Ways Your Paycheck Might Be Affected Once Trump Becomes President

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

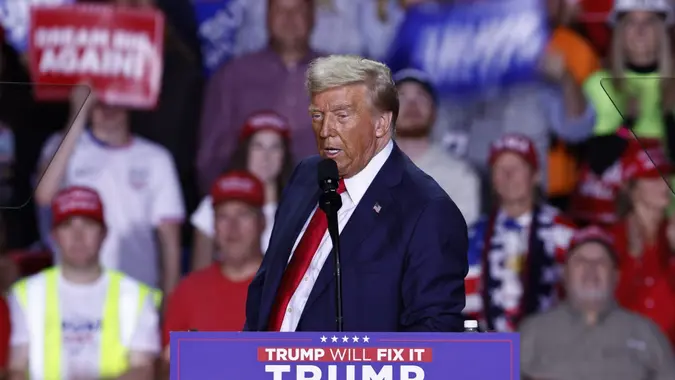

The return of Donald Trump to the White House could have a big impact on the finances of American workers. It could mean a big change in how much money you take home each month.

We don’t know exactly what will happen. But there’s a good chance your paycheck could look different when Trump returns to the White House, depending on what policies get passed.

Despite being a polarizing figure, there’s no denying that Trump’s policies had a significant impact on the economy during his tenure. We’ll explore what Trump’s second term could mean for your paycheck.

Payroll Tax Cuts Could Impact Social Security

One of Trump’s most discussed proposals involves cutting the payroll taxes that fund Social Security and Medicare.

“The greatest clues to how workers’ paychecks might be affected in the next four years come from Trump’s first stint as president,” explained Anthony Termini from RetireGuide. “In 2020, he said that (if re-elected), he’d permanently cut the payroll taxes that fund Social Security and Medicare.”

While this could increase your take-home pay in the short term, it raises questions about the future of these essential programs. But carrying out these cuts may not be straightforward. With only a slim Republican majority in the House, Trump could face resistance from Congress. .

Termini added that “he might get some pushback since the GOP has only a thin majority in the house. But somewhere between where we are today and zero leaves a lot of room for some cut.”

Even some reduction in taxes, though, would mean a temporary increase in the net income you see on your paycheck.

Trade Policies and Global Impact

Another bold proposal from Trump is to replace income taxes with tariffs. On paper, this might seem like a dramatic simplification of the tax code, but in practice, it’s a complex and controversial idea.

Trump’s trade policies were a big part of his first term. He implemented tariffs on imported goods from countries like China to address trade imbalances and protect domestic industries. This protectionist approach was meant to encourage the growth of American businesses and bring back manufacturing jobs. It looks like Trump will maintain his tough stance on trade and continue to use tariffs liberally in his second term.

“Trump now says he can replace the income tax with tariffs,” said Termini, who also said that the math for this doesn’t quite add up. “The Treasury department collects about $5 trillion in income taxes. We import about $3 trillion in goods. Unless tariffs are 166% of everything that comes into the country, it’s unlikely this plan will work.”

A Tax Cut for the Middle Class

Many of Trump’s proposals are bound to face some hurdles. But a middle-class tax cut is more likely to succeed. This is in line with Trump’s tax changes in his first term, which lowered rates for many Americans.

But Termini still thinks you might see some positive changes in your paycheck. “The odds are still better than even that he’ll get some kind of middle class tax cut through Congress — regardless of the tariff issue,” he explained.

A middle-class tax cut sounds great, but the details matter. Cuts to payroll taxes might give you a slightly bigger check each month. You might see some immediate benefits to your bottom line and more money in your pocket. But there could also be long-term consequences years down the road.

It could ultimately lead to less funding for government programs and create long-term headaches for Social Security and Medicare.

Tax Cuts and Job Growth

One of the critical aspects of Trump’s economic agenda was tax cuts. During his presidency, he passed the Tax Cuts and Jobs Act (TCJA) in 2017 to stimulate economic growth.

The TCJA had a mixed impact on people’s paychecks, depending on their income level, family size and location. For some, reduced tax rates and increased deductions may have resulted in noticeable savings. On the other hand, individuals in higher-tax states or those who relied heavily on certain itemized deductions may not have seen significant improvements.

In his second term, Trump likely will continue focusing on tax cuts, potentially leading to more money in your pocket. He may push to make the TCJA permanent.

Editor’s note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Written by

Written by  Edited by

Edited by