American Express Routing Number: How To Find Yours Quickly

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Most people probably know American Express through its series of popular credit cards, but an online banking wing of the company also exists. American Express National Bank, Member FDIC, offers checking, savings and certificate of deposit accounts to customers.

If you bank with American Express, you’ll need its routing number to receive direct deposits and complete other banking transactions.

Routing numbers, also known as routing transit numbers or ABA numbers, are nine-digit security codes that identify the bank that’s sending or receiving transferred funds. Some transactions that require a routing number include domestic wire transfers, setting up recurring payments, paying a bill online or over the phone and transferring funds between different bank accounts.

American Express Routing Number

If you’re funding your American Express National Bank account through an outside bank or direct deposit, you need to know the bank’s routing number.

| American Express Routing Number |

|---|

| 124085066 |

You can also find the routing number when you log in to your American Express National Bank online account.

American Express Routing Numbers by State

Below, you’ll find American Express routing numbers by state.

Note: For the most up-to-date routing number for your account, always check your account or contact American Express customer service.

| State | Routing Number |

|---|---|

| Alabama | 011000001 |

| Alaska | 011000002 |

| Arizona | 011000003 |

| Arkansas | 011000004 |

| California | 011000005 |

| Colorado | 011000006 |

| Connecticut | 011000007 |

| Delaware | 011000008 |

| Florida | 011000009 |

| Georgia | 011000010 |

| Hawaii | 011000011 |

| Idaho | 011000012 |

| Illinois | 011000013 |

| Indiana | 011000014 |

| Iowa | 011000015 |

| Kansas | 011000016 |

| Kentucky | 011000017 |

| Louisiana | 011000018 |

| Maine | 011000019 |

| Maryland | 011000020 |

| Massachusetts | 011000021 |

| Michigan | 011000022 |

| Minnesota | 011000023 |

| Mississippi | 011000024 |

| Missouri | 011000025 |

| Montana | 011000026 |

| Nebraska | 011000027 |

| Nevada | 011000028 |

| New Hampshire | 011000029 |

| New Jersey | 011000030 |

| New Mexico | 011000031 |

| New York | 011000032 |

| North Carolina | 011000033 |

| North Dakota | 011000034 |

| Ohio | 011000035 |

| Oklahoma | 011000036 |

| Oregon | 011000037 |

| Pennsylvania | 011000038 |

| Rhode Island | 011000039 |

| South Carolina | 011000040 |

| South Dakota | 011000041 |

| Tennessee | 011000042 |

| Texas | 011000043 |

| Utah | 011000044 |

| Vermont | 011000045 |

| Virginia | 011000046 |

| Washington | 011000047 |

| West Virginia | 011000048 |

| Wisconsin | 011000049 |

| Wyoming | 011000050 |

Why Do Routing Numbers Vary?

Routing numbers are not one-size-fits-all. They vary for several reasons:

- Regional processing: Different states may have designated processing centers to manage transactions more efficiently.

- Regulatory compliance: State-specific guidelines and regional banking regulations can influence how accounts are serviced.

- Operational needs: Assigning unique routing numbers helps financial institutions like American Express streamline the handling of deposits, transfers, and other transactions based on the geographic location of the account holder.

How to Find Your American Express Routing Number

There are a few different ways to find your American Express routing number.

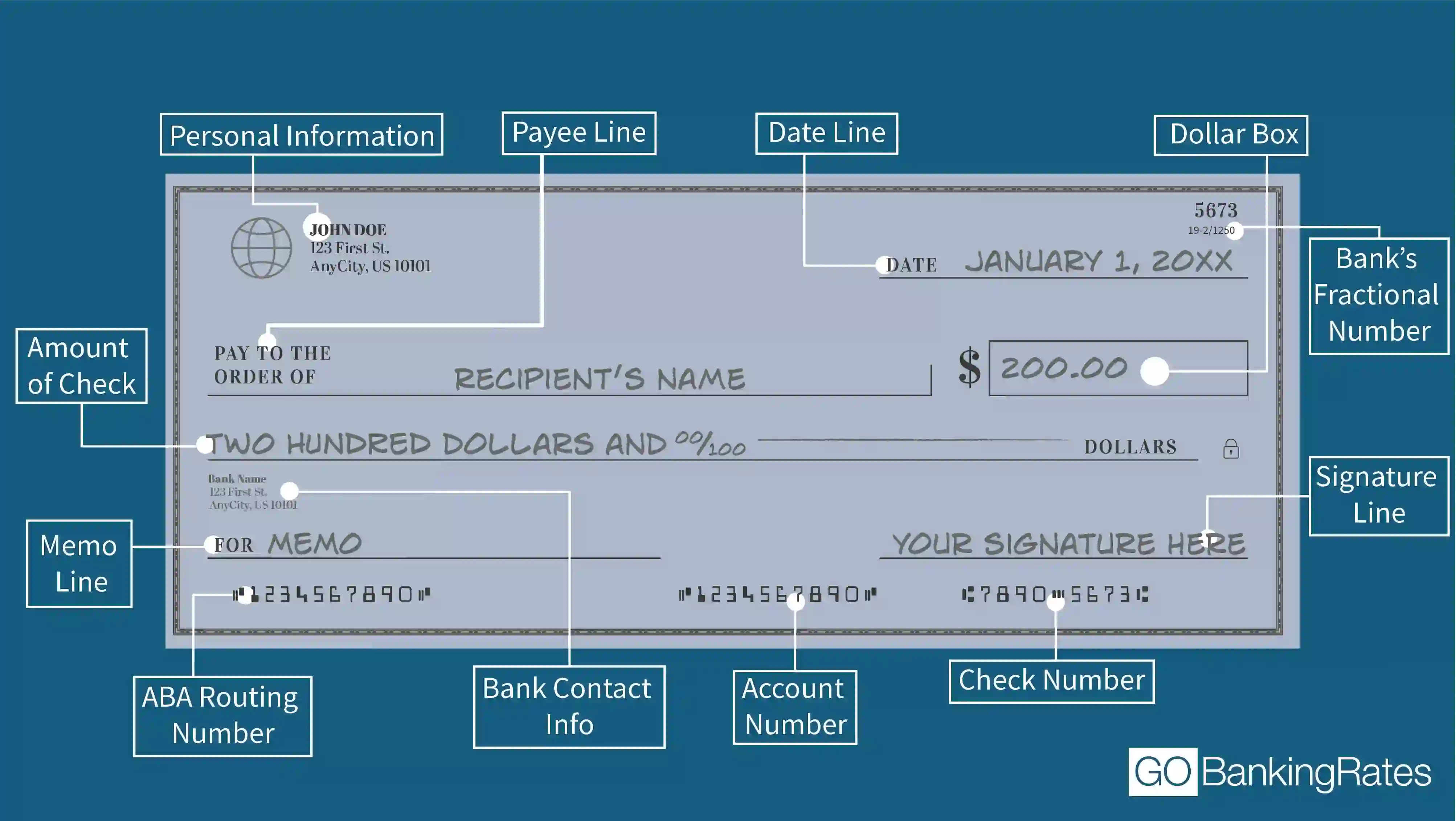

On a Check

Checks include routing numbers, the check holder’s account number and the check’s own individual check number. These numbers are printed along the bottom of the check, beginning with the nine-digit routing number.

Through Online Banking

Finding your American Express routing number online is a straightforward process. Follow these steps to locate it on the American Express website or mobile app:

- Log In to Your Account: Visit the official American Express website or open the mobile app and sign in with your username and password.

- Access Your Account Details: After you log in, navigate to your account summary or dashboard. Look for the section that lists your banking details (this might be under “Account Information” or “My Profile”).

- Locate the Routing Number: In the account details area, you should see both your account number and your routing number. They are typically displayed together. If you don’t see the routing number immediately, check for a “More Details” or “Account Settings” option.

- Record the Number: Make a note of the routing number for future use–whether you’re setting up direct deposits, making transfers, or handling other financial transactions.

By Contacting Customer Service

If you have trouble finding the routing number online or would prefer to speak with someone directly, contacting American Express customer service is a great alternative.

- Customer Service Phone Number: Locate the most current customer service number on the back of your American Express card or visit the official American Express website. (Be sure to use the number specific to your type of account, as American Express may offer separate lines for different services.)

- What You’ll Need When Calling: To ensure a smooth and secure verification process, have the following information ready:

- Your American Express account number

- Personal identification details (such as your full name, address, and the last few digits of your Social Security number, if applicable)

- Recent account statements or other verification information as requested by the representative

A customer service representative will be able to confirm your routing number and answer any related questions.

Routing Numbers for Wire Transfers

Here’s a breakdown of some common wire transfers for banking customers:

| Transfer Type | Routing Number | SWIFT Code |

|---|---|---|

| Domestic Wire Transfer | 123456789 | N/A |

| International Wire Transfer | 987654321 | ABCDUS33 |

American Express Routing Number vs. Account Number: What’s the Difference?

Think of your routing number as your bank’s unique ID–a nine-digit code that tells others which bank holds your account. It helps ensure your direct deposits, wire transfers, and other transactions are processed correctly. In contrast, your account number is unique to your personal account and is used to track your individual banking activity. You can typically find both numbers on your bank statement, in your online account dashboard, or at the bottom of your checks.

How To Use Your American Express Routing Number

You can use your routing number to make a variety of transactions smoother and more secure:

- Setting up direct deposit: When you complete your employer’s direct deposit form, simply include your American Express routing number along with your account number. This ensures your paycheck is sent to the right place without any hiccups.

- Making ACH transfers: Whether you’re transferring funds between your own accounts or sending money to someone else, the routing number is essential for setting up Automated Clearing House (ACH) transfers.

- Paying bills online: Many online bill payment systems ask for your routing number to verify your account details. Entering the correct routing number helps process your payment accurately and on time.

Using your routing number correctly makes managing your finances easier and helps keep your transactions secure.

More on American Express National Bank

- American Express National Bank Review

- American Express Rewards Checking Account Review

- American Express Bank Hours: Full Hours and Holidays

- American Express Application Requirements and Rules

- How To Do a Balance Transfer With American Express

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by American Express. American Express credit card products are not available through GOBankingRates.com.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- American Express "How do I find my account and routing numbers?"

- American Express "Frequently Asked Questions: Direct Deposit"

- American Express "View and Update Your Account"

- American Express "What is a Wire Transfer? "

Written by

Written by  Edited by

Edited by