same concept digitally. But doing so can make it hard to manage. Those who don’t prefer to use cash might be better off using zero-based budgeting.

Who Is Zero-Based Budgeting Right For?

Zero-based budgeting is best for those who want — or perhaps need — greater control over their spending and savings. Because this budgeting method requires one to manage every dollar they spend, it can benefit those who tend to lose sight of their finances during the month.

Ultimately, the right budget for you is the one you will actually use. If a zero-based budget works for you, use it. If not, find another budget option that does. The important thing is to make sure you know where your money needs to go and that it actually gets there.

Takeaway

Although zero-based budgeting can be especially useful for those looking to control their spending and saving, it can be more tedious than other budgeting methods. For those looking to try zero-based budgeting, it’s important to choose a budget tracking tool that can help simplify the process and encourage long-term use. This could be with an app, a spreadsheet, or a simple notebook and pen.

Karen Doyle contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- NextAdvisor. 2022. "Why Zero-Based Budgeting Might Be the Perfect Strategy for 2022."

- Forbes Advisor. 2022. "Your Guide To The 50/30/20 Budgeting Rule."

- Insider. 2022. "A pay-yourself-first budget is a simple way to amp up your savings. Here's how it works."

- Credit.org. "What is the Envelope Budgeting Method?"

Written by

Written by  Edited by

Edited by