What Is an Add-On CD and How Does It Work?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

An add-on certificate of deposit (CD) is a type of savings product that lets you make additional deposits after you open the account — a feature most traditional CDs don’t allow. While you still lock in a fixed interest rate and term, you can continue adding funds over time to grow your balance.

How Add-On CDs Work

Like a regular CD, you start with an initial deposit that sets your interest rate. From there, you can continue adding money during the CD’s term — as long as you follow the bank’s rules around limits and timing. Your funds remain locked until maturity, and early withdrawals typically result in a penalty.

Add-On CDs vs. Traditional CDs: What’s the Difference?

Here’s how add-on CDs stack up against traditional CDs when it comes to growing your savings.

CD Type Additional Deposits Interest Rate Flexible Growth Add-on CD Allowed Fixed Yes Traditional CD Not allowed Fixed No

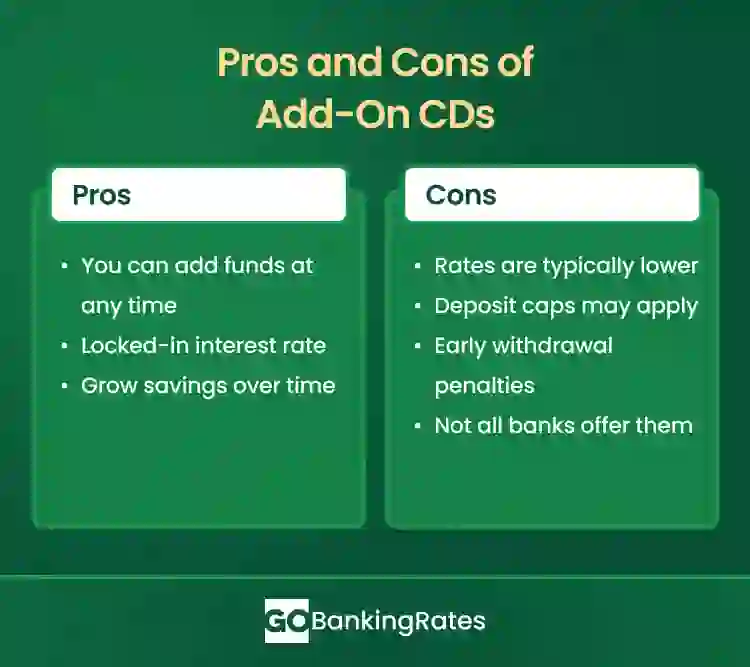

Pros and Cons of Add-On CD Accounts

Before opening a new account, consider the pros and cons of add-on CDs to see if they’re right for you:

Add-On CD Rates in 2025: What To Expect

Add-on CDs aren’t widely available, and rates can vary significantly by institution. In 2025, APYs range from as low as 0.05% to nearly 4%. As the market shifts, many add-on CDs are trending downward.

Here’s a look at current offerings from some top banks:

| Bank | Term | APY | Minimum Deposit |

|---|---|---|---|

| Bank5Connect | 2 years | $500 | |

| Velo Bank | 6 months | $1,000 | |

| TD Bank | 1 year | $250 |

Bank5Connect

Best for: Those who don’t plan to withdraw early and have $500 to initially deposit.

- APY:

- Term: 2 years

- Deposit restrictions: You can make unlimited deposits during the two-year term.

Velo

Best for: Those who can afford the $1,000 minimum deposit and want to capture APY.

- APY:

- Term: 6 months

- Deposit restrictions: You can make additional deposits during the term.

TD Bank

Best for: Those who aren’t looking for a high APY and want the option to invest in an IRA CD account.

- APY:

- Term: 1 year

- Deposit restrictions: You need a minimum of $250 to open the account, and every deposit you make must be $500 or more during the term.

How To Open an Add-On CD Account

Opening an add-on CD is a relatively straightforward process. Here are the steps you can follow:

- Research banks that offer these accounts and compare the CD rates.

- Find out what information and identification the institution requires.

- For online banks, you can upload your materials through the secure portal. If you’re opening an account in person, be sure to bring everything with you.

- Fund the account with the required minimum deposit and add additional funds throughout the term length.

Alternatives to Add-On CDs

Add-on CDs aren’t the right fit for everyone. If you’re unsure whether this savings option aligns with your financial goals, consider exploring other alternatives.

- High-yield savings account: This account gives you access to your money with high interest rates and fewer penalties if you want to withdraw your funds.

- Money market account: Earn interest while maintaining access to your funds. This account typically offers a competitive rate along with check-writing privileges and limited withdrawals.

- Traditional CDs: Typically offer higher interest rates and are widely available, giving you more options to find the best rate and term for your needs.

Here’s a side-by-side look at how these savings vehicles compare to one another:

| Account | Interest Rate | Access To Funds | Minimum Balance | Additional Deposits | Withdrawal Limits | Best For |

|---|---|---|---|---|---|---|

| High-yield savings | Variable, can be higher than most savings options | Withdraw at any time | $0 to $1,000 | Yes | 6 withdrawals per month | Emergency funds, flexibility |

| Money market account | Variable | Limited checks, ATM withdrawal | $500 to $1,000 | Yes | 6 withdrawals per month | Earning interest with some check writing abilities |

| Traditional CD | Fixed for term | Locked until maturity | Varies, but usually low | No, not after original deposit | Penalties for early withdrawals | Lump sum savings with a fixed rate |

| Add-on CD | Fixed for term | Additional deposits allowed, locked until maturity | $0 to $2,500 | Yes | Penalties for early withdrawals | Growing savings with fixed rate |

Who Should Consider an Add-On CD?

- Savers without a large lump sum: Add funds over time instead of making a one-time deposit.

- Planners looking for flexibility: Build your balance gradually while locking in a fixed rate.

- Gig workers or freelancers: Deposit money as it becomes available, no need to open multiple accounts.

- Anyone concerned about future rate drops: Lock in your rate at the time of opening.

Final Thoughts

An add-on CD is a good option for savers who can’t afford a large upfront deposit but still want to grow their savings. You can add funds during the CD’s term and lock in your interest rate from the start. Like a traditional CD, you won’t be able to withdraw funds until maturity — but the ability to build your balance over time adds flexibility. Add-on CDs are rare, but some offer solid APYs worth considering.

Add-On CD FAQ

Here are the answers to some of the most frequently asked questions about add-on CDs.- What banks offer add-on CDs?

- Some banks that currently offer add-on CDs are Bank5Connect, Velo and TD Bank.

- How do add-on CD rates compare to traditional CDs?

- Traditional CDs typically have higher yields than add-on CDs. Unlike a traditional CD, you can add more money to an add-on CD after you open it.

- Are add-on CDs worth it?

- Add-on CDs are a good savings vehicle if you cannot afford the full amount of the CD upfront and want the option of adding money later to secure the APY.

- What does "add-on a CD" mean?

- You can add more money to a CD after opening it. Unlike a regular CD, an add-on CD allows you to deposit more money through regular deposits. The bank may set a limit on how much you can add on.

Andrea Norris, Hiba Boutary and Miriam Caldwell contributed to the reporting for this article.

Rates are subject to change; unless otherwise noted, rates are updated periodically. All other information on accounts is accurate as of July 29, 2025.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by