What Is a Live Check and Should You Cash It?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

We’ve all done it — you get a letter in the mail that looks like a check. You tear it open and sure enough, there’s a check inside. But you don’t recognize the sender. That’s because it’s a live check — a type of personal loan offer that looks like free money but comes with strings attached. Cashing it means you’re agreeing to borrow money under the lender’s terms, which may include high interest rates and fees.

Before you rush to deposit that unexpected check, here’s what you need to know about what live checks are and whether they’re worth the risk.

What Is a Live Check?

A live check is a loan offer disguised as a real check. Lenders send them to people who seem likely to repay — often those with some debt and steady income.

The letter that comes with the check may indicate that you’ve been approved or you’re qualified for a loan, and all you need to do is cash the check. When you do cash the check, it activates a loan agreement. You will be obligated to repay the money according to the lender’s terms — which may or may not be clearly stated.

How Do Live Checks Work?

Here’s the process of a live check loan:

- A lender targets you: They identify you as a potential borrower — often someone with rising debt or recent missed payments.

- Live check arrives in the mail: The live check looks real because it is — and cashing it activates the loan.

- You deposit the check: The funds hit your account quickly, which can be tempting if you’re in need of cash.

- Repayment terms kick in: The money is in your bank account, but you also get a repayment plan that may have high interest rates and even higher fees for late or missed payments.

Are Live Checks Safe To Use?

A live check can be from a legitimate lender, or it can be from a scammer. If you are considering cashing a live check, research the company that sent it to verify that they are actually a lender. And make sure you understand the terms of the loan you are agreeing to. It’s quite possible that you could find better terms from another lender.

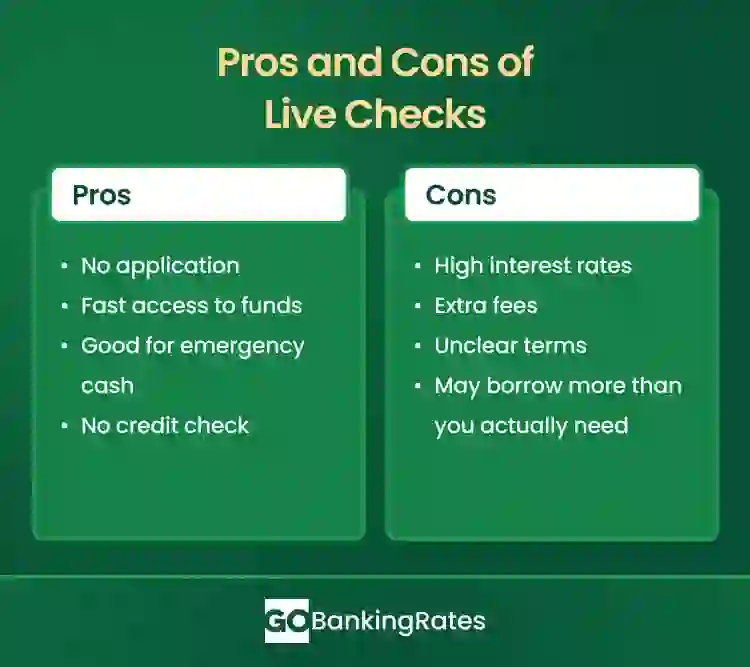

Pros and Cons of Live Checks

Like all lending solutions, live checks have their pros and cons.

Live Checks vs. Traditional Loans: Key Differences To Know

Here’s a side-by-side look at how live checks differ from traditional personal loans.

| Feature | Live Check | Traditional Loan |

|---|---|---|

| Application process | None | Online or in person |

| Speed of disbursement | Deposit immediately | May take a few days |

| Interest rate | Likely high | Typically lower and fixed |

| Loan amount | You get what they offer | Apply for the amount you want |

| Lender | May not be known to you | You choose |

Better Alternatives to Live Checks

Before you go rushing to deposit that live check you got in the mail, here are some alternatives to consider.

Personal Loan

A bank, credit union or online lender may be a better option than cashing a live check.

You can choose your lender, the length of time you have to make the payments and the loan amount. It’s likely the interest rate will be lower.

Home Equity Line of Credit (HELOC)

If you have equity in your home, you might look into a HELOC to get the cash you need.

You can apply for the amount you think you’ll need but you only pay for what you actually borrow. And since this loan is secured by your home, your interest rate will likely be much better.

Friends and Family

If you’re in a short-term cash crunch, you may be able to get a loan from someone you know. To avoid straining the relationship, put the loan terms in writing and be sure to make those payments on time.

How To Protect Yourself From Live Check Scams

The best way to avoid a live check scam is to ignore any check you didn’t ask for. If you do decide to take advantage of a live check, be sure you research the lender and understand exactly what the terms of the loan are.

Final Takeaway: When Does a Live Check Make Sense?

If you are in a situation where you’re unable to obtain a loan by other means, and you have the ability to repay the loan according to the terms, then it can make sense to cash or deposit a live check. Just make sure you know exactly what you are agreeing to.

FAQs About Live Checks

Have more questions about live checks? Here are some quick answers to help you make sense of this type of loan offer.- Is a live check the same as free money?

- No. When you cash or deposit a live check, you are agreeing to a loan. You need to pay back the money with interest according to the terms of the loan.

- Can you cancel a live check loan?

- No. Once you cash or deposit a live check, you are bound by the terms of the loan you agreed to by depositing the check. You can pay the money back, but there may be fees or penalties for paying the loan off early.

- What happens if you don't repay a live check?

- As with any loan, if you don't repay a live check, you will face penalties and interest, and your delinquency will be reported to credit reporting agencies.

- How can I stop getting live checks?

- According to the Consumer Financial Protection Bureau, you can opt out of unsolicited loan offers by calling 1-888-567-8688 or visiting OptOutPrescreen.com.

- How long does it take for a live check to clear?

- A bank is required to clear a check within a reasonable amount of time, but they can hold a check for up to five business days longer than its normal availability schedule. A bank may make some funds available earlier but hold the balance.

Elizabeth Constantineau and Sarah Sharkey contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Office of the Comptroller of the Currency. "I deposited $10,000 to my account. When will the funds be available for withdrawal?"

- Consumer Financial Protection Bureau. 2024. "I received an unexpected preapproved offer, or live check loan, in the mail. What happens if I cash or deposit it?"

Written by

Written by  Edited by

Edited by