How To Get a U.S. Bank Cashier’s Check

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

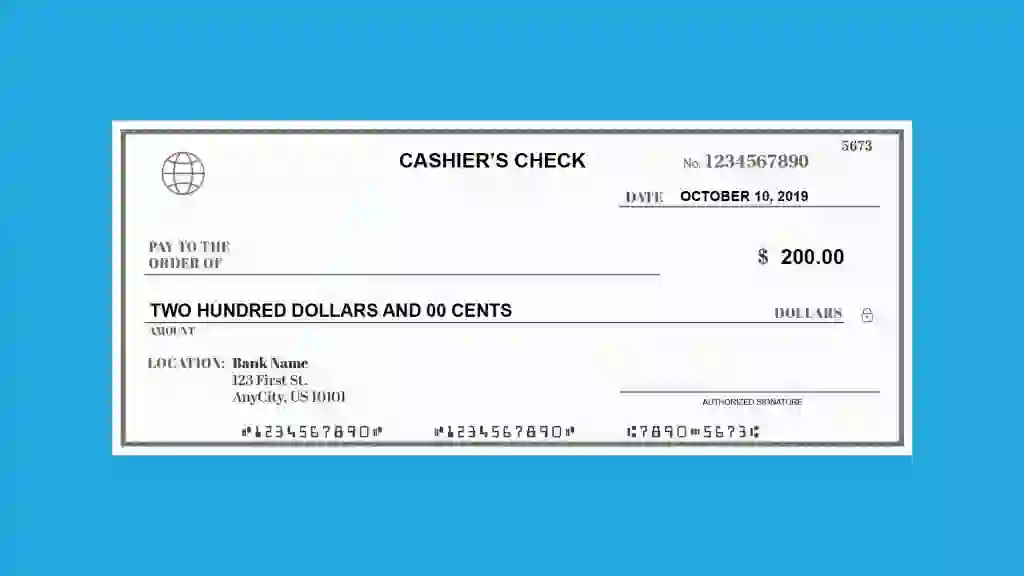

A U.S. Bank cashier’s check is a secure way to handle large payments when cash or a personal check won’t cut it. The bank charges up to $10 per check, so it pays to know exactly when and how to use one. This guide walks you through the steps — and fees — so you can get your cashier’s check quickly and avoid surprises.

U.S. Bank Cashier’s Check Fees

Here’s what you might pay for a cashier’s check at U.S. Bank, depending on the account type.

| U.S. Bank Account Type | Cashier’s Check Fee |

|---|---|

| Standard checking and savings | $10 per check |

| Military accounts | Free |

| U.S. Bank Smart Rewards members | Free for gold, platinum and platinum plus tiers |

Step-by-Step Guide To Getting a Cashier’s Check at U.S. Bank

Getting a cashier’s check from U.S. Bank is simple — just follow these steps.

Step 1: Verify Eligibility

Before heading to a U.S. Bank branch, make sure you meet the eligibility.

- You must have a U.S. Bank account: Cashier’s checks are typically issued only to account holders.

- If you don’t have a U.S. Bank account: Consider alternatives like a money order or certified check.

Step 2: Collect Required Documents

To speed up the process, gather the following details:

- Recipient’s name: The cashier’s check must be made payable to a specific person or business.

- Exact amount: The funds must be available in your account before purchasing the check.

- Check’s purpose: Some financial institutions may ask why you need the cashier’s check, though it’s not always required.

Step 3: Visit a U.S. Bank Branch

U.S. Bank doesn’t currently offer online cashier’s checks, so you’ll need to visit a branch in person. Here’s what to do:

- Find a branch: Use an online locator tool to find the nearest U.S. Bank branch.

- Bring ID: Have a valid photo ID ready, such as a driver’s license, passport or state-issued ID.

- Request the check: Ask the teller for a cashier’s check and provide the recipient’s name, amount and purpose if required.

- Review before leaving: Double-check the details on the check before leaving the branch to ensure accuracy.

Pro Tip

For faster service and extra time to handle any questions, consider making an appointment first. You can schedule one easily through the U.S. Bank mobile app or online banking portal.

Step 4: Pay the Fee

Cashier’s checks aren’t free, and U.S. Bank fees vary based on your account type and branch.

When paying for a cashier’s check, most branches require funds to come directly from your U.S. Bank account. Some locations may also accept cash payments if you’re an account holder.

If you need multiple cashier’s checks, ask your banker about possible fee waivers for high-tier accounts.

What To Know About U.S. Bank Cashier’s Checks

| Factor | What To Know |

|---|---|

| Processing time | A cashier’s check is issued immediately at the branch. |

| Hold time | Funds are guaranteed, but some recipients may hold the check before releasing goods or services. |

| Replacement fees | Lost checks require a claim process and a replacement fee — this can take weeks. |

Can You Get a Cashier’s Check Without a U.S. Bank Account?

If you don’t have an account with U.S. Bank, you won’t be able to get a cashier’s check. However, you do have some alternatives:

- Money orders: Available at post offices, grocery stores and retailers like Walmart. Money orders are usually capped at $1,000.

- Certified checks: Some banks offer certified checks, which guarantee payment like a cashier’s check.

- Other banks: If you have an account at a different bank, check if they can issue a cashier’s check for you.

Keep In Mind

If you often need cashier’s checks, consider opening a basic checking account with U.S. Bank. It can make future transactions faster, easier and sometimes even cheaper.

Final Take: Is a U.S. Bank Cashier’s Check Right for You?

A U.S. Bank cashier’s check is an excellent option for large, secure transactions where payment guarantees are essential. Though there’s a small fee and the requirement to visit a branch in person, the peace of mind that comes with guaranteed funds is worth it.

For those without a U.S. Bank account, exploring alternative options like money orders or certified checks can also provide secure solutions.

U.S. Bank Cashier's Checks FAQ

Here are answers to some of the top questions about U.S. Bank cashier's checks.- Are there limits on cashier's check amounts?

- There are no limits. However, the amount must be fully available in your U.S. Bank account at the time of purchase.

- Can I cancel a cashier's check?

- Cashier’s checks are generally non-cancelable unless they're lost or stolen. You may need to file a claim, which can take several weeks to process.

- What happens if I lose a cashier's check?

- Contact U.S. Bank immediately if you lose a cashier's check. You may need to purchase an indemnity bond before a replacement is issued.

- Can I get a cashier's check online from U.S. Bank?

- No, U.S. Bank doesn't offer online orders for cashier’s checks. You need to visit a branch.

- How long does it take for a cashier's check to clear?

- Most banks treat cashier’s checks as guaranteed funds, but some may hold them for up to two business days for fraud prevention.

More About U.S. Bank

- U.S. Bank Review

- U.S. Bank CD Rates and Terms

- U.S. Bank Interest Rates

- U.S. Bank Hours and Holiday Schedule

- U.S. Bank ATM Limits

Information is accurate as of Sept. 15, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- U.S. Bank. "Online Bank Location tool."

- United States Postal Service. "Sending Money Orders."

- U.S. Bank. "Checking Accounts."

Written by

Written by  Edited by

Edited by