KeyBank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Your checking account’s routing number is used for transferring funds to or from your account, so you’ll need to know it in order to sign up for automatic bill payments, receive a wire transfer or set up direct deposit.

If you’re transferring money from your KeyBank account or need to transfer money to a KeyBank customer’s account, a routing number is necessary to complete the transaction.

Why You Need Your KeyBank Routing Number

Your KeyBank routing number is a crucial part of managing your financial transactions. This nine-digit code ensures that your money moves securely and accurately, whether you’re receiving direct deposits, sending wire transfers, or paying bills online.

How KeyBank’s Routing Number is Used

- Direct Deposits – Receive your paycheck, tax refunds, or government benefits directly into your KeyBank account.

- Wire Transfers – Send or receive domestic and international wire transfers quickly and securely.

- Bill Payments – Pay your utilities, loans, and other recurring bills online using your KeyBank routing and account numbers.

KeyBank Routing Numbers by State

Here’s a look at KeyBank routing numbers for ACH and domestic wire transfers:

| State | KeyBank Routing Number |

|---|---|

| Alaska | 125200879 |

| Colorado | 307070267 |

| Connecticut | 021300077 |

| Florida | 041001039 |

| Idaho | 124101555 |

| Indiana | 041001039 |

| Maine | 011200608 |

| Massachusetts | 021300077 |

| Michigan | 041001039 |

| New York | 021300077 |

| Ohio | 041001039 |

| Oregon | 123002011 |

| Pennsylvania | 021300077 |

| Utah | 124000737 |

| Vermont | 211672531 |

| Washington | 125000574 |

How To Find Your KeyBank Routing Number

You can find your KeyBank routing number in more than one way. You can find it on checks associated with your KeyBank account or by accessing your account online.

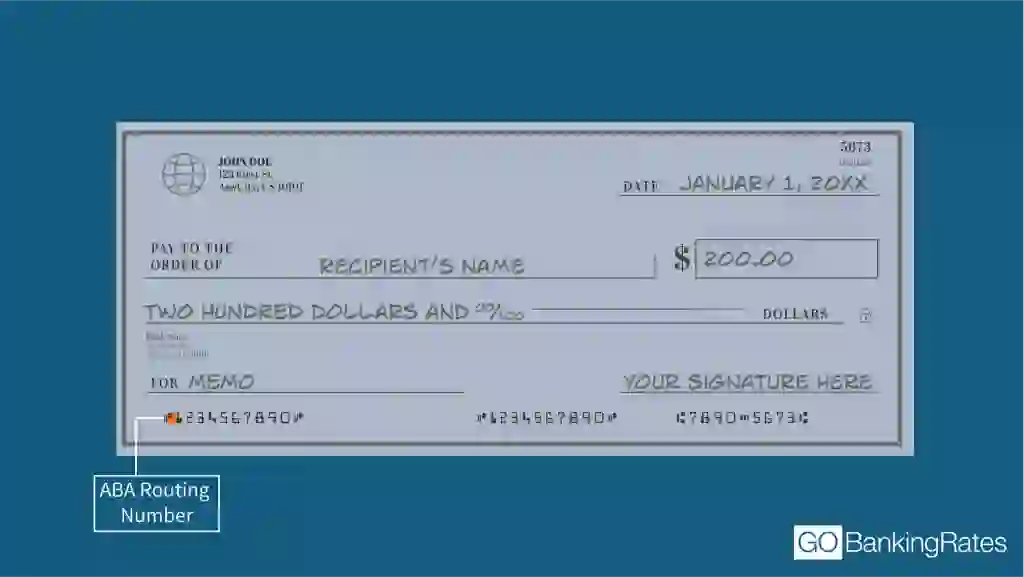

On a Check

On checks, the routing number is the first set of numbers located on the bottom left. The second set of numbers represents your account number, and the last set of numbers makes up the individual check number.

Through Online Banking

You can easily find your KeyBank routing number using their online banking platform or mobile app. Follow these steps:

Via the KeyBank Website

- Log in to your KeyBank online banking account at Key.com.

- Navigate to the ‘Accounts’ section.

- Select the account you need the routing number for.

- Look for the ‘Account Details’ section, where your routing number will be displayed.

Via the KeyBank Mobile App

- Open the KeyBank mobile banking app on your device.

- Log in using your username and password.

- Select your account and scroll to the ‘Account Details’ section.

- Your routing number will be listed along with your account number.

By Contacting Customer Service

If you’re unable to find your routing number online, you can contact KeyBank customer service at 1-800-539-2968 for assistance.

What You’ll Need When Calling

To verify your identity and receive your routing number, be prepared to provide:

- Your full name

- Your KeyBank account number

- The last four digits of your Social Security number

- Any additional security details required for verification

KeyBank Routing Numbers for Wire Transfers

When sending a wire transfer through KeyBank, using the correct routing number and SWIFT code ensures your money reaches the right place quickly and securely. Whether you’re making a domestic transfer within the U.S. or an international payment, having the right details helps avoid delays and processing issues.

Domestic Wire Transfers: For sending money within the United States, KeyBank utilizes specific routing numbers based on the state where your account was opened. It’s important to use the routing number associated with your account’s state to ensure proper processing.

International Wire Transfers: When transferring funds internationally to a KeyBank account in the U.S., you’ll need both the appropriate routing number and KeyBank’s SWIFT code. The SWIFT code is a unique identifier used globally to specify banks during international transactions.

Below is a table summarizing the routing numbers and SWIFT code for KeyBank:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | Varies by state; refer to KeyBank’s routing number directory | N/A |

| International Wire Transfer | Varies by state; refer to KeyBank’s routing number directory | KEYBUS33XXX |

For detailed routing numbers by state, refer to KeyBank’s official routing number directory.

Always check to ensure you have the correct routing number and SWIFT code before initiating a wire transfer to prevent delays or misdirected funds.

KeyBank Routing Number vs. Account Number: What’s the Difference?

Your routing number and account number serve different purposes, but both are essential for managing your KeyBank account.

Purpose of Each Number

- Routing Number: A nine-digit code that identifies KeyBank for transactions like direct deposits, wire transfers, and bill payments. Routing numbers vary by state, so be sure to use the correct one for your account.

- Account Number: A unique identifier assigned to your individual KeyBank account. This number ensures payments are directed to the right place when you transfer money, set up payments, or receive deposits.

Where to Find Them Both

- Online Banking & Mobile App – Log in to your KeyBank account and check the account details section.

- Checks – The routing number is the first set of numbers on the bottom left, while your account number follows.

- Customer Service – If you need help, call KeyBank customer support at 1-800-539-2968.

How To Use Your KeyBank Routing Number

Your KeyBank routing number is needed for several key financial transactions, including direct deposits, ACH transfers, and bill payments.

Setting Up Direct Deposit

For your paycheck, tax refunds, or government benefits to be deposited directly into your KeyBank account, provide:

- KeyBank routing number (specific to your state)

- Your KeyBank account number

- Any additional forms required by your employer or benefits provider

Making ACH Transfers

ACH transfers allow you to send and receive money electronically. You can use ACH transfers to:

- Move money between your KeyBank account and another bank

- Set up automatic payments for loans or subscriptions

- Receive payments from clients or other sources

To initiate an ACH transfer, use:

- KeyBank routing number

- Your KeyBank account number

Paying Bills Online

Many businesses and service providers accept payments directly from your KeyBank account. To set up online bill payments for utilities, loans, or subscriptions:

- Log into KeyBank online banking or the mobile app.

- Navigate to the Bill Pay section.

- Enter your routing number and account number to link your payment method.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by