Your Bank of Oklahoma Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’ve ever set up direct deposit, paid a bill online, or sent a wire transfer, you’ve probably needed your routing number. But if you’re not sure what yours is, don’t worry–you’re not alone. Your Bank of Oklahoma routing number is essential for ensuring your transactions go through without any issues. Let’s go over everything you need to know.

Bank of Oklahoma Routing Number

Bank of Oklahoma uses only one routing number. To send a domestic ACH transfer, Bank of Oklahoma’s routing number is 103900036.

This number is used for direct deposits, ACH transfers, and domestic wire transfers. If you’re sending or receiving an international wire transfer, you’ll also need Bank of Oklahoma’s SWIFT code, which we’ll cover shortly.

How To Find Your Bank of Oklahoma Routing Number

If you need to verify your routing number, here are a few easy ways to find it:

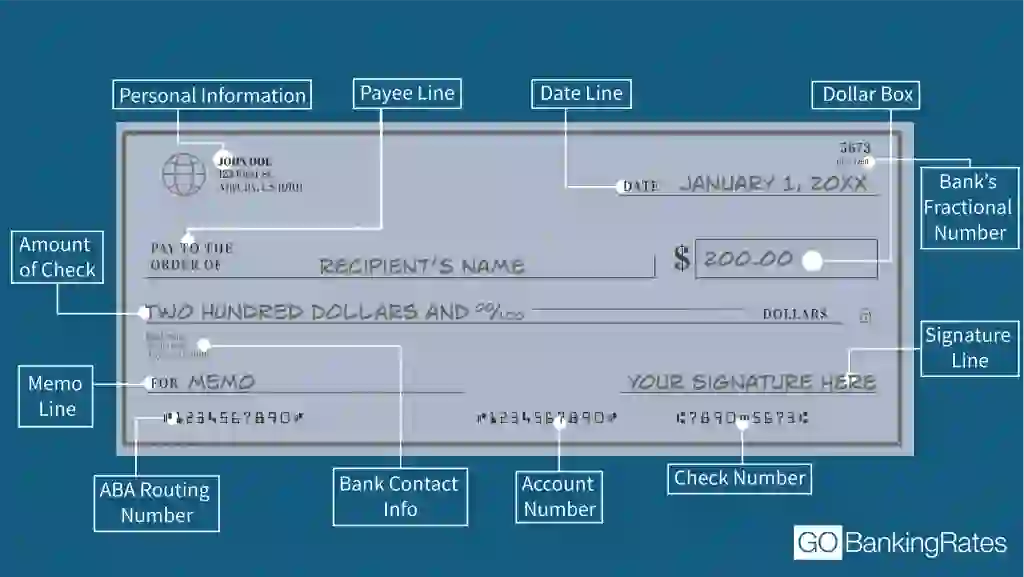

On a Check

Your routing number is printed on the bottom left corner of your check. It’s the first nine-digit number before your account number.

Through Online Banking

If you don’t have a check handy, you can find your routing number online:

- Log into your Bank of Oklahoma online banking account.

- Navigate to the account details section.

- Your routing number should be listed along with your account number.

By Contacting Customer Service

Still not sure? Bank of Oklahoma’s customer service can confirm your routing number. Have the following information ready:

- Your account number

- The type of transaction you’re making

- Any additional verification details they may request

Bank of Oklahoma Routing Numbers for Wire Transfers

Wire transfers require a different set of details than everyday transactions. If you’re transferring money domestically or internationally, you’ll need the correct routing number and, for international transfers, the SWIFT code.

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 103900036 | N/A |

| International Wire Transfer | 103900036 | BAOKUS44 |

If you’re receiving an international wire transfer, the sender’s bank will require both the routing number and SWIFT code.

Bank of Oklahoma Routing Number vs. Account Number: What’s the Difference?

It’s easy to mix these up, so here’s a simple breakdown:

- Routing Number – Identifies Bank of Oklahoma and ensures your funds are sent to the right place.

- Account Number – Uniquely identifies your specific account within the bank.

Both numbers are printed on your checks, but the routing number always appears first.

How To Use Your Bank of Oklahoma Routing Number

Now that you know your routing number, here’s how you can use it:

- Set up direct deposit – Have your paycheck or government benefits automatically deposited into your account.

- Make ACH transfers – Send or receive electronic payments.

- Pay bills online – Set up automatic payments for rent, utilities, and other expenses.

- Wire transfers – Move money between accounts domestically or internationally.

Having your routing number handy makes banking much easier and helps prevent delays in transactions.

Written by

Written by  Edited by

Edited by