How Much Does a Walmart Money Order Cost?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you need to pay a bill or buy something with a check and you don’t have a checking account, a money order is a good solution. For starters, a money order is cheap and easy to obtain — you can pick one up at your local Walmart.

Money orders are like cash. Once you purchase one, you can use it to pay an outstanding bill through the mail or give money in person. The recipient can cash your money order or deposit it in their bank account.

What Is a Money Order and When Should You Use One?

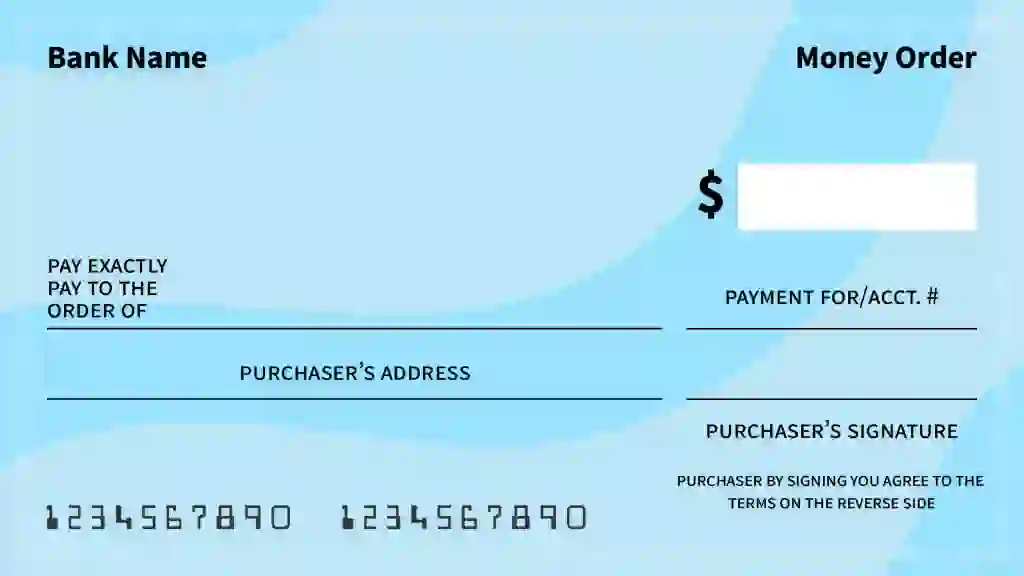

A money order is essentially a prepaid check. To get one, you pay the amount of the money order’s value plus a small fee. Then, you’ll be issued the money order, which you will fill out with your name and the recipient’s name.

You can use a money order to make small-to-medium payments for expenses like bills, rent, and gifts or send money overseas. One of the main benefits of a money order is that it’s paid in advance, meaning it can’t bounce like a personal check can. Money orders are issued with numbers, so they are traceable. You can usually cancel and reissue a money order if lost or stolen, as long as you have saved the stub containing all the required information.

How Much Does a Walmart Money Order Cost at Walmart?

While the exact charge varies by store, it’s no more than $1 at your local Walmart, and that’s a very competitive fee. The U.S. Postal Service, by comparison, charges $2.55 for money orders up to $500 and $3.60 for money orders between $500.01 and $1,000.

How To Purchase a Money Order at Walmart

Walmart isn’t a bank. However, it can issue money orders because they are prepaid financial instruments. Here are the steps to take to purchase a money order from Walmart.

- Gather your information and have it handy. When filling out a money order, you’ll need to provide the payees name, as well as your own. You’ll also need to dollar amount and may need to provide a memo note about the purpose of purchase. In some cases, you may need to provide the payees address and your own address, though this isn’t always the case.

- Pay for the money order in-store at the Walmart Money Center or Customer Service area. You must pay with cash or a debit card to purchase a money order from Walmart. Walmart does not accept credit cards as a form of payment for money orders.

- Send or deliver your money order. You can either mail the money order or deliver it to the payee.

Once you have your Walmart money order, remember that it is as good as cash. Walmart advises you to complete all fields, such as your name and the recipient’s name, as soon as you buy it.

Are Walmart Money Orders Worth It? Benefits and Limitations

You might want to use a Walmart money order to make your next payment for several reasons.

Benefits of a Walmart money order:

- A money order can’t bounce. Once it’s paid for, Walmart loads the value onto the money order, and you can use it for just about any purpose — paying rent, your monthly electricity bill or to gift a friend. That’s distinctly different from a check, which a bank may decline if there aren’t enough funds in the account to make the payment.

- Security. When you purchase a money order and use it to pay someone, you aren’t sharing private details, like your address or bank account routing details on a personal check. If you aren’t familiar with the person or entity you’re paying, you may feel more comfortable using a money order rather than risking the safety of your checking account.

- You can use cash for a Walmart money order. If you don’t currently have a bank account or debit card, you can buy money orders from Walmart using cash. That’s advantageous for people who can’t open a bank account for various reasons or don’t yet need one.

- Walmart offers minimal fees for money orders. Fees vary by Walmart location, but will never be over $1.

Limitations of a Walmart money order:

- You can’t use a credit card. Walmart does not accept credit cards as payment for money orders. You can only use cash or a debit card to purchase a money order from Walmart.

- Maximum payment limits. Most institutions cap a money order’s monetary limit to $1,000. This limit can vary, so check with your local Walmart about their maximum dollar amounts.

Alternatives to Walmart Money Orders

There are different payment methods you can use besides money orders. Below are a few:

- Cashier’s check

- Wire transfer

- Digital wallet, like Apple Pay

- Online money transfer services, like Wise or Zelle

When choosing one of these alternative options, remember that many services charge fees. For example, it may cost you around $10 to purchase a cashier’s check. The fees will depend on the amount of money you’re sending, the financial institution you’re using, and the destination of payment — say, domestic versus international transfers when using a bank wire transfer.

Final Take

Like any financial service, purchasing a money order requires a small fee. Walmart’s money order fees are some of the lowest you’ll find, with a maximum charge of $1. It’s easy to purchase a money order at your nearest Walmart location using cash or a debit card. Make sure to fill out the money order after purchasing it and keep the money order stub safe for tracking purposes.

Virginia Anderson and Jami Farkas contributed to the reporting for this article.

Information is accurate as of Jan. 16, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by