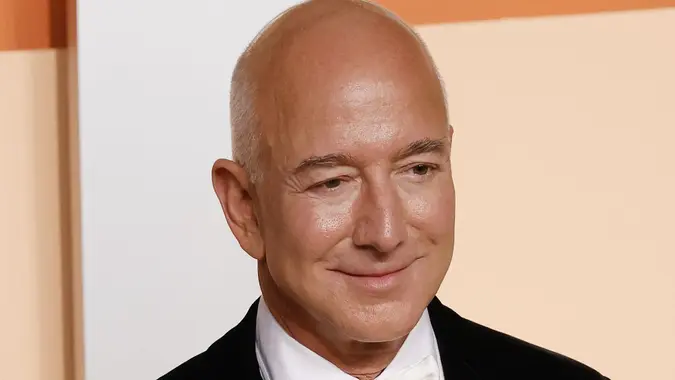

4 Habits of Jeff Bezos That Can Help You With Your Money

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Even Jeff Bezos had to start somewhere. The tech titan began Amazon in a Washington state garage and built it into one of the most important companies on the planet. That journey is full of lessons, some of which could help you reach your goals.

Here are four habits Bezos followed to become one of the richest people in the world.

1. Live Below Your Means

One of Bezos’ key philosophies is living well below your means. He exemplified that by driving a standard Honda Accord up until at least 2013. Already very wealthy at that point, he could have easily purchased a more expensive, flashier car but chose not to.

This is a habit that anyone can benefit from financially. Spending less than you earn is a fundamental step toward building wealth. So, the next time you get a raise or find extra money in your monthly budget, consider investing or saving it. Doing so will make it easier to cover unexpected costs and prepare you for reaching longer-term financial goals.

2. Start Small

Bezos started Amazon from the garage of his home in Bellevue, Washington, in 1995. His bare-bones office was little more than a desk and a computer. It’s a great example of the value of starting small.

Amazon saved a lot of money in its early days by avoiding office space rent. This kept the company agile and in a strong position financially, while laying the foundation for rapid future growth.

The key lesson is that even your biggest goals will start with a few small steps. But that doesn’t mean you need to rush to get through them as quickly as possible or expand before you’re ready. Instead, you can be like Bezos and take the slow-and-steady route to sustainable financial progress.

3. Follow a ‘Day 1’ Philosophy

One of Bezos’ key principles is maintaining a “Day 1” attitude. This essentially means treating each day on your journey toward a goal as if it’s the first day. It’s a small mindset shift that can add up to significant benefits over time.

Maintaining a “Day 1” attitude means consistently reconsidering your core assumptions. Instead of blindly going through the motions of a plan previously developed, you stay nimble, respond to new information and adapt proactively. This will help you manage the natural ups and downs of progress.

4. Learn From Failure

Finally, Bezos is very open about his failures and how much he’s learned from them. In one interview, he said, “I’ve made billions of dollars of failures at Amazon.com, literally billions of dollars of failures.”

But those failures didn’t stop Bezos from building Amazon into the tech giant it is today. He learns from his mistakes. The only way to truly fail is to give up. As long as you keep trying and, like Bezos, learn from the challenges you face, you should make consistent progress toward your financial and personal goals over time.

How To Apply This to Your Life

Bezos likes to start each day with a slow, unplugged morning in the kitchen. The morning is a good time to review the habits you’re trying to adopt and reconsider any previous assumptions. But you can do this whenever it makes sense in your schedule.

For example, suppose you’re following Bezos’ “Day 1” philosophy. In that case, you might spend a few minutes each morning reconsidering your savings or investing strategy to make sure it’s still right for your needs. Or maybe you’ve recently had a failure at work. If so, try to distill a few lessons from it to see what you might do differently next time — and don’t get discouraged.

It’ll also be important to compound these habits over time. That’s where you’ll see the best results. For example, if you want to live well below your means, skipping an expensive night out can help you do it. But the financial benefits would be fairly minor unless you maintained that habit consistently over a multi-month or year period.

These habits aren’t just about money. They’re a great way to approach your life and anything you hope to achieve in it.

More From GOBankingRates

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by