EverBank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Routing numbers are important components of the financial universe. You might not think about them much, but routing numbers are constantly in use, identifying from where and to where funds are transferred. In this piece, you will learn what your EverBank routing number is.

EverBank Routing Number

EverBank has one routing number for direct deposits, ACH transfers and other everyday transactions:

| EverBank Routing Number |

|---|

| 063092110 |

How To Find Your EverBank Routing Number

There are a few places you can check to find your routing number:

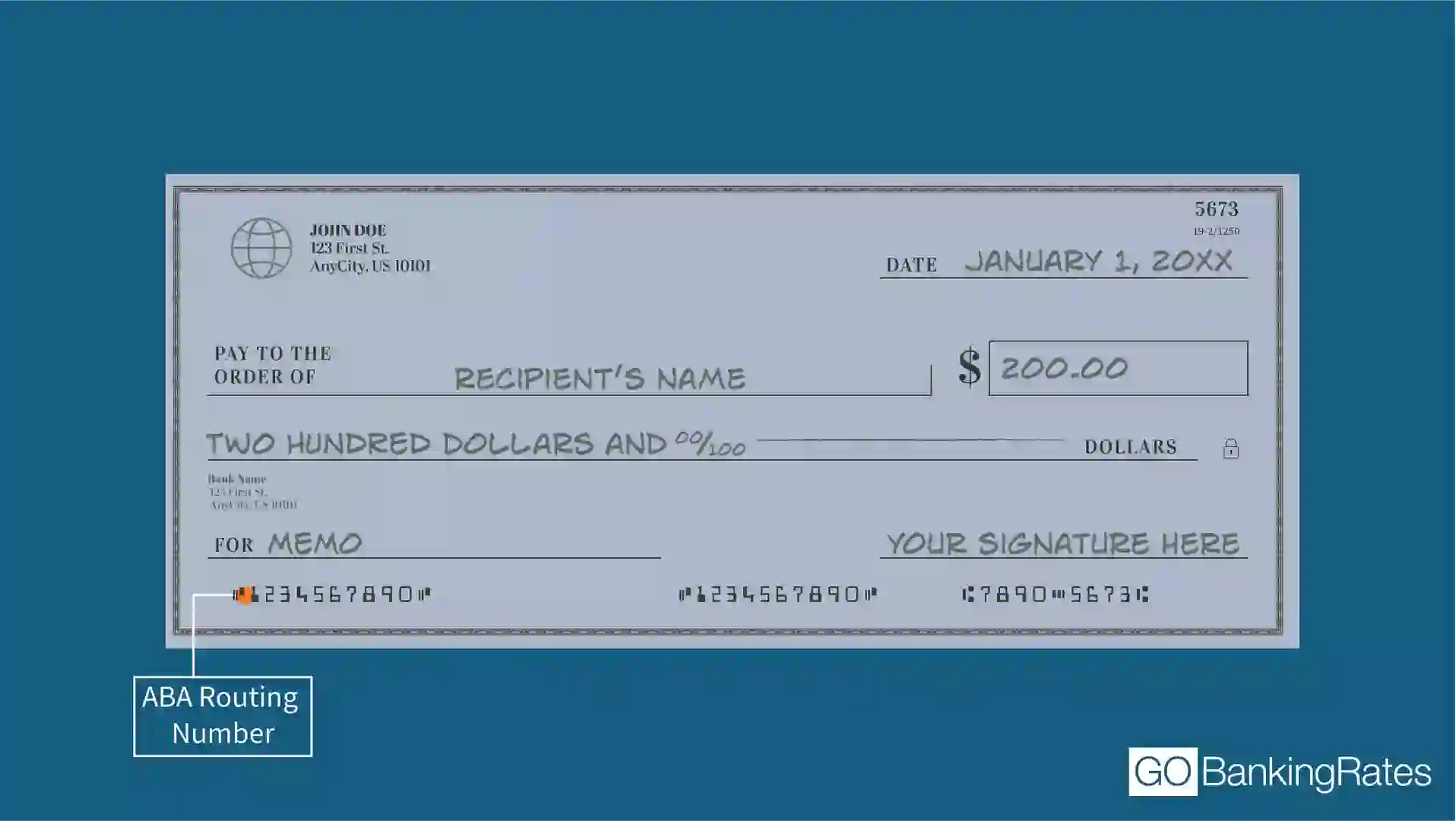

On a Check

Checks contain three numbers printed across the bottom: Routing number, account number and check number. The routing number is on the lower-left corner of the check. Then comes the account number and lastly, the check number.

Through Online Banking

If you don’t have a check handy, you can find your routing number by logging into your EverBank online bank account:

- Sign in to your EverBank account.

- Select the account you need the routing number for.

- Look for the “Account Details” section, where your routing number will be displayed.

By Contacting Customer Service

If you’re unsure which routing number to use, EverBank’s customer service team can help. Call 1-888-882-3837 during the following times to speak to a representative:

- Monday to Friday: 8 a.m. to 8 p.m. EST

- Saturday: 9 a.m. to 7 p.m. EST

EverBank Routing Numbers for Wire Transfers

If you want to send or receive a domestic wire transfer, you’ll need a routing number. EverBank uses the number 063000225 for wire transfers — this is different from the routing number used for direct deposits and ACH transfers.

For international wire transfers, banks use SWIFT codes to identify financial institutions globally. Essentially, SWIFT codes function as routing numbers for international transfers.

Here’s a quick reference guide:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic wire transfer | 063000225 | N/A |

| International wire transfer | 063000225 | EVBKUS3M |

EverBank Routing Number vs. Account Number: What’s the Difference?

A routing number is used to identify the financial institution processing a transaction, while an account number is unique to each individual bank account.

When making payments or setting up transfers, always double-check that you’re using the correct numbers.

How To Use Your EverBank Routing Number

Your EverBank routing number is required for a number of financial transactions, including the following:

- Paying bills online: Many service providers request a routing number for electronic payments.

- Setting up direct deposit: Get your paychecks, tax refunds or government benefits deposited automatically into your account.

- Ordering new checks: If you need new checks, you’ll have to supply your bank’s routing number.

FAQ

Here are the answers to some of the most frequently asked questions about EverBank routing numbers.- Do all EverBank accounts have the same routing number?

- Most EverBank accounts use the same routing number: 063092110. Wire transfers require a different routing number: 063000225.

- How do I find my EverBank routing number without a check?

- You can find your EverBank routing number by logging into your online bank account or calling 1-888-882-3837.

- Can I use the same routing number for wire transfers?

- No, EverBank wire transfers require a different routing number: 063000225. International wire transfers also require a SWIFT code: EVBKUS3M.

More About EverBank

Data is accurate as of March 10, 2025, and is subject to change.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by