PNC Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Sending and receiving money electronically with your PNC Bank account is not only convenient but also necessary for direct payroll deposits and certain other transactions. All electronic bank transactions in the U.S. require a routing number, which identifies your bank, and there are several ways to find your PNC routing number. Keep reading to learn more.

Your PNC Bank Routing Number: Why You Need It

Your PNC Bank routing number is essential for managing various financial transactions, including direct deposits, wire transfers, and bill payments. This nine-digit code ensures that your funds are accurately directed to and from your account.

PNC Bank Routing Numbers By State

PNC utilizes a variety of routing numbers across states and regions to accommodate its widespread presence. Here’s a rundown of PNC’s routing numbers by state:

| State | PNC Routing Number |

|---|---|

| Alabama | 043000096 |

| Delaware | 031100089 |

| District of Columbia | 054000030 |

| Florida | 267084199 |

| Georgia | 053100850, 061192630 |

| Illinois | 071921891 |

| Indiana | 043000096 |

| Kentucky | 083000108 |

| Maryland | 054000030 |

| Michigan | 041000124 |

| Missouri | 071921891 |

| New Jersey | 031207607 |

| North Carolina | 043000096 |

| Ohio | 042000398, 041000124 |

| Pennsylvania | 043000096 |

| South Carolina | 53100850 |

| Virginia | 054000030 |

| West Virginia | 271971560 |

| Wisconsin | 071921891 |

Note: Some states have multiple routing numbers. It’s important to verify the correct routing number for your specific branch or account type.

PNC’s routing numbers vary depending on the type of transaction you’re making. Whether you’re conducting a wire transfer or setting up bill payments, the specific routing number you need will differ. It’s crucial to use the right one to ensure your transactions process smoothly.

How To Find Your PNC Bank Routing Number

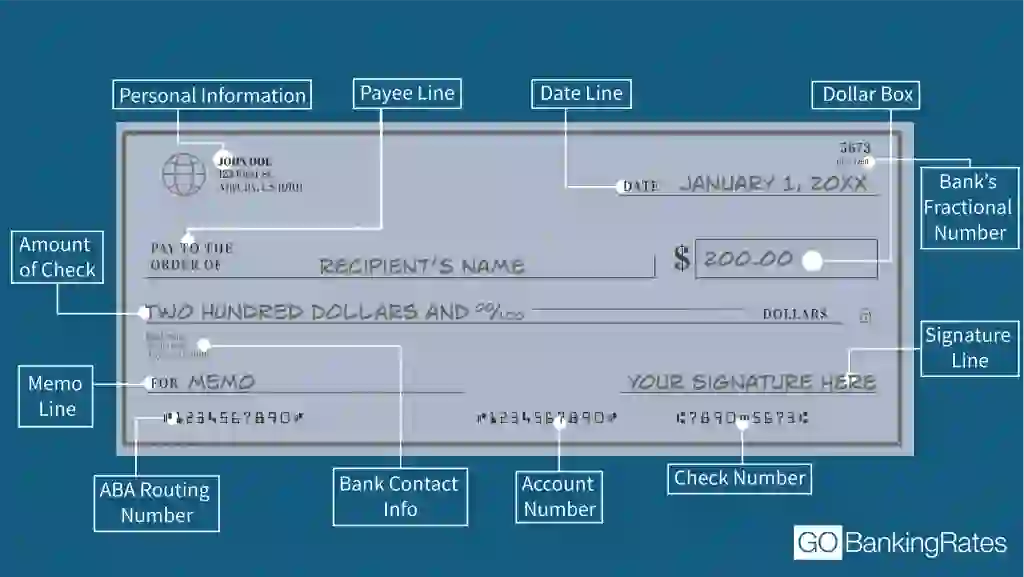

On a Check

You can locate your routing number at the bottom left corner of your PNC Bank check. It’s the first nine-digit number, followed by your account number and the check number.

Through Online Banking

To find your routing number via PNC Bank’s online services:

- Log in to your PNC Bank online banking account.

- Select the account for which you need the routing number.

- Navigate to the account details or information section.

- Your routing number, along with your account number, will be displayed there.

For detailed instructions, visit PNC’s official guide: pnc.com

By Contacting Customer Service

If you prefer direct assistance:

- Phone: Call PNC Bank’s customer service at 1-888-PNC-BANK (1-888-762-2265).

Be prepared to provide your full name, account number, and any security details for verification.

PNC Bank Routing Numbers for Wire Transfers

When performing wire transfers, it’s essential to use the correct routing information:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 043000096 | N/A |

| International Wire Transfer | 043000096 | PNCCUS33 |

Note: Always confirm with your local branch or the recipient to ensure you’re using the correct routing number and SWIFT code for your specific transaction.

PNC Bank Routing Number vs. Account Number: What’s the Difference?

Your PNC Bank routing number and account number are both essential for managing your banking transactions, but they serve different purposes.

Purpose of Each Number

- Routing Number: A nine-digit code that identifies PNC Bank for transactions like direct deposits, wire transfers, and bill payments. Routing numbers vary by state, so it’s important to use the correct one for your account.

- Account Number: A unique identifier assigned to your specific PNC Bank account. This number ensures that transactions are directed to the right account when you send or receive money.

Where to Find Them Both

- Online Banking & Mobile App – Log in to your PNC Bank account and check the account details section.

- Checks – The routing number is the first set of numbers on the bottom left, followed by your account number.

- Customer Service – If you need help, call PNC Bank customer support at 1-888-PNC-BANK (1-888-762-2265).

How To Use Your PNC Bank Routing Number

Your PNC Bank routing number is essential for various financial transactions, including setting up direct deposits, making ACH transfers, and paying bills online.

Setting Up Direct Deposit

To receive your paycheck, tax refunds, or government benefits directly into your PNC Bank account, provide:

- PNC Bank routing number (specific to your state)

- Your PNC Bank account number

- Any additional forms required by your employer or benefits provider

Making ACH Transfers

ACH (Automated Clearing House) transfers allow you to send and receive money electronically. You can use ACH transfers to:

- Transfer money between your PNC Bank account and another bank

- Set up automatic payments for loans, rent, or subscriptions

- Receive payments from clients or other sources

To initiate an ACH transfer, use:

- PNC Bank routing number

- Your PNC Bank account number

Paying Bills Online

You can pay bills directly from your PNC Bank account using online banking.

Karen Doyle and Caitlyn Moorhead contributed to the reporting for this article.

Information is accurate as of Oct. 8, 2024.

The article above was refined via automated technology and then fine-tuned and verified for accuracy by a member of our editorial team.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by