M&T Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

M&T Bank traces its history back more than 160 years to its founding in Buffalo, New York, and continues to serve customers along the East Coast. M&T offers standard banking products and services, including wire transfers for sending or receiving funds.

Your M&T Bank Routing Number: The Key to Smooth Transactions

Understanding your routing number is essential for managing your finances effectively. This nine-digit code ensures that your money reaches the right destination when you’re setting up direct deposits, paying bills online, or initiating wire transfers.

Keep reading to learn M&T Bank’s routing number and SWIFT code so you’ll be ready when you need them to complete transactions.

M&T Bank Routing Numbers by State

M&T Bank routing numbers may differ, depending on the state. Find the routing number associated with the state where you opened your account below:

| State | Routing Number |

|---|---|

| Connecticut | 022000046 |

| Delaware | 031302955 |

| Maine | 022000046 |

| Maryland | 052000113 |

| Massachusetts | 022000046 |

| New Hampshire | 022000046 |

| New Jersey | 022000046 |

| New York | 022000046 |

| Pennsylvania | 031302955 |

| Vermont | 022000046 |

| Virginia | 052000113 |

| Washington, D.C. | 052000113 |

| West Virginia | 052000113 |

Using the right routing number is key to making sure your wire transfers goes through without any issues.

How To Find Your M&T Bank Routing Number

Here are a few ways to locate your M&T Bank routing number:

On a Check

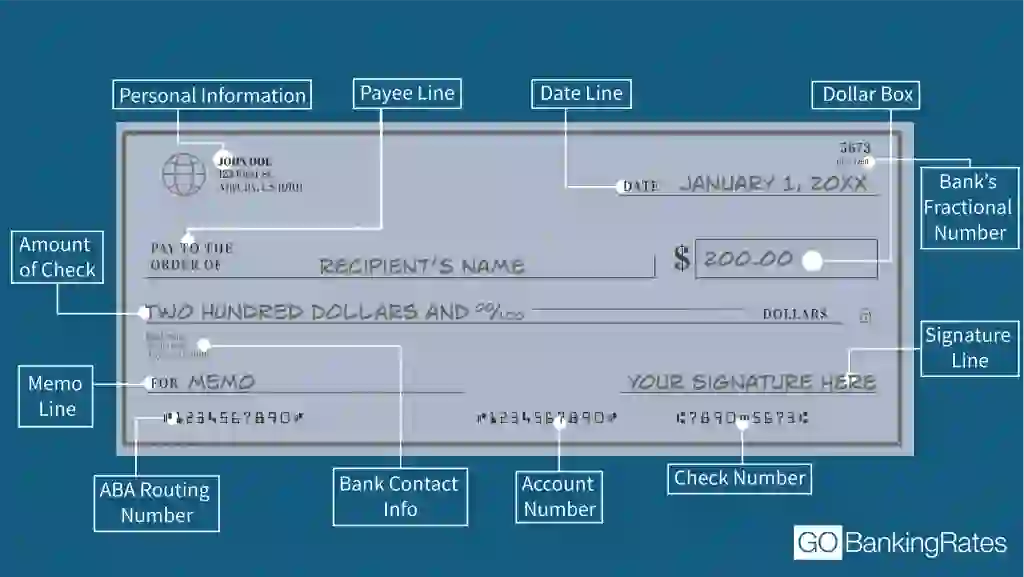

Look at one of your M&T Bank checks. The routing number is the first nine-digit number located at the bottom left corner, followed by your account number and the check number.

Through Online Banking

Log in to your M&T Bank online account or mobile app:

- Select your deposit account from the ‘Account Summary’ screen.

- Tap the ‘Account Info’ button in the upper right-hand corner.

- Your routing number will be listed there.

By Contacting Customer Service

Call M&T Bank’s customer service at 1-800-724-2440. Have your account information ready for verification.

M&T Bank Routing Numbers for Wire Transfers

For wire transfers, M&T Bank uses specific routing information:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 022000046 | N/A |

| International Wire Transfer | 022000046 | MANTUS33 |

The SWIFT code is necessary for international transfers to identify M&T Bank globally.

M&T Bank Routing Number vs. Account Number: What’s the Difference?

It’s important to distinguish between these two numbers:

- Routing Number: Identifies the bank and is used for processing transactions like direct deposits and wire transfers.

- Account Number: Specifies your individual bank account.

Both numbers are essential for ensuring your transactions are processed correctly.

How To Use Your M&T Bank Routing Number

Your routing number is used in various banking activities:

- Setting up direct deposit: Set up direct deposit by giving your employer or other payers your routing and account numbers, so your payments go straight into your account.

- Making ACH transfers: Used for electronic bank transactions, such as transferring funds between accounts or paying bills.

- Paying bills online: You’ll need your routing number when setting up bill payments through M&T Bank’s online banking.

- Sending wire transfers: For both domestic and international wire transfers, ensure you use the correct routing number and, if applicable, the SWIFT code.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by