Chase SWIFT Code: What It Is and How To Use It for International Transfers

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

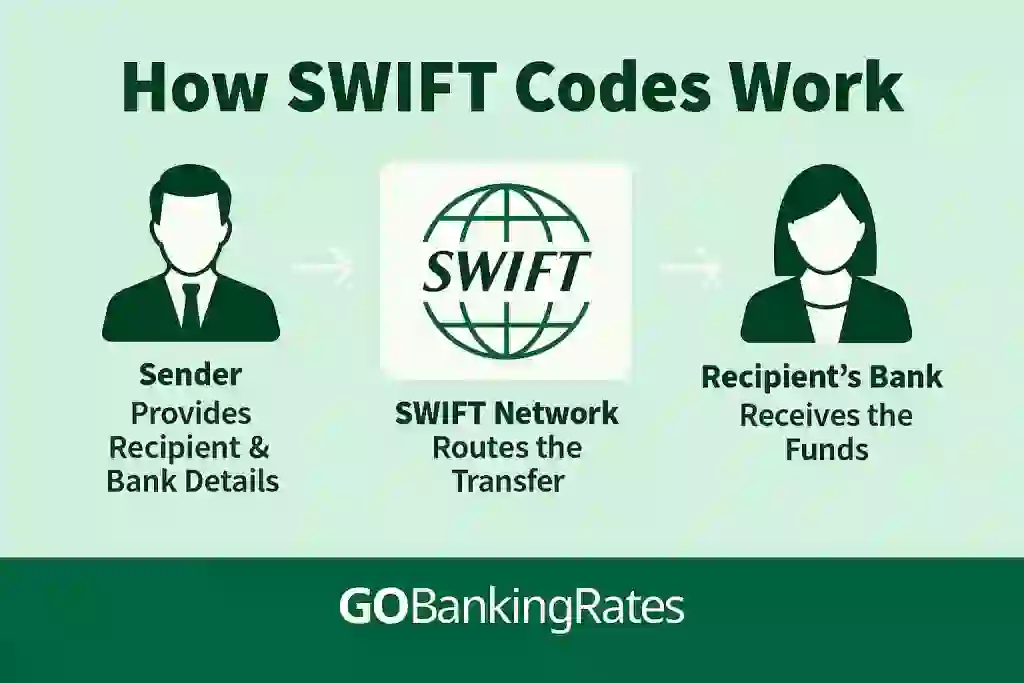

If you’re sending or receiving money from overseas, you’ll need a SWIFT code — the global banking identifier that ensures funds arrive at the correct financial institution.

For Chase Bank, the code is CHASUS33 — but knowing it is only the first step.

Here’s what the Chase SWIFT code means, how to use it safely and how it compares to other international money-transfer options.

What Is the Chase SWIFT Code?

A SWIFT code (also known as a Bank Identifier Code, or BIC) is an 8- to 11-character code that identifies a bank and its location for international transfers.

For Chase Bank, the main SWIFT code is:

| Chase SWIFT Code | Bank Address |

|---|---|

| CHASUS33 | 270 Park Avenue, New York, NY 10017 |

You might also see it written as CHASUS33XXX — the “XXX” simply indicates the Chase headquarters branch. Both formats are correct.

Branch-Specific Chase SWIFT Codes

While CHASUS33 works for most international transactions, some Chase business lines and regional branches may have unique SWIFT codes. For example, a corporate banking division or investment services department may use an alternate identifier for routing international wires.

Tip: To confirm you’re using the correct SWIFT code, log in to your Chase online account or call your local branch. You can also reference your account statement or wire instructions for branch-specific details.

If you’re sending funds from outside the U.S., your local Chase branch or partner bank may require a different SWIFT/BIC depending on currency type or service.

SWIFT vs. IBAN: What’s the Difference?

It’s easy to confuse a SWIFT code with an International Bank Account Number (IBAN), but they serve different purposes:

| Identifier | Used For | Example Format | Who Uses It |

|---|---|---|---|

| SWIFT/BIC | Identifies a bank globally | CHASUS33 | Europe, the Middle East and parts of Asia |

| IBAN | Identifies an individual bank account | GB29 NWBK 6016 1331 9268 19 | Europe, the Middle East and parts of Asia |

Because the U.S. banking system does not use IBANs, Chase customers only need the SWIFT code for international transfers.

How To Use a SWIFT Code for International Transfers

Here’s how to send or receive money through Chase using a SWIFT code:

- Gather recipient details:

Collect the recipient’s full name, address, bank name, account number and SWIFT/BIC. - Log in or visit a branch:

Access the international wire section via your Chase account online or mobile app, or speak with a banker in person. - Enter transfer details:

Input the recipient’s SWIFT code, account number, currency type and transfer amount. - Provide required documentation:

Some countries may require additional details, like the reason for payment or tax identification. - Verify accuracy:

Double-check all information before submitting to prevent delays or returned transfers. - Confirm and track:

Once submitted, you’ll receive confirmation and can track the transfer’s progress.

How To Find the Right Chase SWIFT Code

You can locate your SWIFT code in several ways:

- Chase website: Visit the Chase international wire transfers page for official codes.

- Online banking: Log in to your account and look under “International Wires.”

- Customer service: Call 1-800-935-9935 or visit a Chase branch.

- Validation tools: Use Chase’s official resources or a trusted third-party SWIFT verification tool to confirm your code before sending money.

Chase vs. Wise: Cost and Speed Comparison

If you frequently send money abroad, it’s worth comparing Chase’s traditional wire system with modern digital transfer services like Wise.

| Service | Outgoing Fee (USD) | Exchange Rate Markup | Delivery Speed | Best For |

|---|---|---|---|---|

| Chase Bank | $40-$50 | 2%-3% above mid-market | 1-5 business days | Large, one-time international transfers |

| Wise | ~1% of amount | Uses real-time mid-market rate | Minutes-2 days | Frequent or small-amount transfers |

According to Wise’s 2025 pricing data, users may save up to 70% on total transfer costs compared to traditional banks. However, Chase offers stronger privacy controls, direct bank support and FDIC-insured security for account holders.

Localization Tips for International Customers

Depending on your country, Chase’s corresponding banks may use localized SWIFT identifiers:

- Canada or UK: Confirm whether your local Chase subsidiary or partner bank requires its own SWIFT/BIC.

- Asia or Europe: Use the recipient’s local IBAN when applicable, but still include Chase’s global SWIFT (CHASUS33).

- Latin America: Ask the recipient’s bank to confirm if an intermediary U.S. bank (often JPMorgan Chase & Co.) is required for routing.

How Long Do Chase SWIFT Transfers Take?

Transfer speed varies by destination, currency, and intermediaries:

| Transfer Type | Estimated Timeframe |

|---|---|

| U.S. dollar transfers | 1-2 business days |

| Foreign currency transfers | 3-5 business days |

| Delays (weekends, holidays, time zones) | +1-2 days possible |

To minimize delays, submit transfers early in the day, verify all details and ensure no local banking holidays affect your recipient.

What To Know Before Sending a Chase International Wire

Keep these points in mind before you send funds overseas:

- Fees apply: Chase charges for outgoing and incoming international wires.

- Exchange rates vary: The rate may differ from mid-market levels.

- Processing times differ: Some destinations take up to five business days.

- Daily limits apply: Chase sets limits on international wire amounts.

Common Errors With SWIFT Transfers (and How To Avoid Them)

Avoid these mistakes to ensure smooth delivery:

- Wrong SWIFT code: Always confirm CHASUS33 or your branch-specific code before sending.

- Incomplete recipient details: Missing information can delay or reject transfers.

- Currency mismatch: Verify you’re sending in the correct currency.

- Exceeding limits: Check your transfer maximums before submitting.

Double-check your SWIFT code, recipient name, and currency before hitting “Send.” Small errors can lead to long delays or returned funds.

Final Take to GO: Making the Most of Your Chase SWIFT Code

The Chase SWIFT code CHASUS33 enables secure international transfers worldwide. But the smartest senders verify branch-specific details, compare fees and confirm exchange rates before sending money abroad.

If you frequently make international payments, consider alternatives like Wise for smaller, low-fee transfers — or stick with Chase for large, bank-to-bank transactions that offer FDIC protection and direct support.

To explore more, check out:

- Chase Bank Review

- Chase Bonus Offers and Promotions

- Chase ATM Limits

- Chase Bank Hours

- Chase CD Rates

Quinlan Grim contributed to the reporting for this article.

Information is accurate as of Oct. 6, 2025.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by