Chase Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A routing number is vital for efficient banking transactions. When you open an account with Chase, you’ll be assigned a Chase routing number that ensures your funds are routed correctly for deposits, withdrawals, and wire transfers.

Because Chase is a large national bank, it has multiple routing numbers, so it’s crucial to use the right one.

Why the Chase Routing Number Matters

Your routing number — also called an ABA number — directs money transfers between financial institutions. Alongside your account number, it identifies exactly where your funds should go.

If you enter the wrong routing number, your transaction may be delayed or even sent to the wrong account.

Chase Routing Numbers by State

Chase routing numbers vary by location. Use this table to find the one that corresponds to the state where you first opened your account:

| State | Chase Routing Number |

|---|---|

| Arizona | 122100024 |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Florida | 267084131 |

| Georgia | 061092387 |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Michigan | 072000326 |

| Nevada | 322271627 |

| New Jersey | 021202337 |

| New York – Downstate | 021000021 |

| New York – Upstate | 022300173 |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Texas | 111000614 |

| Utah | 124001545 |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

Good To Know: Although many states have unique routing numbers, Nevada shares California’s 322271627.

How To Find Your Chase Routing Number

There are a few different ways to find a Chase routing number:

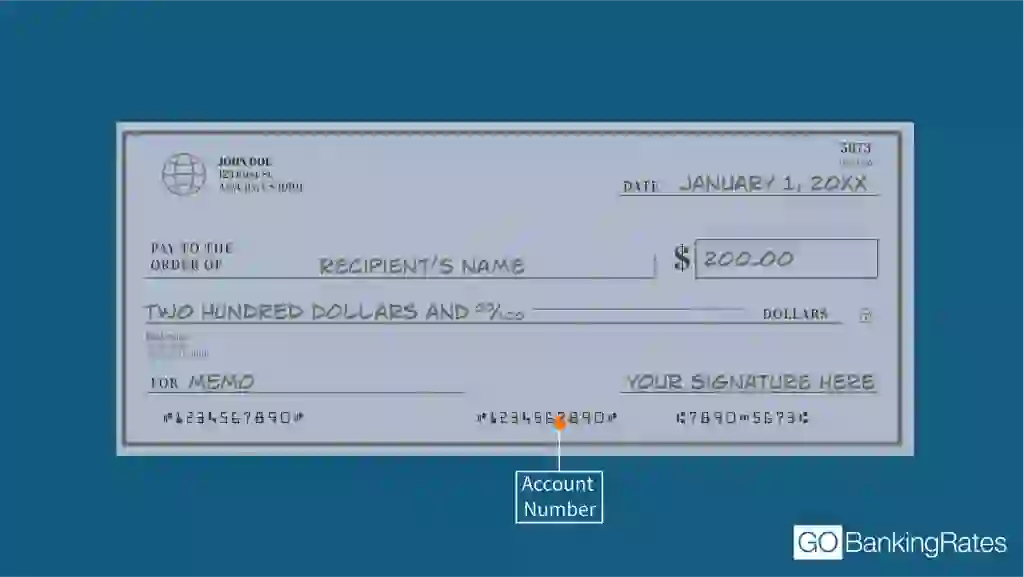

1. On a Check

For Chase checking accounts, the routing number is the first nine digits at the lower-left corner of your paper checks.

2. Through Online or Mobile Banking

- Chase Mobile® App: Sign in, tap your account tile, and select “Show details.”

- Chase Website: Log in, click the last four digits of your account number, and then choose “See full account number.”

3. By Contacting Customer Service

Call 800-935-9935. Chase representatives will verify your identity and provide your correct routing number.

Chase Routing Numbers for Wire Transfers

For domestic and international wire transfers, use the following:

| Transfer Type | Number |

|---|---|

| Domestic Wire Transfer | 021000021 |

| International Wire Transfer | 021000021 |

| SWIFT Code | CHASUS33 |

- SWIFT Code: Used for international transactions to identify banks globally. Provide this along with your account number and any other details your sender or recipient may require.

Chase Routing Number vs. Account Number

- Routing Number: Directs funds between banks (like a bank’s address).

- Account Number: Identifies your specific account at Chase.

Chase is so large that it uses different routing numbers depending on your location. Verify the correct number if you move or open an account in another state.

When You’ll Need Your Chase Routing Number

Use your Chase routing number whenever you’re:

- Setting up direct deposit for your paycheck.

- Making payments by phone or through a biller’s website.

- Scheduling automatic bill payments.

- Linking your checking account to payment apps (Venmo, PayPal, etc.).

- Transferring funds between accounts at different banks.

- Sending or receiving wire transfers (domestic and international).

How Routing Numbers Work

A nine-digit routing number is structured so that the first four digits identify the Federal Reserve Bank, the next four digits identify your bank, and the final digit (the “check digit”) helps validate the entire routing sequence.

Example: For the California/Nevada routing number 322271627, the middle four digits “7162” are tied to Chase, and the final digit confirms the routing number’s authenticity.

Final Take to GO

Using the correct Chase routing number ensures your transactions process smoothly. Always double-check that you have the right routing and account numbers before you set up direct deposits, wire transfers or bill payments.

If you’re unsure, contact Chase customer service or verify within your Chase online or mobile banking portal.

Chase Routing Number FAQ

Here are the answers to some of the most frequently asked questions about how to find your Chase routing number.- Do all Chase accounts have the same routing number?

- No. Not all Chase accounts use the same routing number. The routing number you have depends on the state where you opened the account. There are also different routing numbers used for direct deposits versus a wire transfer.

- How do I find my Chase routing number without a check?

- There are a few way to find your Chase routing number if you don't have checks. You can log into your account via the mobile app or the Chase website and check there. Or you can contact customer service.

- Can I use the same routing number for wire transfers?

- No. Chase uses different routing numbers for wire transfers than what is used for direct deposits.

More About Chase

Karen Doyle, Ryanne Mena and Erika Giovanetti contributed to the reporting of this article.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Swift "Business Identifier Code (BIC)"

- Chase Bank "website"

- American Bankers Association "ABA Routing Number"

- Chase Bank "Account and Routing Number"

- Chase Bank "Mobile Banking"

- Chase Bank "Customer Service"

- Chase Bank "How to Wire Money"

Written by

Written by  Edited by

Edited by