Union Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Union Bank Routing Number: What You Need To Know

Union Bank has merged with U.S. Bank, and all Union Bank accounts are now managed by U.S. Bank.

If you previously banked with Union Bank, you’ll now need to use U.S. Bank’s services, including its routing numbers for transactions. Finding this routing number is simple and straightforward.

Union Bank Routing Number

Since Union Bank is now a part of U.S. Bank, you can use their routing numbers. You’ll need to find the routing number for the state where you first opened your account.

| State or Region | U.S. Bank Routing Number |

|---|---|

| Arizona | 122105155 |

| Arkansas | 082000549 |

| California — Northern | 121122676 |

| California — Southern | 122235821 |

| Colorado — Aspen | 102101645 |

| Colorado — all other areas | 102000021 |

| Idaho | 123103729 |

| Illinois — Northern | 071904779 |

| Illinois — Southern | 081202759 |

| Indiana | 074900783 |

| Iowa — Council Bluffs | 104000029 |

| Kansas | 101000187 |

| Kentucky — Northern | 042100175 |

| Kentucky — Western | 083900363 |

| Minnesota — East Grand Forks | 091215927 |

| Minnesota — Moorhead | 091300023 |

| Minnesota — all other areas | 091000022 |

| Missouri | 081000210 |

| Missouri — Western | 101200453 |

| Montana | 092900383 |

| Nebraska | 104000029 |

| Nevada | 121201694 |

| New Mexico | 107002312 |

| North Carolina | 064103707 |

| North Dakota | 091300023 |

| Ohio — Cleveland | 041202582 |

| Ohio — all other areas | 042000013 |

| Oregon | 123000220 |

| South Dakota | 091408501 |

| Tennessee | 064000059 |

| Utah | 124302150 |

| Washington | 125000105 |

| Wisconsin | 075000022 |

| Wyoming | 307070115 |

| All other states | 091000022 |

How To Find Your Union Bank Routing Number

There are a few ways to find your routing number. If you remember which state you opened your account in, use the chart above. You can also do the following:

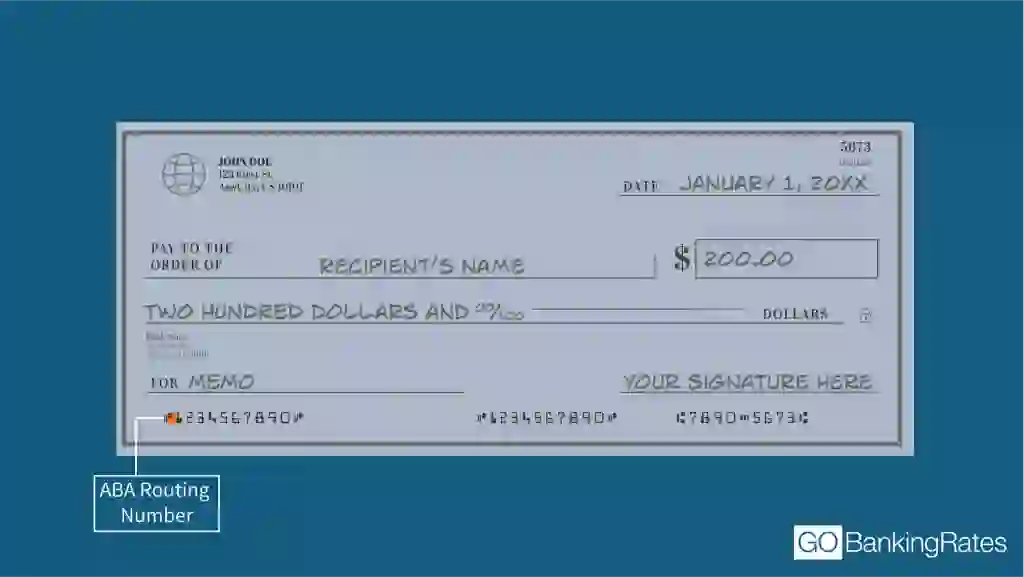

On a Check

If you have a U.S. Bank checking account, you can find your routing number on a check — the check routing number is the first nine numbers in the lower left corner.

Through Online Banking

Since Union Bank is now U.S. Bank, you can visit U.S. Bank’s website or mobile app to find your routing number. Follow these steps:

- Log in to your U.S. Bank online account.

- Navigate to your account settings or details.

- You should be able to spot your routing number close to your account number.

By Contacting Customer Service

You might not have a check or access to online banking, however, so you can also call U.S. Bank any time at 800-872-2657 to find the routing number for your account. A representative will be able to look up the number and provide it to you over the phone.

Union Bank Routing Numbers for Wire Transfers

To send a wire transfer, you’ll need your U.S. Bank routing number. Customers who wish to send a wire transfer outside of the United States might also be asked to provide a SWIFT code, which is made up of both letters and numbers. This code always contains between eight and 11 characters.

Here are the details you’ll need to supply for wire transfers:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic wire transfer | Varies by state | N/A |

| International wire transfer | Varies by state | USBKUS44IMT |

Union Bank Routing Number vs. Account Number: What’s the Difference?

Your routing number and account number serve different purposes but work together to process transactions:

- Routing number: Identifies the bank or credit union where your account is held.

- Account number: Unique number assigned to your specific account.

How To Use Your Union Bank Routing Number

You’ll need your routing number for a few different banking activities, including:

- Bill payments: Set up automatic payments for your monthly bills — utilities, rent or mortgage.

- Direct deposit: Provide your routing and account number to your employer or government agency to receive direct deposit payments.

- Wire transfers or ACH transfers: Use your routing number to send or receive money transfers.

FAQ

Here are the answers to some of the most frequently asked questions about Union Bank routing numbers.- Do all Union Bank accounts have the same routing number?

- No, since Union Bank merged with U.S. Bank, routing numbers now vary by state.

- How do I find my Union Bank routing number without a check?

- You can find your routing number in a few ways:

- Check online banking.

- Look on the U.S. Bank mobile app.

- Contact customer service at 800-872-2657.

- You can find your routing number in a few ways:

- Can I use the same routing number for wire transfers?

- No. U.S. Bank has different routing numbers for each state. If you want to make an international wire transfer, you will also need a SWIFT code.

More About U.S. Bank

Information is accurate as of Feb. 19, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by