Could Universal Savings Accounts Become a Reality When Trump Takes Office?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

There are a number of tax-advantaged savings accounts currently available to Americans that enable you to grow your savings, or withdraw your savings, with tax benefits. Most of these types of accounts require you to save or spend the funds for specific purposes, such as retirement accounts, like 401(k) plans and IRAs, education savings accounts (529 plans) and health savings accounts (HSA).

If some lawmakers have their way, there may be a new kind of account known as universal savings accounts (USAs), which would let people withdraw their savings from them at any time for any purpose, tax-free (you wouldn’t get any pretax savings, however).

Two different versions of this plan have been proposed: one by Republican lawmakers and another by the proponents of Project 2025, a policy blueprint designed for a Republican administration by the conservative Heritage Foundation, according to Kiplinger.

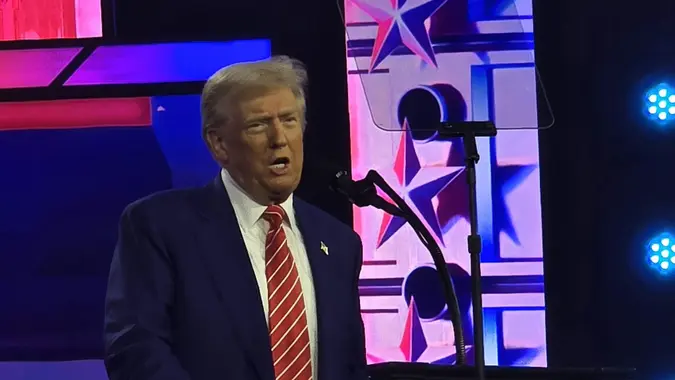

With President-elect Donald Trump entering the White House to a Republican-led Congress, could these kinds of accounts become a reality sooner than later?

Simplicity Could Win

Crystal Stranger, a lawyer, enrolled agent (EA), senior tax director and CEO of OpticTax.com, said she thinks it is “highly likely” that we will see a universal savings account (USA) rolled out quickly in the new administration.

“If they replace the overly complex HSA accounts, and the emergency savings accounts from the Secure 2.0 act that have not been well publicized, then there shouldn’t be much of a budget cost involved, which means the law can be passed quickly,” she explained.

She compared the USA account to international versions found in the UK and Canada, which she said “are well-loved for their ease of savings and tax-free provisions.”

She envisions them being popular with taxpayers across the spectrum in the U.S. as well, and a great incentive to save for a house or business.

They Could Protect Against Inflation

Additionally, in an inflationary environment like the U.S. has been in for some time, saving in regular savings accounts is less effective because, she said, “as you save your money both becomes less valuable, then if invested the earnings are taxed, even if they do not increase in real value, after inflation is considered.”

She said that many people do not understand this about inflation, “and even with a good investment return it could still lead to a loss in buying power,” she said.

For example, she explained, if your money earns a 5% return but inflation is 10%, if you have $100,000 in the bank at the end of the year you have $105,000, but it is only worth the same as $94,500 was a year before. It is worth noting that the last time inflation was 10% or higher was 1980, when it was 12.5%, and 7% in 2021 in the midst of the pandemic. Still, her point is that the value of your money changes based on the inflation rate.

Furthermore, she explained, say you pay 25% income taxes on the $5,000 in earnings, then you only have $93,375 in purchasing power left. In order to counter 25% tax and (a theoretical) 10% inflation, you would need to earn roughly 15% on your investment.

This means that spending during inflation is smarter than saving, but that is only good for the economy to an extent, as it reduces the safety net of households when they spend all their savings, she said.

“Creating tax-free savings accounts helps to reduce the bite of taxes, making savings during an inflationary period more palatable. This allows for a way to encourage savings, which helps to increase the financial stability of the country.”

The Downside

Not everyone thinks USAs are a good idea however, according to Reuters which reported that the Center on Budget and Policy Priorities (CBPP) fears that such accounts would push people to pull money out of taxable accounts, thus leading to a decline in federal revenue, which could affect government spending on other important programs. Additionally, it could disincentivize people from saving in their retirement accounts.

While Americans may welcome yet another tax advantaged way to save, the fate of these accounts may be determined more quickly than ever once Trump takes office.

Written by

Written by  Edited by

Edited by