Flagstar Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Flagstar Bank is a full-service regional bank that earned a spot in GOBankingRates’ rankings of the Best Premium Checking Accounts for 2024. With high-yield CD options, a choice of four checking accounts to meet your needs and branches in nine states, Flagstar Bank blends the personalized service of a regional bank with robust product offerings.

If you recently opened a Flagstar Bank checking or savings account, you might be wondering about Flagstar’s routing number. Here’s what you need to know.

Flagstar Bank Routing Number by State

Unlike large national banks with multiple routing numbers for different states, Flagstar Bank has one routing number. The Flagstar Bank routing number is 226071004.

This number is used for ordering checks, domestic wire transfers, direct deposits, and ACH transactions.

How To Find Your Flagstar Bank Routing Number

On a Check

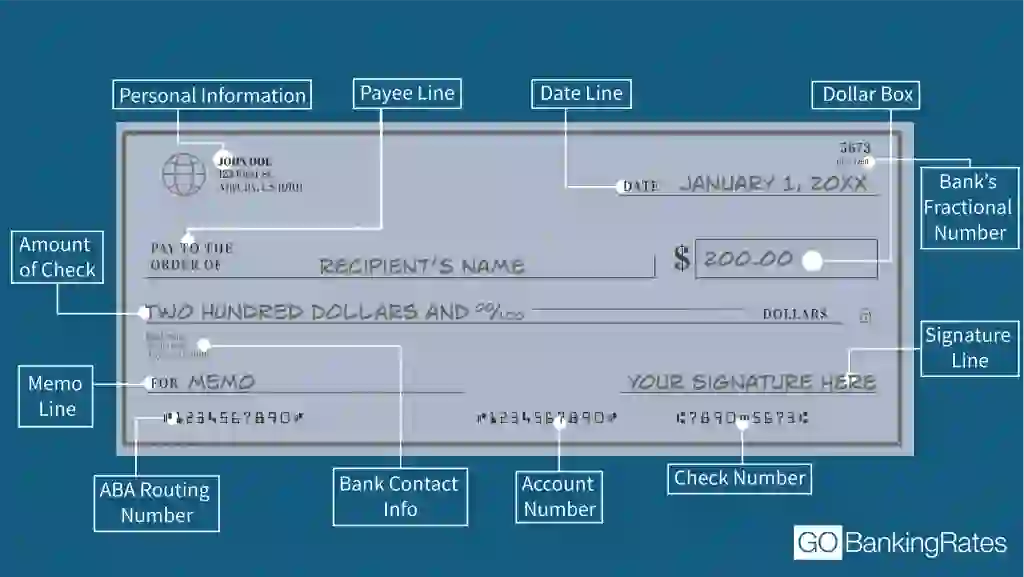

You can find the routing number at the bottom left corner of your Flagstar Bank check. It’s the first nine-digit number, followed by your account number.

Through Online Banking

To locate your routing number online:

- Log in to your Flagstar Bank online banking account.

- Navigate to the “Account Details” or “Settings” section.

- Your routing number will be displayed alongside your account information.

By Contacting Customer Service

If you’re still unsure, you can reach out to Flagstar Bank’s customer service:

- Phone: 1-800-945-7700

- Hours: Monday to Friday: 7:30 a.m. to 8 p.m. (ET); Saturday: 8:30 a.m. to 6 p.m. (ET); Sunday: Closed

Flagstar Bank Routing Numbers for Wire Transfers

If you’re sending a wire transfer, make sure to use the correct routing information. Here’s what you need to know:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 226071004 | N/A |

| International Wire Transfer | 226071004 | FLGSUS33XXX |

For domestic transfers, all you need is the routing number. If you’re sending money internationally, you’ll also need the SWIFT code to route the transfer properly. Always double-check the details with the recipient to prevent delays.

Flagstar Bank Routing Number vs. Account Number: What’s the Difference?

While both numbers are essential for banking transactions, they serve different purposes:

- Routing number: Identifies the financial institution and ensures that transactions are routed to the correct bank.

- Account number: Uniquely identifies your specific account within the bank.

Both numbers are necessary for setting up direct deposits, automatic payments, and wire transfers.

How To Use Your Flagstar Bank Routing Number

Your routing number is used in various financial transactions, including:

- Setting up direct deposit: Provide your employer with Flagstar Bank’s routing number and your account number so your paycheck can be deposited directly into your account.

- Making ACH transfers: Use the routing number for automatic payments, such as utility bills or loan payments.

- Paying bills online: When setting up bill payments through Flagstar Bank’s online banking platform or a third-party service, you’ll need the routing number and your account number.

Having your Flagstar Bank routing number handy ensures that your financial transactions are processed smoothly and accurately. Whether you’re receiving funds via direct deposit, sending money through a wire transfer, or setting up automatic bill payments, this information is key to a seamless banking experience.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by