First Citizens Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

First Citizens Bank has been a part of the U.S. banking system for over 120 years. The Raleigh, North Carolina-based bank now operates more than 500 branches across 21 states.

Your First Citizens Bank routing number is essential for ensuring your transactions go through smoothly. Let’s break it all down so you can find the right number and get back to business.

First Citizens Bank Routing Numbers by State

While First Citizens Bank’s routing number is 053100300, the bank sometimes uses different routing numbers depending on what state you opened your account in and what action you’re trying to complete. The following routing numbers correspond to electronic payments such as direct deposits and ACH payments.

| State | First Citizens Bank Routing Number |

|---|---|

| Arizona | 122187335 |

| California | 122037760 |

| Colorado | 102089644 |

| Florida | 067092022 |

| Georgia | 061191848 |

| Illinois | 275071288 |

| Kansas | 101089823 |

| Maryland | 055003463 |

| Michigan | 275071288 |

| Minnesota | 275071288 |

| Missouri | 101089810 |

| Nebraska | 053100300 |

| Nevada | 053100300 |

| New Jersey | 053100300 |

| New Mexico | 107089652 |

| North Carolina | 053100300 |

| Oklahoma | 103089834 |

| Oregon | 123084958 |

| South Carolina | 053906041 |

| Tennessee | 064008970 |

| Texas | 114993906 |

| Virginia | 051401836 |

| Washington | 125107671 |

| West Virginia | 051503174 |

| Wisconsin | 275071288 |

Note: Routing numbers may vary based on the type of transaction (e.g., paper checks, electronic payments, wire transfers). It’s always a good idea to verify your specific routing number by checking your account details or contacting First Citizens Bank directly.

How To Find Your First Citizens Bank Routing Number

If you’re not sure which routing number to use, here are a few easy ways to find it:

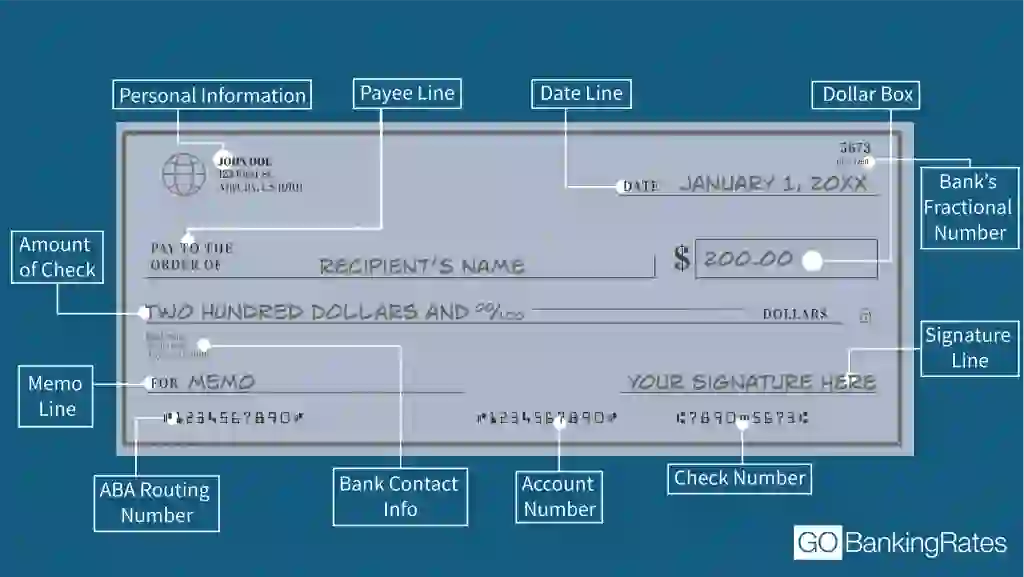

On a Check

Your routing number is printed at the bottom left corner of your checks. It’s the first nine-digit number before your account number.

Through Online Banking

If you don’t have a check handy, you can find your routing number online:

- Log in to your First Citizens Bank account.

- Go to the account details section.

- Look for the routing number listed alongside your account number.

By Contacting Customer Service

Still unsure? Give First Citizens Bank’s customer service a quick call. Before you dial, make sure you have:

- Your account number

- The state where you opened your account

- Any other verification details they might ask for

First Citizens Bank Routing Numbers for Wire Transfers

Wire transfers often use different routing numbers than regular transactions. If you’re sending or receiving a wire transfer, here’s what you need to know:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 053100300 | N/A |

| International Wire Transfer | 053100300 | FCBTUS33 |

Important: For international wire transfers, you’ll also need First Citizens Bank’s SWIFT code. Make sure to double-check the routing number and SWIFT code with the bank.

First Citizens Bank Routing Number vs. Account Number: What’s the Difference?

It’s easy to mix up these numbers, so here’s a quick refresher:

- Routing number: Identifies your bank’s location and helps process transactions.

- Account number: Specifically identifies your personal or business account.

Both numbers are printed on your checks, but the routing number always comes first.

How To Use Your First Citizens Bank Routing Number

Now that you have your routing number, here’s what you can do with it:

- Set up direct deposit: Get your paycheck deposited into your account automatically.

- Make ACH transfers: Send or receive payments electronically.

- Pay bills online: Schedule automatic payments for rent, utilities, and subscriptions.

- Wire transfers: Move money between accounts domestically or internationally.

Keeping your routing number handy will make banking much easier, helping you avoid delays and ensuring your money gets where it needs to go.

Information is accurate as of Feb. 18, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by