CIT Bank Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you need to receive a wire transfer, pay a bill online or order checks, you need to know your bank’s routing number. Routing numbers are important components of everyday banking transactions because they identify financial institutions that send money back and forth. Keep reading to learn what CIT Bank’s routing number is and how to use it.

CIT Bank Routing Number

CIT Bank has only one routing number for personal accounts:

| CIT Bank Routing Number |

|---|

| 124084834 |

If you are a commercial or institutional client at CIT Bank, you’ll need to call the bank to find out your routing number for wire transactions.

How To Find Your CIT Bank Routing Number

There are a few places you can look to find your CIT Bank routing number.

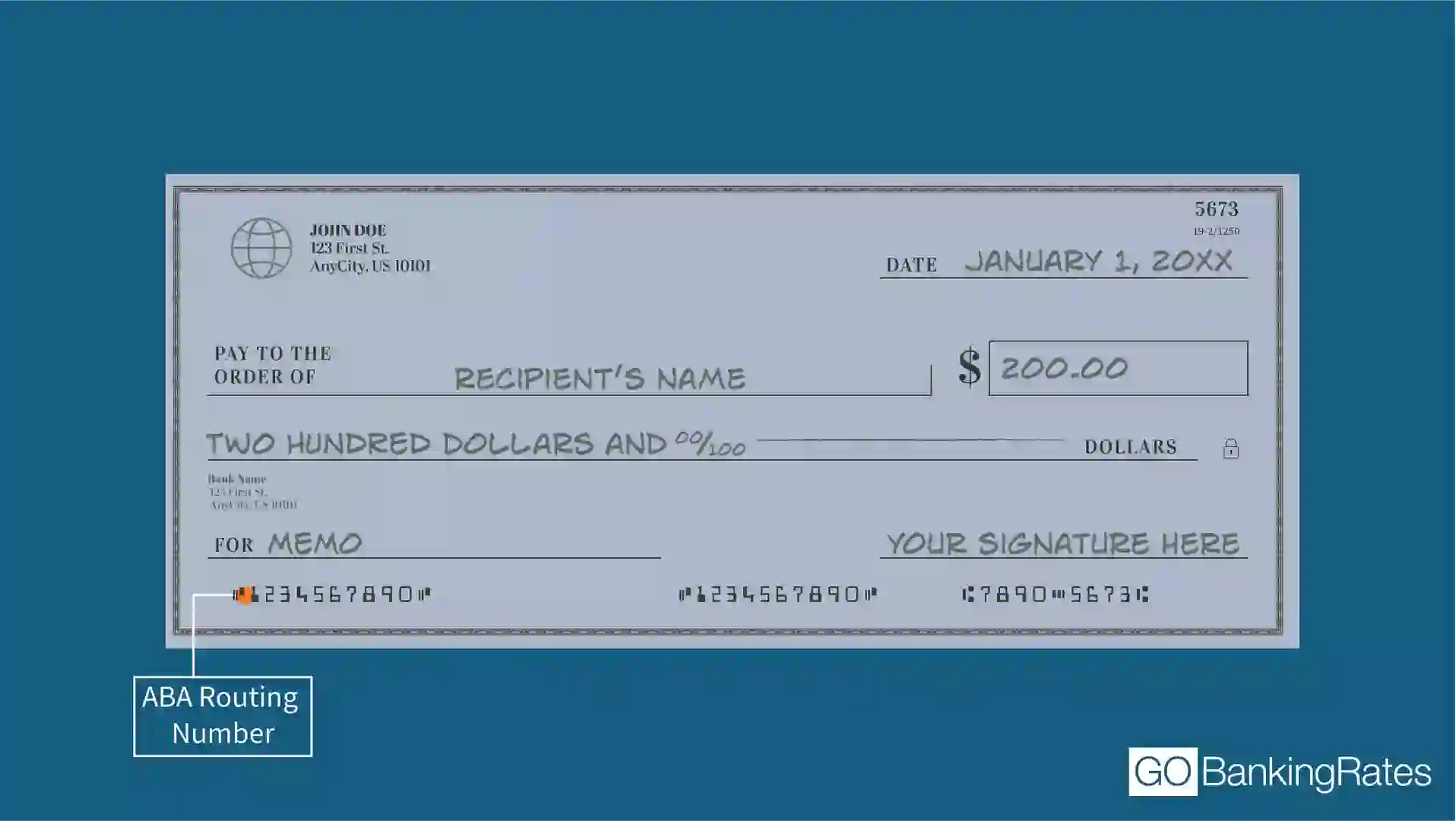

On a Check

Your routing number is printed on the lower-left corner of a check. It’s always the first number in a sequence of three different numbers, followed by the account number and individual check number.

Through Online Banking

You can also find your routing number by logging in to your CIT account. Here are the steps you can take:

- Log in to the CIT mobile app or website.

- Look for the account settings or account details menu.

- Once you click into this section, you should see your routing number displayed close to your account number.

By Contacting Customer Service

You can call CIT Bank customer service if you need help finding your routing number. Dial 855-462-2652 to speak to a representative during the following times:

- Monday to Friday: 9 a.m. to 9 p.m.

- Saturday: 10 a.m. to 6 p.m.

CIT Bank Routing Numbers for Wire Transfers

For international wire transfers, you’ll generally use a bank’s SWIFT code rather than a routing number. However, not all banks have SWIFT codes. CIT Bank’s website notes that the bank does not accept incoming international wire transfers.

Here’s the information you’ll need to send CIT Bank wire transfers:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 124084834 | N/A |

| International Wire Transfer | N/A | N/A |

CIT Bank Routing Number vs. Account Number: What’s the Difference?

Routing numbers are nine-digit numbers used to identify banks and other financial institutions. Customers in the same region will typically have the same routing number. Account numbers, on the other hand, are unique just to you and your accounts. Your checking and savings accounts will all have different account numbers.

How To Use Your CIT Bank Routing Number

Routing numbers originally were used to identify the processing endpoint for checks. Since then, their use has expanded to include the following:

- Ordering new checks

- Paying bills

- Setting up online payments

- Ensuring that tax refunds get deposited into the right accounts.

FAQ

Here are the answers to some of the most frequently asked questions about CIT Bank routing numbers.- Do all CIT Bank accounts have the same routing number?

- Yes, CIT has just one routing number for all accounts -- 124084834.

- How do I find my CIT Bank routing number without a check?

- To find your routing number, you can log into your mobile banking account, check your paper bank statements or call CIT Bank customer service at 855-462-2652.

- Can I use the same routing number for wire transfers?

- CIT Bank uses different routing numbers depending on whether an incoming wire transfer will be received by a personal, commercial or institutional account.

- If you have a commercial or institutional account and want to know your routing number for wire transfers, call the bank at 877-748-0004.

More About CIT Bank

Information is accurate as of March 6, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Written by

Written by  Edited by

Edited by