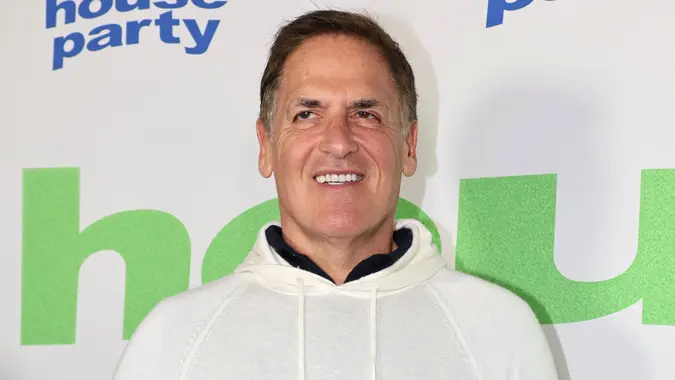

Mark Cuban and Warren Buffett Agree on This Important Money Advice

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

As we head into a potential recession, you may be wondering the best way to protect yourself in the event of job loss or continued inflation. Billionaires Mark Cuban and Warren Buffett have some advice. And it happens to be the same piece of advice: Avoid debt.

According to CNBC, Cuban views “paying off your credit cards” as the best investment anyone can make, adding, “Paying off whatever debt you have.”

He explained it using basic math, but the thought process may be eye-opening to many people. “Whatever interest rate you have — it might be a student loan with a seven percent interest rate — if you pay off that loan, you’re making seven percent.”

Cuban called this money in your pocket a “safer” investment than stocks or real estate. Of course, you could then take that money and invest it in the S&P 500, for an average 10% return over time.

If you’re paying down credit card debt, your interest rate is likely much higher than 7%. GOBankingRates recently reported that the national average APR on credit cards is 24%.

Billionaire Warren Buffett was on record decades ago offering similar advice. In a 2004 Berkshire Hathaway meeting, he told a teen, “[J]ust to don’t get in debt,” adding, “It’s very tempting to spend more than you earn, it’s very understandable. But it’s not a good idea.”

If you’ve been leveraging credit card rewards for cash back or flyer miles, you might be resisting the urge to cut up your credit cards forever. Cuban says that’s okay. In an interview with Money, Cuban said, “Using a credit card is okay if you pay it off at the end of the month.”

Cuban struggled with credit card debt early in his career, saying that getting his credit cards ripped up was the hardest lesson he learned. “I would charge something and think I would be able to pay it off and then not be able to.”

“The hardest lesson I learned was getting my credit cards ripped up,” he told Money during a recent interview. “I would charge something and think I would be able to pay it off and then not be able to. I can’t tell you how many credit cards I had ripped up.”

He added, “Paying off your credit cards after 30 days, or not even using credit cards, is the smartest investment you can make or not make.”

You can choose the avalanche method of paying down debt, where you pay down debt with the highest interest first. Or you can knock out smaller balances first for a feeling of satisfaction, which is called the snowball method. Whatever you do, choose one.

Make a financial plan Decide how you can cut expenses or earn more money fast to pay down debt.

Once you’ve cleared your debt, both billionaires recommend putting that money toward investments. “Consistently buy an S&P 500 low-cost index fund,” Buffett told CNBC. “I think it’s the thing that makes the most sense practically all of the time.”

Written by

Written by  Edited by

Edited by