What Is a Stock? Beginner’s Guide To Investing

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Stocks can be difficult to grasp at first glance, but anyone can learn how to invest in individual companies. They’re an excellent tool for long-term wealth creation, but what is a stock and how does it work, exactly? Read on to find out.

What Is a Stock?

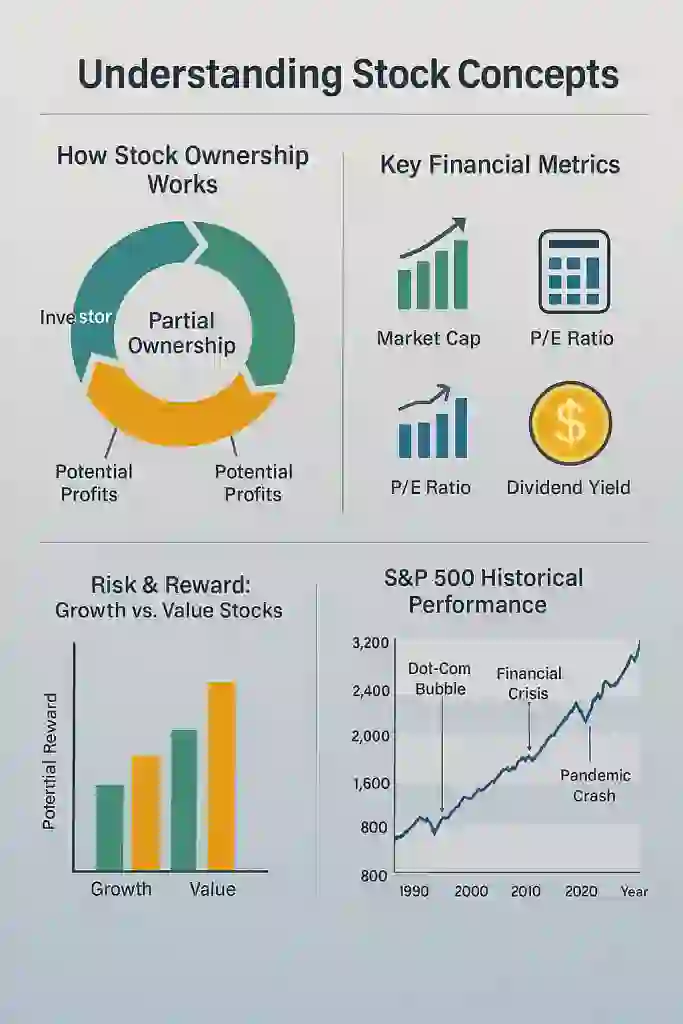

A stock is a type of security that represents partial ownership of a company. When you buy shares of stock, sometimes referred to as “equities,” you actually purchase a small part of the business. With them, you hold a proportional claim on that company’s assets and earnings.

Stocks play a key role in the portfolios of many investors because of their potential to generate high returns and build wealth. There are two main ways investors make money from stocks:

- When the value of the stock increases over time, you can generate income. For example, if you buy a stock for $20 a share and then sell it at $50, you earn a profit of $30 for each share you sell.

- Stocks can also earn investors money through dividends, a percentage of company profits that are shared with investors. Not all stocks pay dividends, and some offer larger dividends than others. Dividends are typically paid on a quarterly basis.

Stocks also benefit the businesses that sell them. Companies sell stock to raise money that they can use to expand or invest in new projects. By selling stock, businesses have access to large amounts of cash without taking on debt.

Market Tip: 2025 Investing Trends

The hottest sectors of 2025 include AI and tech infrastructure, industrial and defense stocks, and select financials benefiting from higher rates. Investors are also rotating into emerging markets and reshoring-focused companies tied to U.S. manufacturing and cybersecurity.

Keep in mind, these sectors can shift quickly. Diversify and avoid chasing short-term hype — focus on long-term fundamentals instead.

Why People Invest in Stocks

Stocks are one of the most effective ways to build long-term wealth. Historically, the stock market has delivered higher average returns than bonds or savings accounts. Investors buy stocks to:

- Grow their money faster than inflation

- Earn dividends or passive income

- Take advantage of compounding over time

- Own a stake in companies they believe in

How To Get Started

Real estate mogul and “Shark Tank” investor Barbara Corcoran advises buying when you’re financially prepared rather than waiting for the market to calm down. Conditions will always shift, she notes, and holding out for the perfect moment could mean missing out on great opportunities altogether.

You can begin investing with just a small amount of money and a brokerage account.

- Choose a platform. Online brokers like Fidelity, Charles Schwab, or Robinhood make it easy to open an account.

- Decide what to buy. Start with well-known companies or diversified ETFs.

- Set a budget. Only invest money you can leave untouched for several years.

- Keep learning. Understand fees, taxes, and how to place buy/sell orders before diving in.

What Kind of Returns To Expect

Stock returns vary from year to year, but over time, the S&P 500 has averaged around 7% to 10% annual growth after inflation. Some years may see losses, while others can deliver double-digit gains — that’s part of normal market fluctuation.

Quick Tip

The longer you stay invested, the more you benefit from compounding growth and the market’s long-term upward trend.

How Stock Prices Are Determined

A stock’s price goes up or down largely due to supply and demand. If more investors want to buy a stock, the price will increase. If more are looking to sell, the price decreases.

Many factors can influence whether investors want to buy or sell a stock, and therefore the movement of the stock’s price.

- A stock price may rise if the company announces strong earnings and forecasts future growth.

- However, an earnings report that falls below expectations can cause the price to drop.

- General market conditions, interest rates and even the political environment can also lead to the movement of a stock’s price.

Common Stocks vs. Preferred Stocks

Shares of stock typically fall into two categories: common stock and preferred stock. Both types of stock represent partial ownership of a company, but there are some important differences between the two.

What Are Common Stocks?

As the name suggests, common stocks are the type of stocks most people invest in. Common stock comes with voting rights — usually one vote per share. These rights allow investors to have a say in electing the board of directors and can influence other company decisions.

Common stock tends to fluctuate in price more dramatically than preferred stock, which gives it greater potential for growth. Common stockholders are not guaranteed to be paid a dividend, although many companies do pay dividends on common stock.

If a company becomes insolvent, common stockholders are the last to hold a claim to company assets.

What Are Preferred Stocks?

Preferred stocks are generally considered to be safer and less volatile than common stocks. They typically pay a fixed dividend that is often higher than the common stock, and they don’t tend to move up and down in price as much.

Preferred stockholders have a higher claim to company assets and earnings, but they usually don’t have voting rights.

Because fewer shares are bought and sold on a typical day, preferred stock may not offer as much liquidity as common stock. So you may not get as good of a price if you choose to sell it.

Key Differences Between Common and Preferred Stocks

| Common Stocks | Preferred Stocks |

|---|---|

| Voting rights | No voting rights |

| Dividends not guaranteed | Fixed dividends |

| Higher growth potential | Lower volatility |

| More liquidity | Less liquidity |

| Last claim on assets | Higher claim on assets |

Types of Stocks

There are several different categories of stocks, each with its own purpose and valuation metrics. Three of the most common types of stocks you’ll come across are growth stocks, value stocks and dividend stocks.

Growth Stocks vs. Value Stocks

Growth stocks and value stocks each have very different characteristics, and many investors choose to hold at least some percentage of both types of stocks in their portfolio.

Value Stocks

- Value stocks refer to companies that appear to be undervalued at a certain point in time.

- These companies typically have strong fundamentals and steady earnings, but the stock price may be depressed due to other factors.

- A typical metric to look out for in value stocks is the price-to-earnings ratio.

- Stocks will be assigned different P/E ratios based on growth rates. If it falls below historical averages, this may present a buying opportunity, because markets have overlooked the fundamentals of a business.

Growth Stocks

- Growth stocks are fast-paced companies that are expanding rapidly and growing revenue.

- These stocks don’t necessarily have to be profitable, but investors will invest on the basis that someday they will be.

- Technology stocks often fall into the growth category.

- Since growth stocks are forward-looking for long-term returns, the primary metrics to consider are innovation, competitive advantages and a growing market share.

Dividend Stocks

Dividend stocks act as an income generation tool for investors. These are more mature companies that have a steady and predictable pace for earnings and profitability. As such, investors receive a portion of profitability in the form of a dividend.

The terms dividend and yield are often used interchangeably. This is the percentage return investors are awarded on a per-share basis.

Dividend stocks can also benefit from price appreciation — or an increase in market capitalization. General Mills (GIS) and Exxon Mobil (XOM) are examples of dividend stocks.

Key Investing Terms To Know

Understanding a few core investing terms can help you analyze stocks more effectively.

- Market capitalization. This is a company’s total value in the stock market, calculated by multiplying the share price by the number of outstanding shares. Companies are often grouped as small-cap, mid-cap, or large-cap based on this figure.

- Stock indices. Market benchmarks like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite track groups of companies to show how the broader market is performing.

- Financial metrics. Indicators such as the price-to-earnings (P/E) ratio, earnings per share (EPS), and dividend yield help investors compare a company’s valuation and profitability to others in its industry.

These concepts form the foundation for evaluating performance and risk — and can help you decide whether a stock fits your investing goals.

Stocks vs. Other Investment Options

Individual stocks are just one type of investment that people may have in their portfolios. Some other options that can help make up a balanced portfolio include bonds, mutual funds and ETFs.

Stocks vs. Bonds

When you buy a stock, you purchase a fraction of the company. When you buy bonds, you’re lending money, usually to either a company or the government, with the expectation that you’ll be paid interest on that loan over a set period of time.

Bonds are considered to be a lower-risk investment than stocks. However, stocks usually offer the potential for much higher returns.

Bonds can be an ideal choice for an investor looking to add steady, stable income to their mix. Stocks are usually a better choice for investors looking for greater long-term growth.

Stocks vs. Mutual funds and ETFs

Mutual funds and exchange-traded funds provide a convenient way to invest in a large mix of assets without having to purchase each asset individually. Both mutual funds and ETFs involve many investors pooling money together. This money is invested in a diversified portfolio that may include dozens or hundreds of stocks, bonds and other assets.

Here are some key points to know:

- A mutual fund is managed by a professional fund manager.

- Investors buy shares of the mutual fund, and the value of those shares rises and falls with the value of the underlying assets in the fund.

- Mutual funds often come with management fees and other expenses.

- An ETF is a basket of assets that trades on a stock exchange.

- ETFs act similar to individual stocks in that the price fluctuates as investors buy and sell them.

- Many ETFs are passively managed and are set up to track a market index, such as the S&P 500. For this reason, ETFs often charge lower fees than mutual funds.

Mutual funds and ETFs can be ideal investment vehicles for beginning investors. They offer exposure to a broad mix of stocks and bonds without requiring the funds, expertise or time to piece together a diversified portfolio one by one. However, beginning investors should take a close look at the fees associated with a particular fund or ETF before buying it.

Where Stocks Are Traded: Understanding Stock Exchanges

Once a company issues shares, they’re traded on organized markets known as stock exchanges. These exchanges provide a regulated environment where buyers and sellers can trade efficiently and transparently.

Some of the most well-known exchanges include:

- New York Stock Exchange (NYSE). The world’s largest exchange by market capitalization. It’s home to many blue-chip companies like Apple, Coca-Cola and JPMorgan Chase.

- Nasdaq. Known for its focus on technology and growth companies such as Microsoft, Amazon and Nvidia. Unlike the NYSE, which has a physical trading floor, Nasdaq is fully electronic.

- Other Global Exchanges. Investors may also trade on international markets, such as the London Stock Exchange (LSE), Tokyo Stock Exchange (TSE) or Hong Kong Stock Exchange (HKEX).

Each exchange has listing requirements that companies must meet — including financial health, market capitalization and corporate governance standards — to ensure credibility and investor protection.

Understanding the Risks of Stock Investing and Market Volatility

Investing in stocks offers long-term growth potential, but it also comes with risk. Prices can swing daily based on company performance, investor sentiment, or global events — and even experienced investors face losses at times.

- Market volatility. Stock prices naturally rise and fall. Corrections (10% declines) and bear markets happen periodically, but history shows the market tends to recover over time.

- Company risk. A single company’s poor performance, leadership changes, or competition can cause its stock to drop even if the broader market is strong.

- Emotional investing. Selling during downturns or chasing hot stocks can lead to losses. Focus on long-term goals instead of short-term market noise.

- Diversification. Spreading investments across different industries and assets helps limit losses when one area underperforms.

- Inflation and rates. High inflation or rising interest rates can reduce stock returns and make other investments more appealing.

Tips for Beginner Investors

Investing can be an effective way to build wealth, but it also comes with risk. Stock prices can rise and fall quickly due to market volatility, company performance, or broader economic changes. Understanding these fluctuations — and how to stay calm when they happen — is key to long-term success.

- Start small. Remember that investments come with risks. Starting with smaller investments will allow you to become familiar with how the values of those assets fluctuate under various market conditions.

- Understand your investments. Learn about the assets you’re investing in to make informed decisions. For example, if you’re considering an ETF, find out which stocks are in it and the management fee that is charged.

- Prioritize diversification. Spread your investments across a mix of assets to reduce your risk.

- Avoid emotional decisions. The market will fluctuate from day to day. Keep your eyes on your long-term goals and don’t let sudden changes influence your investing decisions.

- Expect ups and downs. Market volatility is normal. Stay focused on long-term goals rather than reacting to daily price changes.

Final Take

Putting money in the stock market carries risks, but the reward potential remains high. Beginners interested in stocks should carry out research beforehand to minimize the chance of losing money. Contacting a financial advisor or consulting online resources should be a top priority to determine risk tolerance, goals and strategies for stocks.

FAQ

Here are the answers to some of the most frequently asked questions regarding stocks.- What is the simple definition of a stock?

- A stock simply represents a share of ownership of a business.

- What is the difference between common and preferred stocks?

- Common stock and preferred stock both represent a small piece of ownership of a company.

- Common stock comes with voting rights and offers more growth potential and liquidity. However, common stockholders have the last claim to assets if a company becomes insolvent.

- Preferred stock doesn't typically come with voting rights, but it does offer a fixed dividend that is usually higher than what is paid out for common stock. Preferred stockholders have a higher claim to the company's assets and earnings.

- How do I start investing in stocks as a beginner?

- To begin investing in stocks, you'll need to start by opening a brokerage account. Research different asset options before investing.

- Can you lose all your money in stocks?

- Yes, it is possible to lose all your money in stocks, but it is rare. This could happen if a company went bankrupt and its stock lost all value.

- Are stocks riskier than other investments?

- Yes, stocks can be riskier than some other investments, such as bonds, certificates of deposit or interest-earning savings accounts. This is because the value of stocks can decrease, causing the investor to lose money.

- What are some examples of successful stock investments?

- Apple (AAPL) is an example of a stock that has increased in value significantly over time. If you had invested $1,000 in Apple stock 20 years ago, it would be worth more than $200,000 today.

John Csiszar and David Granahan contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- CNN Business. 2022. "The meme stock craze is back: AMC, GameStop and Bed Bath & Beyond soar."

- Charles Schwab. 2022. "Ways to Help Reduce Risk in Your Portfolio."

- Scotiabank. 2022. "How to reduce your risks in trading stocks."

- Business Insider. 2022. "Blue-chip stocks: Highly reliable stocks from well-established companies that can add strength and safety to any portfolio."

- RBC Direct Investing. "RBC Direct Investing."

- U.S. Securities and Exchange Commission. "U.S. Securities and Exchange Commission."

- Fidelity. "Understanding market capitalization."

- Finra. 2022. "Market Cap Explained."

Written by

Written by  Edited by

Edited by