SoFi Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

When working with a financial institution, it’s useful to know what your routing number is. You’ll need this specific number for a variety of banking tasks, including setting up direct deposit, linking your bank account to an external account, and transferring funds to a payment app. If you are a SoFi® customer, keep reading to learn everything you need to know about your routing number.

A routing number is a nine-digit number that is associated with a particular financial institution. The key number indicates where transactions should be processed. In some cases, you might hear the routing number referred to as an American Bankers Association number or ABA number.

Some banks have a single routing number, while others have multiple routing numbers.

SoFi Routing Number: The Key to Smooth Transactions

When you need to send or receive money through your SoFi account, your routing number plays a crucial role. Whether you’re setting up direct deposits, making wire transfers, or paying bills online, having the right routing number ensures your transactions go through without a hitch.

SoFi Routing Numbers by State

SoFi’s routing number is 031101334. This is SoFi’s routing number for all transactions across the United States, regardless of the state in which an account was opened. ou can use this routing number as a piece of the puzzle when completing banking tasks.

Unlike some banks that use different routing numbers depending on the state or type of transaction, SoFi Bank keeps it simple with one routing number for everything, no matter where you are. This makes banking easier and helps avoid any mix-ups.

How To Find Your SoFi Routing Number

There are a few different ways to find your SoFi routing number.

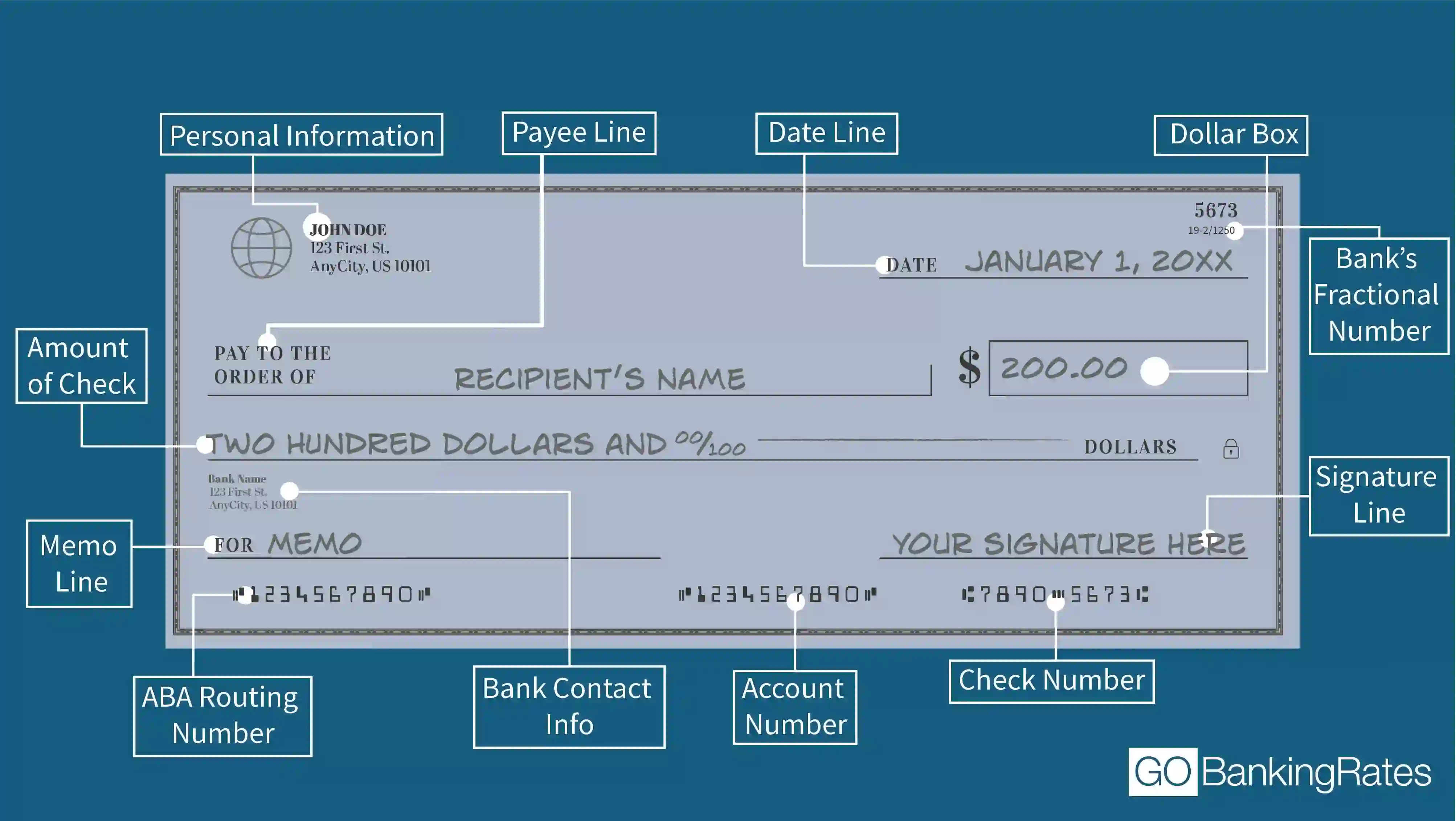

On a Check

Another way to find your SoFi routing number is to take a look at your checks. If you have physical checks through the bank, it should have both your routing number and account number printed on the bottom. Your routing number is the first nine digits in the bottom left corner of your physical check.

Through Online Banking

You can also find your SoFi routing number by logging in to your SoFi account. If you’re using the mobile app, you’ll go to the “Banking” tab and select the “More” icon. If you’re using the desktop version of SoFi’s platform, you’ll head to the “Banking” tab, select “More” and select “Account details” to find your routing and account numbers.

By Contacting Customer Service

You can always reach out to their customer service team for assistance.

You can contact SoFi Bank’s customer support at 1-855-456-7634 for any questions related to your routing and account numbers.

What You’ll Need When Calling

To verify your identity and get the correct routing number, be prepared to provide:

- Your full name

- Your SoFi account number

- The last four digits of your Social Security number

- Any other security details required for verification

SoFi representatives can confirm your routing number and answer any additional banking questions you may have.

SoFi Routing Numbers for Wire Transfers

SoFi Bank, N.A. facilitates domestic wire transfers using its standard routing number, 031101334. However, it’s important to note that SoFi does not currently support international wire transfers and, therefore, doesn’t have an associated SWIFT code.

Here’s a summary:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 031101334 | N/A |

| International Wire Transfer | N/A | N/A |

For domestic wire transfers, ensure you use the routing number 031101334. Since international wire transfers are not supported, alternative methods should be considered for transferring funds internationally.

SoFi Routing Number vs. Account Number: What’s the Difference?

Your routing number and account number serve different purposes, but both are essential for managing your SoFi Bank account.

Purpose of Each Number

- Routing Number: A nine-digit code that identifies SoFi Bank in financial transactions, such as direct deposits, bill payments, and wire transfers.

- Account Number: A unique identifier assigned to your individual SoFi account. It specifies where your money is held and is needed for setting up payments and deposits.

How To Use Your SoFi Routing Number

Your SoFi Bank routing number is essential for various financial transactions, including setting up direct deposits, making ACH transfers, and paying bills online. Here’s how you can use it effectively:

Setting Up Direct Deposit

To have your paycheck, government benefits, or other recurring payments deposited directly into your SoFi account, provide your employer or benefits provider with:

- Your SoFi routing number

- Your SoFi account number (found in the app or online banking)

- Any additional forms required by your employer

Making ACH Transfers

ACH (Automated Clearing House) transfers allow you to move money between accounts at different banks, such as transferring funds from an external bank to your SoFi account or setting up automatic payments. When initiating an ACH transfer, you’ll need:

- Your SoFi account number

- Your SoFi routing number

Paying Bills Online

Many companies, including utility providers, lenders, and subscription services, allow you to pay bills directly from your bank account. To do this:

- Log in to the biller’s website and select bank transfer or ACH payment as your payment method.

- Enter SoFi’s routing number and your account number.

- Confirm and schedule your payment.

You’ll need your routing number and account number to complete many types of financial transactions. Whether you are setting up a transfer of funds or getting your direct deposit in order, it’s critical to take a close look at the numbers. A mistake could lead to your funds heading to the wrong account. With that, double-check that your routing number and account number are correct before moving forward.

FAQ

- Does SoFi Checking and Savings have one routing number and account number?

- If you're a SoFi banking customer, you'll have a routing number and different account numbers for your checking and savings accounts. You can find this information via the bank's mobile app or its online banking platform.

- Is SoFi Checking and Savings a real bank account?

- Yes. SoFi is a legitimate, FDIC-insured financial institution.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per depositor per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $3M through participation in the program. See full terms at SoFi.com/banking/fdic/sidpterms. See list of participating banks at SoFi.com/banking/fdic/participatingbanks.

Written by

Written by  Edited by

Edited by